|

|

|

|

|||||

|

|

Pagaya Technologies Ltd. PGY is one of the most compelling fintech companies in today’s market. The company leverages cutting-edge artificial intelligence (AI) and machine learning to enhance credit decision-making and underwriting across consumer lending platforms. Its proprietary AI-driven models enable financial institutions to broaden access to credit while maintaining strong risk management and operational efficiency.

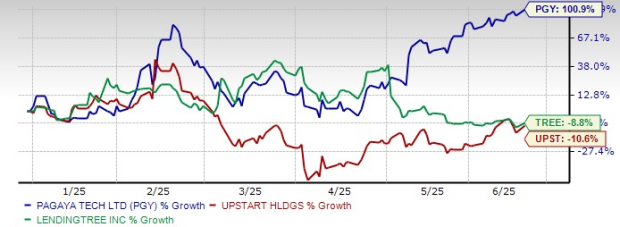

Hence, investors are bullish on PGY stock, which has surged 100.9% this year. The company has fared better than its close competitors, LendingTree TREE and Upstart Holdings UPST. So far this year, shares of LendingTree have declined 8.8%, while Upstart has lost 10.6%.

YTD Price Performance

Let’s find out what’s driving PGY stock and whether you can still add it to your portfolio or not.

Diversified and Resilient Business Model: Pagaya’s core strength lies in its resilient and adaptable business model. The company is actively expanding beyond its original focus on personal loans, moving into auto lending and point-of-sale (POS) financing. This diversification reduces exposure to cyclical risk in any single loan category, making the business more stable across economic cycles.

Parallelly, Pagaya is diversifying its funding sources. It has built a robust network of more than 135 institutional funding partners to support the sale of its asset-backed securities (ABS). Also, the company leverages forward flow agreements—structured financing arrangements in which institutional investors commit to purchasing future loan originations from Pagaya’s banking partners. These agreements offer a critical alternative funding source if ABS markets face disruptions during periods of market stress.

PGY has a competitive edge in its proprietary data and product suite. One standout offering is its Pre-screen solution, which enables banks and lenders to present pre-approved loan offers to existing customers without the need for a formal application. By analyzing the lender’s customer base and identifying qualified borrowers proactively, the company helps financial institutions deepen customer relationships and expand credit access with minimal incremental marketing spend. This marks an evolution in its value proposition—from driving market share gains for partners to now enhancing their share of wallet with existing customers.

Lean Balance Sheet: Pagaya operates a capital-efficient model that largely avoids holding loans on its balance sheet, significantly reducing its exposure to credit risk and market volatility. This is made possible through a robust network of institutional funding partners and a strategic focus on issuing ABS. The capital raised in advance is held in trust and deployed only when a lending partner originates a loan through Pagaya’s AI-driven network. At that point, the loan is immediately acquired by a pre-committed funding source, either through an ABS vehicle or a forward flow agreement. As a result, most loans never reside on Pagaya’s balance sheet or only do so briefly before being transferred.

This off-balance-sheet model has proven particularly effective during periods of elevated interest rates and market stress, such as from 2021 through 2023. By minimizing credit exposure and avoiding significant loan write-downs, Pagaya has managed to preserve its financial flexibility in turbulent environments.

Pagaya appears to rely heavily on forward flow agreements. These contracts provide a reliable and predictable source of capital, helping the company maintain liquidity even amid tightening credit markets and rising inflation. The company’s funding strategy is highly capital-efficient. It enables it to scale while minimizing equity dilution and limiting balance sheet risk. As of March 31, 2025, Pagaya reported $206.5 million in cash and short-term investments, alongside $507.8 million in debt, positioning it well for continued growth.

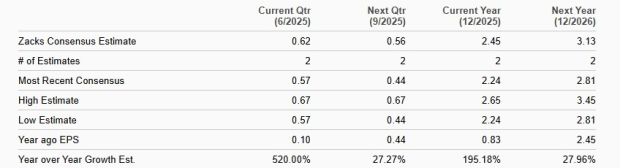

Over the past two months, the Zacks Consensus Estimate for earnings for 2025 and 2026 has moved higher to $2.45 and $3.13, respectively. The consensus estimate for earnings indicates 195.2% and 28% growth for 2025 and 2026, respectively.

PGY Earnings Estimates

Management projects net income (GAAP) to be in the range of $10-$45 million for 2025.

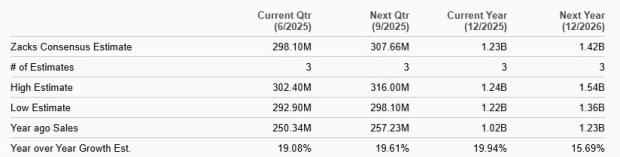

The Zacks Consensus Estimate for 2025 and 2026 sales implies year-over-year growth of 19.9% and 15.7%, respectively. The company expects total revenues and other income to be between $1.175 billion and $1.3 billion. Last year, the metric was $1.032 billion.

PGY Sales Estimates

Pagaya stock is currently trading at a 12-month trailing price-to-book (P/B) of 3.20X, which is below the industry’s 3.37X. This shows the stock is trading at a discount.

Price-to-Book

PGY stock is inexpensive compared with Upstart, which has a P/B of 7.74X. Similarly, it is trading at a discount compared with LendingTree’s P/B of 4.61X.

Given its strong year-to-date performance, resilient business model and capital-efficient funding strategy, Pagaya stands out in the fintech space. Its AI-driven platform, diversified revenue streams and reliance on forward flow agreements shield it from market volatility and credit risk.

With accelerating earnings and revenue estimates, along with bullish analyst sentiment, PGY is well-positioned for continued growth. Moreover, the stock trades at a discount relative to peers like Upstart and LendingTree, making its valuation attractive. For investors seeking exposure to a high-growth, tech-enabled lender with solid fundamentals, PGY stock remains a compelling buy.

At present, PGY sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 14 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite