|

|

|

|

|||||

|

|

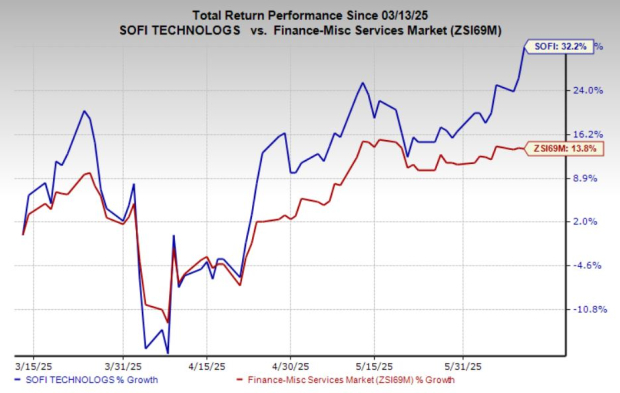

Shares of SoFi Technologies, Inc. SOFI have climbed 32% over the past three months, outpacing the industry’s 13.8% growth. Over the past year, the stock has soared 121.5%.

This sharp rally prompts a key question: Does SOFI still offer a buying opportunity, or would it be smarter to wait for a potential pullback? Let’s take a closer look.

SOFI is well-positioned to benefit from shifting federal student loan policies that limit forgiveness options. As the Trump administration enacts stricter criteria, more borrowers may seek private refinancing to manage repayment, creating a growth opportunity for SoFi. The company’s digital-first platform, competitive rates, and flexible terms appeal to borrowers navigating reduced federal relief. This environment has already driven a 59% year-over-year surge in student loan origination volume in the first quarter of 2025, signaling renewed demand. With borrowers increasingly seeking alternatives, SoFi’s refinancing business could gain further momentum, translating into stronger revenue growth and enhanced positioning within the broader financial services sector.

SoFi’s land-and-expand strategy remains a core strength, provided it is effectively managed. The company has a strong track record of executing this ambitious growth approach. By offering a diverse range of financial services, SoFi attracts a growing customer base. This, in turn, incentivizes more partners to integrate their offerings within SoFi’s expanding ecosystem. The result is a robust cross-selling dynamic that enhances overall profitability.

Given this, it is unsurprising that management maintains an aggressive revenue growth outlook for 2025. SOFI’s increasing ability to cross-sell financial products is expected to drive significant EPS expansion, which is crucial for long-term shareholder value creation. Even in a conservative scenario, management projects a 24% to 27% revenue increase, with EPS surging 80% to 87%. This substantial discrepancy between revenue growth and bottom-line expansion underscores SoFi’s ability to leverage economies of scale.

Galileo, SoFi’s B2B financial services platform, is a pivotal growth driver. By enabling seamless payment and lending integrations, it positions SoFi as a leading player in the embedded finance market. This sector is projected to witness a robust 16.8% CAGR through 2029, fueled by increasing demand for integrated financial solutions. Galileo's ability to attract high-profile clients and diversify SoFi’s revenue streams strengthens the company's long-term outlook. The platform’s adoption by other financial firms further solidifies SoFi’s market position and enhances its ability to capture additional market share.

SoFi’s financials reinforce its bullish long-term thesis. In the first quarter of 2025, the company achieved a 20% year-over-year increase in net sales, with a remarkable 217% surge in net income. This impressive profitability growth highlights SoFi’s strong operating leverage, driven by its ability to scale efficiently. The addition of 800,000 new members in the quarter — the highest absolute increase recorded — enhances the company’s cross-selling potential while reducing customer acquisition costs.

All three business segments contributed to revenue growth in the first quarter. Lending and Technology Platform revenues grew 25% and 10% year over year, respectively, while the Financial Services segment surged an impressive 101%.

The Zacks Consensus Estimate for SOFI’s 2025 earnings stands at 27 cents per share, reflecting a substantial 80% year-over-year increase. Similarly, projected revenues for 2025 are estimated to be $3.29 billion, marking a 26.2% increase from the previous year.

Despite its strong fundamentals, SoFi faces notable challenges. As a financial services company, its performance is highly sensitive to macroeconomic conditions, particularly Federal Reserve policy and the overall health of the U.S. economy. With the possibility of prolonged high interest rates and recessionary risks linked to Trump’s proposed tariff hikes, the environment remains uncertain.

Competition also remains a critical concern. SoFi may benefit from a first-mover advantage in the U.S. fintech space, but it faces formidable pressure from established banking powerhouses such as JPMorgan JPM and Bank of America BAC. These institutions not only bring decades of customer trust and regulatory experience but are also rapidly expanding their digital capabilities to counter fintech disruptors. JPMorgan has been actively investing in digital banking infrastructure, while Bank of America continues to enhance its mobile and AI-driven services to retain tech-savvy consumers. As SoFi scales, competing with legacy giants like JPMorgan and Bank of America — alongside agile fintechs like Revolut, which is now pursuing a U.S. banking license — will remain a defining test of its long-term resilience.

SOFI appears overvalued compared to its industry peers following the recent surge in its stock price. The company's forward 12-month Price/Earnings (P/E) ratio is 40.03, more than double the industry average of 18.63. This elevated valuation suggests that investors are pricing in aggressive growth expectations, which may not be fully supported by current fundamentals. While market enthusiasm can drive short-term gains, such a high premium relative to peers raises questions about sustainability.

Given SoFi’s strong growth trajectory, expanding ecosystem, and improving financial performance, the long-term investment case remains compelling. However, considering macroeconomic uncertainties and the stock’s relatively high valuation, a prudent approach would be to adopt a hold strategy at current levels. Investors may consider waiting for further price corrections before adding positions, ensuring a more attractive entry point while mitigating downside risks. A wait-and-see approach will allow investors to reassess valuation levels and economic conditions before making new commitments to the stock.

SOFI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite