|

|

|

|

|||||

|

|

Roku ROKU has partnered with Amazon AMZN Ads to launch a new integration that could reshape how advertisers reach Connected TV (CTV) audiences. Through Amazon DSP, advertisers can now access an estimated 80 million U.S. CTV households within the Roku and Fire TV ecosystems, gaining unmatched reach through authenticated, logged-in viewers. This collaboration brings together two of the largest CTV platforms, expanding advertiser access to a vast and highly addressable audience across connected devices.

Early results have been promising. Advertisers saw 40% more unique viewers with the same budget and reduced ad repetition by nearly 30%. The integration also allows smarter targeting and better measurement by recognizing users across devices. For Roku, this partnership with Amazon could strengthen its ad business and drive higher platform monetization.

Roku shares jumped 10.4% following the announcement of the partnership, signalling strong investor optimism about the growth opportunities this deal could unlock for the company.

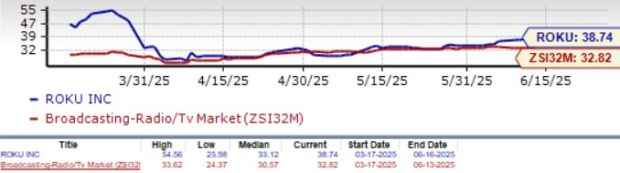

In the trailing three months, Roku shares climbed 23.4%, outperforming the Zacks Broadcast Radio and Television industry’s growth of 20.1% and the Zacks Consumer Discretionary sector’s return of 7.8%. The rise in the company’s shares shows investor confidence in its long-term growth strategy.

Roku’s advertising strategy is gaining strong momentum, powered by tech-driven upgrades like its AI-powered Home Screen, deeper integrations with tools, such as Ads Manager and partnerships with Adobe and INCRMNTAL. The recent partnership with Amazon adds another layer of strength, giving advertisers access to a large base of authenticated viewers through Amazon DSP.

Roku’s efforts in advertising have been paying off. In the first quarter of 2025, Roku’s platform revenues grew 17% year over year to $881 million. Ad revenues, excluding the media and entertainment vertical, grew at an even faster rate and outpaced the broader U.S. OTT ad market. The Roku Channel also saw a sharp 84% year-over-year increase in viewing hours, highlighting rising engagement across the platform.

The Zacks Consensus Estimate for 2025 loss is pinned at 17 cents per share, which has remained unchanged over the past 30 days, indicating growth of 80.9% from the figure reported in the year-ago quarter.

The consensus mark for 2025 total revenues is pegged at $4.55 billion, suggesting year-over-year growth of 10.54%.

Roku’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 51.15%.

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

Roku operates in a highly competitive advertising industry and competes with several companies that are aggressively expanding their ad-supported streaming businesses. Two key rivals include Netflix NFLX and Paramount Global PARA.

Netflix said in May that 94 million subscribers now use its ad-supported tier, up from 70 million in November, reflecting strong demand for its lower-priced plan amid global economic uncertainty. With more than 300 million global customers across all tiers, Netflix continues to see steady spending and engagement despite broader market pressures.

Paramount+, the streaming service of Paramount Global, is expanding its global footprint by introducing its ad-supported basic tier in Germany, Switzerland and Austria. This move reflects the company’s broader strategy to scale its advertising business through international growth.

Roku’s Devices segment continues to be a weak spot in its overall business, despite stronger-than-expected unit sales in the first quarter of 2025. The company remains under pressure from macroeconomic challenges and heavy promotional activity that carried over from the holiday season, which significantly impacted profitability. While Roku has launched new devices and expanded into international markets, the segment still struggles to contribute meaningfully to the bottom line and remains a drag on overall performance.

In the first quarter of 2025, Devices revenues were $140 million, up 11% year over year, but the segment posted a steep gross loss of $19 million.

Roku currently trades at a price-to-cash flow ratio of 38.74X, which is at a premium compared to the Zacks Broadcast Radio and Television industry average of 32.82X. While this valuation gap suggests that investors have high growth expectations for this stock, it is not a good pick for a value investor. A value score of D further reinforces an unattractive valuation for ROKU at this moment.

Roku’s expanding platform revenues, growing ad footprint and improving user engagement through innovations like the AI-powered Home Screen and Roku Channel underscore its potential in the CTV space. The recent partnership with Amazon further enhances its competitive edge, offering better ad performance and broader reach. These developments reflect strong strategic execution and a scalable business model.

However, challenges remain. The Devices segment continues to drag on profitability, and Roku’s valuation appears stretched relative to the industry. While long-term prospects are solid, near-term risks warrant caution. Investors should watch for sustained execution and margin improvement and hold the stock for now.

ROKU currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise for investors to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 48 min | |

| 57 min |

AI Stocks At Crossroads As Nvidia, Snowflake, CoreWeave, Salesforce Step Into Spotlight

AMZN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow Rises Before Nvidia Earnings; First Solar Sinks On Weak Outlook (Live Coverage)

AMZN

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours |

MercadoLibre Stock Falls After Q4 Results. Why A Revenue Beat Wasn't Enough To Revive Rally.

AMZN

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite