|

|

|

|

|||||

|

|

After dipping by more than 10% each earlier this year, the major stock market indexes are once again on the upswing. As of this writing, the S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average are between 2% and 6% below their all-time highs.

With that in mind, let's consider which breakout growth stocks are worth targeting right now.

Image source: Getty Images.

First, there's Spotify Technology (NYSE: SPOT). As of this writing, Spotify stock is up more than 58% year to date, and is hovering near its all-time high. Powered by an impressive earnings beat in its first quarter results, it certainly qualifies as a breakout growth stock.

One reason you may want to consider Spotify right now is that its key performance metrics continue to climb. In the first quarter, monthly active users (MAUs) increased 10% year over year. Furthermore, premium subscribers grew by 12%, to 268 million. But here's what's important to understand -- this growth has been part of a long-term trend stretching back several years. In short, there's been no slowdown to the actual revenue generating business whatsoever.

Indeed, Spotify's MAUs have increased roughly 10x over the last ten years, from 68 million to 678 million.

While most Spotify users are listening on an ad-supported membership, the company aims to convert as many of those users to paid subscribers as possible. Paid subscribers generate about 90% of Spotify's revenue, so increasing overall users -- and paid subscribers in particular -- is essential to the company's revenue growth.

With Spotify's user growth exceeding expectations, Wall Street analysts have taken notice. Investment bank Jefferies recently raised its price target for Spotify stock from $730 to $845. It noted that better-than-expected user growth -- led by emerging markets -- and higher ad rates could act as further catalysts for the stock. In addition, potential price increases and further cost reductions could boost its margins.

Spotify's artificial intelligence (AI) initiatives offer another compelling reason for investors to consider the stock. The company has already rolled out elements like AI DJ, natural language search, and AI-created playlists. These features help personalize each user's experience on the platform, boosting overall engagement and satisfaction.

For growth-oriented investors, now could be the right time to pull the trigger on Spotify. However, utilizing a dollar-cost-averaging approach could be a smart move, as it relieves you of the pressure of trying to pick the "right" time to buy shares.

Next, there's Roblox (NYSE: RBLX), one of 2025's hottest stocks, with shares up 78% year to date.

So, why is Roblox stock suddenly on fire? It's because of the company's improving fundamentals.

In the first quarter, Roblox beat analysts' estimates by reporting a loss of $0.33 per share.According to estimates compiled by Yahoo Finance, analysts' consensus expectation was for the company to report a loss of $0.45 per share.

True, a net loss is still a loss, and Roblox has struggled to deliver any quarterly profits dating back to 2021. However, for a growth stock which is still early in its life cycle, profits are not essential -- at least not yet. Far more important is that the company continues to grow and that its balance sheet can support its operations.

And on that front, Roblox is doing ok. The company has $2.7 billion in cash and $1.8 billion in debt. Moreover, its free cash flow over the last 12 months amounted to about $1 billion, meaning the company isn't facing a cash crunch.

As for growth, revenue increased by 29% year over year, and bookings (money spent on Roblox's virtual currency, Robux, which later gets reported as actualized revenue) increased by 31%.

Finally, the company announced that payouts to its creators during the quarter surpassed $281 million. That puts them on pace to exceed $1 billion for the whole year. Rising creator payouts are important because they will likely entice more prospective game developers to launch games on Roblox, knowing that the company has paid substantial compensation to other developers.

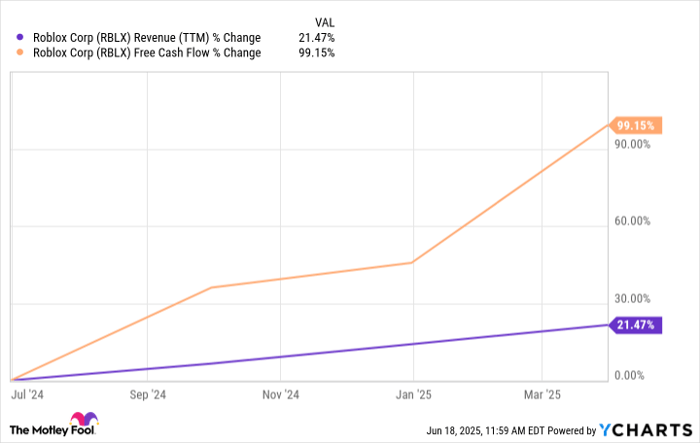

So, is now the right time to buy shares of Roblox? Investors with a long-term growth mindset may want to strike now, as some of the company's key metrics, like revenue and free cash flow, are increasing.

RBLX Revenue (TTM) data by YCharts.

Granted, Roblox isn't a stock for everyone. The company's lack of profitability makes it unsuitable for some investors and portfolios. However, for those with an appetite for growth, Roblox is a stock worth considering.

Before you buy stock in Roblox, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roblox wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $658,297!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $883,386!*

Now, it’s worth noting Stock Advisor’s total average return is 992% — a market-crushing outperformance compared to 172% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of June 9, 2025

Jake Lerch has positions in Roblox and Spotify Technology. The Motley Fool has positions in and recommends Roblox and Spotify Technology. The Motley Fool has a disclosure policy.

| 7 hours | |

| 7 hours | |

| 8 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite