|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The artificial intelligence (AI)-driven, astonishing bull run of 2023 and 2024 has suffered major hurdles in 2025. The Fed’s ambiguity over further rate cuts this year, fears of a near-term recession and the availability of a low-cost Chinese AI platform have unnerved investors.

However, the technology sector has lately returned to its northward trajectory. Expectations of a U.S.-China trade deal, the delay by the Trump administration to impose 50% tariffs on the European Union and the ongoing negotiations related to tariff and trade policies with several other major trading partners of the United States boosted market participants’ confidence.

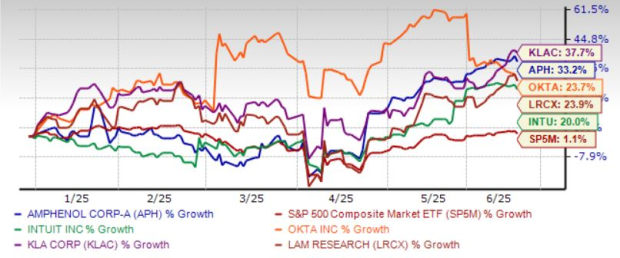

At this stage, we have identified five technology giants that have surged in first-half 2025. The favorable Zacks Rank of these companies will usher in more price upside in the second half. These stocks are: Amphenol Corp. APH, Intuit Inc. INTU, Okta Inc. OKTA, Lam Research Corp. LRCX and KLA Corp. KLAC.

Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 Amphenol provides connectivity solutions using AI and ML (machine learning) technologies. It provides AI-powered high-density, high-speed connectors and cables, and interconnect systems optimized for signal integrity and thermal performance.

Amphenol benefits from a diversified business model. APH’s strong portfolio of solutions, including high-technology interconnect products, is a key catalyst. Increased spending on both current and next-generation defense technologies bodes well for APH’s top-line growth. Apart from Defense, APH’s prospects ride on strong demand for its solutions across the Commercial Air, Industrial and Mobile devices.

The Andrew acquisition is expected to add roughly $0.09 to earnings in 2025. APH’s diversified business model lowers the volatility of individual end markets and geographies. Its strong cash-flow-generating ability is noteworthy.

Amphenol has an expected revenue and earnings growth rate of 32.3% and 40.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.5% in the last 30 days.

Zacks Rank #1 Intuit has been benefiting from steady revenues from the Online Ecosystem and Desktop business segments. INTU’s strong momentum in Online Services revenues is driven by the solid performance of Mailchimp, payroll and Money, which includes payments, capital and bill pay.

INTU’s Credit Karma business is benefiting from strength in Credit Karma Money, credit cards, auto insurance and personal loans. INTU’s strategy of shifting its business to a cloud-based subscription model will help generate stable revenues over the long run. Cloud is a flourishing part of the technology space and has been gaining momentum in recent years.

Intuit’s generative artificial intelligence (AI)-powered "Intuit Assist," provides financial assistant, enabling personalized insights and recommendations, integrated into products like TurboTax, Credit Karma, QuickBooks, and Mailchimp, aiming to fuel small business and personal financial success.

Intuit has an expected revenue and earnings growth rate of 12.1% and 18.4%, respectively, for the next year (ending July 2026). The Zacks Consensus Estimate for next-year earnings has improved 4.2% in the last 30 days.

Zacks Rank #2 Okta operates as an identity partner in the United States and internationally. OKTA offers a suite of products and services used to manage and secure identities, such as Single Sign-On, which enables users to access applications in the cloud or on-premises from various devices. OKTA also provides Universal Directory, a cloud-based system of record to store and secure user, application, and device profiles for an organization.

OKTA’s Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data, while API Access Management enables organizations to secure APIs. Access Gateway enables organizations to extend Workforce Identity Cloud, and Okta Device Access enables end users to securely log in to devices with Okta credentials.

OKTA has expected revenue and earnings growth rates of 9.4% and 16.7%, respectively, for the current year (ending January 2026). The Zacks Consensus Estimate for current-year earnings has improved 2.8% over the last 30 days.

Zacks Rank #2 Lam Research is riding on its strength across 3D DRAM and advanced packaging technologies. Growing etch and deposition intensity owing to increasing technology inflections in 3D architectures is a plus. A rebound in the System business owing to improving memory spending is a positive for LRCX.

Strategic investments in research and development activities position LRCX well to capitalize on the growing wafer fab equipment (WFE) spending. For 2025, WFE is expected to be approximately $100 billion. Foundry/logic, DRAM and NAND investments are expected to be higher year over year. Solid demand related to LRCX’s high-bandwidth memory is another driver.

Lam Research has an expected revenue and earnings growth rate of 1.6% and -0.5%, respectively, for next year (June 2026). The Zacks Consensus Estimate for next-year earnings has improved 0.5% in the last 30 days.

Zacks Rank #1 KLA benefits from strong demand in leading-edge logic, high-bandwidth memory, and advanced packaging, which are driving growth in the semiconductor industry. Advanced packaging is expected to exceed $850 million in 2025.

KLAC’s robust portfolio and its leadership in process control systems are enabling customers to manage increasing design complexity. The services business also continues to perform well. KLAC is well-positioned to capitalize on AI advancements, with AI driving demand for higher-value wafer processing and more complex designs.

KLAC has an expected revenue and earnings growth rate of 2.5% and 2%, respectively, for next year (June 2026). The Zacks Consensus Estimate for next-year earnings has improved 0.5% in the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

This AI Stock Roars To Profit, Builds Bullish Base Ahead Of This Key Catalyst

APH

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite