|

|

|

|

|||||

|

|

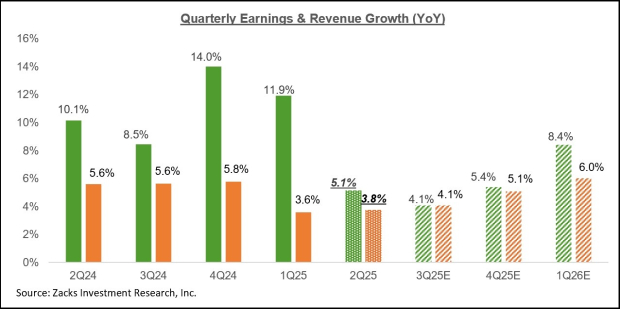

The expectation is for Q2 earnings to increase by +5.1% from the same period last year on +3.8% higher revenues. This will be a material deceleration from the +11.9% earnings growth in Q1 on +3.6% revenue growth.

In the unlikely event that actual Q2 earnings growth for the S&P 500 index turns out to be +5.1%, as currently expected, this will be the lowest earnings growth pace for the index since the +4.3% growth rate in 2023 Q3.

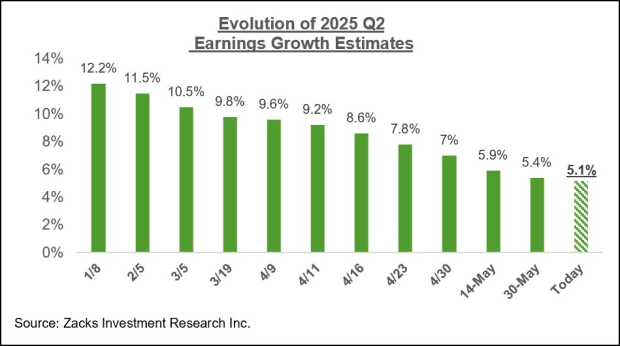

We have been regularly flagging in recent weeks that 2025 Q2 earnings estimates have been steadily decreasing, as shown in the chart below.

The magnitude of cuts to 2025 Q2 estimates since the start of the period is larger and more widespread compared to what we have become accustomed to seeing in the post-COVID period.

Since the start of April, Q2 estimates have declined for 14 of the 16 Zacks sectors (Aerospace and Utilities are the only sectors whose estimates have increased), with the largest cuts to Conglomerates, Autos, Transportation, Energy, Basic Materials, and Construction sectors.

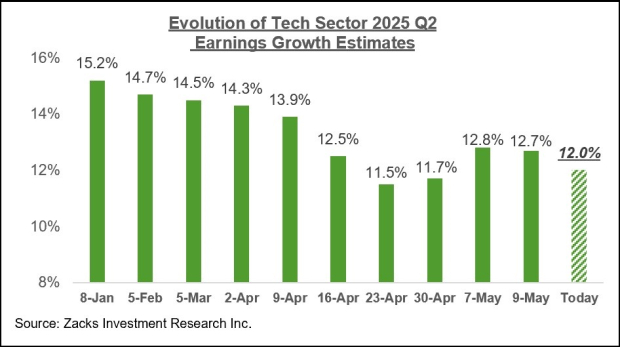

Estimates for the Tech and Finance sectors, the largest earnings contributors to the S&P 500 index, accounting for more than 50% of all index earnings, have also been cut since the quarter got underway. But as we have been pointing out in recent weeks, the revisions trend for the Tech sector has notably stabilized in recent weeks, which you can see in the chart below.

We see this same trend at play in annual estimates as well. The chart below shows the Tech sector’s evolving earnings expectations for full-year 2025

A likely explanation for this stabilization in the revisions trend is the easing of tariff uncertainty after the more punitive version of the tariff regime was delayed. Analysts started revising their estimates lower in the immediate aftermath of the early April tariff announcements, but appear to have since concluded that those punitive tariff levels are unlikely to get levied, helping stabilize the revisions trend.

The chart below shows current Q2 earnings and revenue growth expectations in the context of the preceding four quarters and the coming three quarters.

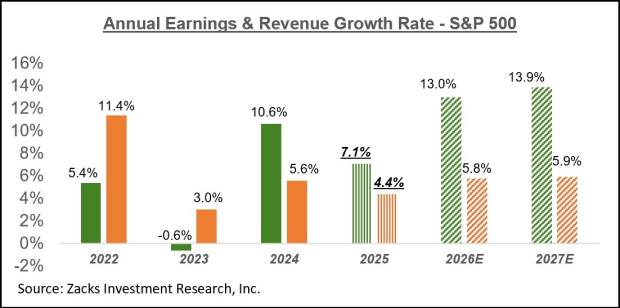

The chart below shows the overall earnings picture on a calendar-year basis.

In terms of S&P 500 index ‘EPS’, these growth rates approximate to $254.04 for 2025 and $287 for 2026.

The chart below shows how these calendar year 2025 earnings growth expectations have evolved since the start of Q2. As you can see below, estimates fell sharply at the beginning of the quarter, which coincided with the tariff announcements, but have notably stabilized over the last four to six weeks.

Key Earnings Reports This week

The Q2 earnings season will really get going when the big banks come out with their June-quarter results in about a month. But we will have officially counted almost two dozen quarterly reports from S&P 500 members by then. All of those reports will be from companies with fiscal quarters ending in May, which we and other research organizations count as part of the June-quarter tally.

We have seen such fiscal May-quarter results from four S&P 500 members, including last Wednesday’s strong release from Oracle ORCL. We have another six S&P 500 members scheduled to report results this week, including Accenture ACN, Lennar LEN, and others.

Oracle shares were up significantly following the beat-and-raise quarterly release, which came after two consecutive quarterly reports that market participants had found disappointing. Oracle’s cloud growth appears to have finally arrived, with fiscal 2026 cloud revenues expected to grow by +40%, up from the fiscal 2025 growth rate of +24% (Oracle’s fiscal year ends in May).

As noted earlier, the stock has spiked on the earnings release and is now up +29.3% this year, handily outperforming the S&P 500 index (up +2.1%) and the Zacks Tech sector (up +2.5%).

Shares of IT consulting firm Accenture have been under pressure lately, reflecting a challenging operating environment for its end-markets. The stock is down -11.4% this year, which compares to a +2.1% gain for the S&P 500 index and a +2.5% gain for the Zacks Tech sector. The issues in the Accenture story, in a generalized qualitative sense, pertain to the negative effects on corporate IT budgets of the ongoing tariff uncertainty and the deflationary effects of AI-driven operating efficiencies.

One could argue that Accenture’s scale lends its results considerable stability, particularly in comparison to other peers like India-based Infosys, TCS, and Wipro. But these macro headwinds nevertheless limit the stock’s near-term upside potential. The company is scheduled to report results on June 20th, with estimates essentially unchanged over the last two months.

Lennar, the homebuilder, is scheduled to report results after the market’s close on Monday, June 16th. The homebuilder is expected to bring in $1.97 per share in earnings on $8.24 billion in revenues, representing year-over-year changes of -41.7% and -5.97%, respectively.

This is a challenging environment for Lennar and other homebuilders, with demand hindered by affordability concerns and elevated mortgage rates. The stock was down after each of the last five quarterly releases and has lost roughly a fifth of its value this year (down -20.3%), which compares to the Zacks Construction sector’s -1.9% decline and the S&P 500 index’s +2.2% gain.

Q2 Earnings Season Scorecard

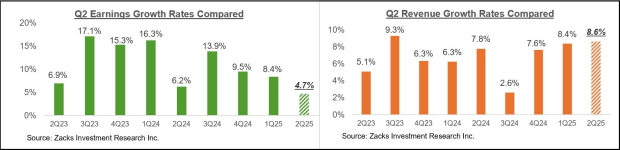

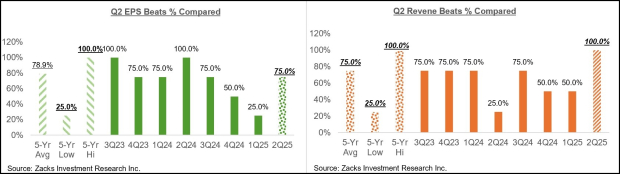

As noted earlier, we have already seen fiscal May-quarter results from four S&P 500 members, which we include in our Q2 tally. Total earnings for these four index members that have reported results are up +4.7% from the same period last year on +8.6% revenue gains, with 75% of the companies beating EPS estimates and all beating revenue estimates.

The comparison charts below put the Q2 earnings and revenue growth rates for these index members in a historical context.

The comparison charts below put the Q2 EPS and revenue beats percentages in a historical context.

We are not drawing any conclusions from these results, given the small sample size at this stage. But we nevertheless wanted to put these early results in a historical context.

For a detailed view of the evolving earnings picture, please check out our weekly Earnings Trends report here >>>> Earnings Estimates Stabilize: A Closer Look

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite