|

|

|

|

|||||

|

|

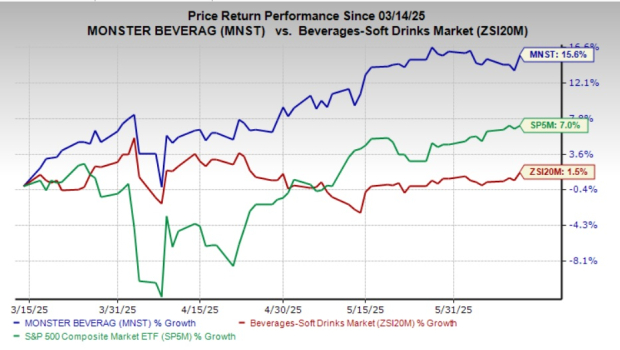

Monster Beverage Corporation MNST shares have gained 15.6% in the past three months, outperforming the Zacks Beverages - Soft drinks industry and the broader S&P 500 index’s growth of 1.5% and 7%, respectively. This strong performance underscores the company’s solid business strategies and market positioning.

MNST stock last traded at $63.69 and sits very close to its 52-week high of $64.45, reached on May 28, 2025. This recent pullback may offer a compelling opportunity for investors seeking exposure to a well-positioned player in the beverage industry with long-term growth potential.

From a technical perspective, MNST is showing solid momentum. The stock remains above its 200-day moving average, a sign of underlying strength and bullish sentiment. This technical positioning reinforces investor confidence in the company’s financial stability and outlook.

Monster Beverage continues to benefit from its expansion in the energy drinks market and ongoing product launches, reinforcing its category strength. Improving margins, supported by easing supply-chain pressures and lower input costs, have added to its financial stability. Monster Beverage outperformed expectations in the first quarter of 2025, with earnings per share exceeding forecasts. Gross margin improvement was driven by effective pricing strategies and continued supply-chain optimization, highlighting the company’s solid operational execution and resilience amid global challenges.

Consumer demand for energy drinks remains robust, with strong category growth in the United States. Monster Beverage’s retail sales momentum extended globally, with notable gains in China, Australia and South Korea. The company also captured market share in several European markets — including Great Britain, Germany and the Netherlands — underscoring its expanding international presence and enduring consumer appeal.

In the first quarter, the impact of tariffs on Monster Beverage’s operating results was minimal. Management noted the tariff landscape remains complex and fluid. The company will continue recognizing aluminum tariffs through the higher Midwest premium and is reviewing mitigation strategies across its operations. Its flavor and concentrate subsidiary, AAF, plans to establish a facility in Brazil, expected to begin operations in the future. MNST remains enthusiastic about its innovation pipeline for 2025.

Monster Beverage has been benefiting from the expansion of the energy drinks category and product launches. The company has seen growth opportunities in household penetration and per capita consumption, and robust demand for energy drinks. It has introduced several products in the reported quarter. In the United States, Monster Energy Ultra Blue Hawaiian has been among the top-selling products. Innovation has been playing a major role. MNST continues to launch its affordable energy brands, Predator and Fury, in various markets across the world.

Despite its strong performance in core energy drinks and product innovation, Monster Beverage faced notable headwinds in the first quarter of 2025, primarily stemming from its Alcohol Brands segment. The segment’s net sales plunged 38.1% year over year, caused by the reduced sales volumes of the Beast product line and the launch of the Nasty Beast Hard Tea product line in the year-ago period.

Net sales for the first quarter was hurt by bottler/distributor ordering patents, particularly in the United States and EMEA. Changes in foreign currency exchange rates adversely impacting sales in the Alcohol Brand segment, unfavorable weather, one less selling day in the reported quarter and uncertain economic factors were woes.

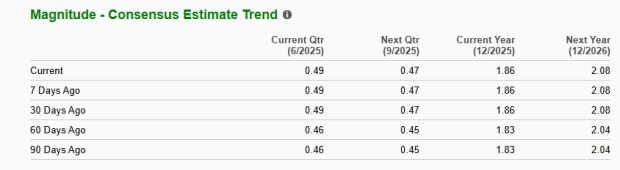

Reflecting the positive sentiment around Monster Beverage, the Zacks Consensus Estimate for earnings per share (EPS) projects solid growth in the coming years. For fiscal 2025, EPS is expected to rise by 14.8% year over year, followed by an additional 11.8% increase in 2026.

Monster Beverage's recent growth highlights its strong market momentum and operational excellence, with the stock trading near its 52-week high. The company remains a compelling investment positioned for potential upside, supported by its strong brand portfolio, innovation and long-term growth strategies. However, investors should remain cautious about near-term risks, including challenges in its Alcohol Brands segment. Given these factors, long-term investors may consider holding MNST shares. Currently, MNST carries a Zacks Rank #3 (Hold).

Nomad Foods Limited NOMD manufactures, markets and distributes a range of frozen food products in the United Kingdom and internationally. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods' current fiscal-year sales and earnings implies growth of 4.6% and 7.3%, respectively, from the prior-year levels. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Mondelez International, Inc. MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank #2 (Buy). MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 5.3% from the year-ago numbers.

Oatly Group AB OTLY, an oatmilk company, provides a range of plant-based dairy products made from oats. It presently carries a Zacks Rank of 2. OTLY delivered a trailing four-quarter earnings surprise of 25.1%, on average.

The consensus estimate for Oatly Group’s current fiscal-year sales and earnings implies growth of 2.7% and 65.8%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite