|

|

|

|

|||||

|

|

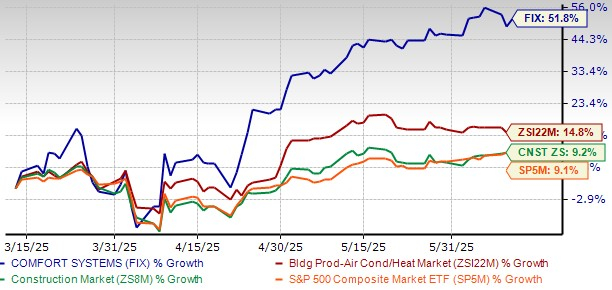

Comfort Systems USA FIX has delivered a stunning 51.8% stock gain over the past three months, comfortably outperforming the broader market and its peers in the Zacks Building Products - Air Conditioner and Heating industry, which rose just 14.8% in the same period. Even the S&P 500 and the broader Construction sector posted comparatively modest gains of 9.1% and 9.2%, respectively. Driven by booming demand across data centers, industrial projects, and modular construction, FIX is capitalizing on long-term structural trends that favor its specialized capabilities.

This rally leaves investors wondering whether the momentum is sustainable or if the stock is due for a breather.

FIX Stock’s 3-Month Performance

In the past three-month period, this national leader in mechanical, electrical, and plumbing (MEP) services has also outperformed key competitors such as AAON, Inc. AAON, Watsco, Inc. WSO, and EMCOR Group, Inc. EME. AAON declined 3.2%, Watsco fell 9.9%, while EMCOR gained 26.5%. Compared to AAON, Watsco, and EMCOR, the stock’s performance stands out—especially as AAON and Watsco lagged, and only EMCOR posted a notable gain.

As of Wednesday, the stock closed at $496.70, 10.2% below its 52-week high of $553.09 but 82% above its 52-week low of $272.93.

Technical indicators suggest continued strong performance for Comfort Systems. From the graphical representation given below, it can be observed that FIX stock is trading above both 50 and 200-day simple moving averages, signaling a bullish trend. The technical strength underscores positive market sentiment and confidence in its financial health and prospects.

Comfort Systems may be riding a wave of investor enthusiasm, but it hasn’t yet reached frothy valuation territory. Shares currently trade at a forward 12-month P/E ratio of 25.83, below the industry average of 28.43. Even after the recent rally, the stock remains below the higher end of its three-year P/E range, suggesting there’s still upside without entering overvalued territory.

Moreover, the company’s return on invested capital (ROIC) of 27.09%, far above the industry average of 7.93%, shows that Comfort Systems isn’t just growing; it’s doing so efficiently.

FIX Valuation

A major reason behind the market’s bullish stance is FIX’s deep exposure to the exploding demand for AI, data centers, and semiconductor facilities. These projects now contribute 37% of total revenue, up from 30% last year. Comfort Systems’ specialized HVAC and electrical capabilities are indispensable for mission-critical infrastructure, and management confirms that its bookings pipeline for these projects remains strong through 2026.

As enterprises invest in generative AI and hyperscale cloud platforms, FIX stands to benefit from an enduring cycle of capital investment. Its national footprint, technical expertise, and growing modular capacity make it a go-to contractor for complex builds requiring speed, precision, and reliability.

Modular construction has become a strategic pillar of growth for Comfort Systems. Now accounting for 19% of first-quarter 2025 revenue, this approach allows for faster installations, better quality control, and improved labor efficiency—advantages that are increasingly vital in fast-growth sectors like tech and healthcare. The company’s 2.5 million square feet of modular space supports rapid scale-up to meet demand.

FIX’s average modular project value now exceeds $20 million, and many of these are embedded within broader building contracts, reinforcing its role as a full-scope solutions provider. In warmer climates like Texas and Florida, year-round buildability further accelerates deployment and revenue conversion.

Comfort Systems is also riding the wave of America’s industrial renaissance. Industrial projects made up 62% of first-quarter volume, bolstered by renewed manufacturing activity, federal clean energy incentives, and corporate reshoring initiatives. Key verticals include pharmaceuticals, electronics, and heavy industry, segments that require intricate MEP systems and long-duration project management.

The company’s strong labor access and financial stability give it a competitive edge for large-scale projects that demand trusted execution partners. These dynamics position the company as a structural winner in the multi-year onshoring trend.

Comfort Systems gains steady growth from institutional markets like healthcare, which now makes up 10% of its revenue amid rising demand for hospital upgrades. Public education and government work also provide stability, helping offset cyclical swings in their more volatile segments and ensuring consistent revenue across economic cycles.

M&A remains a cornerstone of Comfort Systems’ growth model. The recent acquisition of Century Contractors in early 2025 is expected to add $90 million in revenue, while aligning with the company’s disciplined integration philosophy. Comfort Systems selectively targets regional players that share its operational standards, expanding both geographic reach and sector expertise. With more than $130 million in net cash, the company has the financial flexibility to pursue future acquisitions opportunistically. Strategic expansion, particularly in Sunbelt states, continues to unlock new markets and deepen client relationships.

Tariff imposition under a potential Trump administration could pose significant challenges for Comfort Systems, particularly through higher input costs and supply chain disruptions. As a leading provider of HVAC, electrical, and mechanical contracting services, the company relies on materials such as steel, aluminum, copper, and imported components. Increased tariffs on metals or goods from key trading partners could drive up material costs, squeezing profit margins and potentially delaying projects. While direct impacts remain limited for now, suppliers have begun imposing 4–6% price hikes, citing anticipated cost pressures.

Additionally, broader economic impacts such as inflation and reduced construction spending due to trade tensions may lead clients to postpone or scale back projects, weighing on Comfort Systems’ growth prospects.

Analysts are becoming increasingly bullish on Comfort Systems' earnings potential. Over the past 30 days, the Zacks Consensus Estimate for FIX’s 2025 earnings per share has climbed to $19.28 from $19.07, signaling growing confidence in the company’s outlook.

Comfort Systems is well-positioned for strong earnings growth, with projections forecasting a 32.1% increase in 2025. Meanwhile, revenue is expected to grow at a healthy pace, with a 9.9% rise anticipated for the year, further solidifying optimism around the company’s growth trajectory.

Comfort Systems has emerged as a top performer in the construction space, propelled by durable trends in AI, industrial reshoring, modular innovation, and institutional spending. Its 52% rally in three months may give some investors pause, but the fundamentals remain solid, and valuation is not stretched relative to growth potential.

While near-term gains could cool, long-term visibility remains robust. With strong analyst support, an improving service mix, and a healthy balance sheet for strategic expansion, FIX is well-positioned to sustain earnings growth. Investors who already hold the stock should maintain their positions to capitalize on these durable tailwinds. Comfort Systems currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 15 hours | |

| 23 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite