|

|

|

|

|||||

|

|

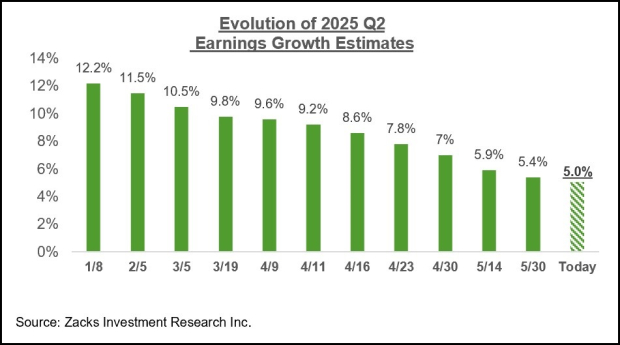

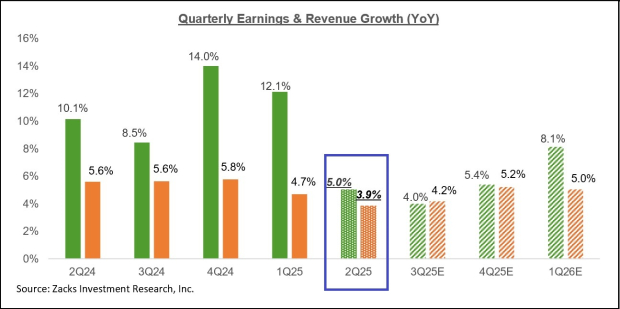

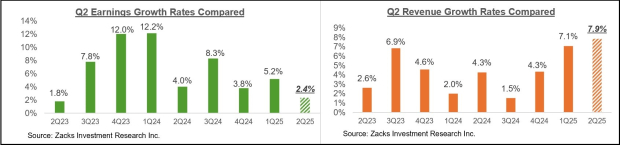

The expectation is for Q2 earnings to increase by +5% from the same period last year on +3.9% higher revenues. This will be a material deceleration from the growth trend of recent quarters.

In the unlikely event that actual Q2 earnings growth for the S&P 500 index turns out to be +5% as currently expected, this will be the lowest earnings growth pace for the index since the +4.3% growth rate in 2023 Q3.

We have been regularly flagging in recent weeks that 2025 Q2 earnings estimates have been steadily coming down, as you can see in the chart below.

The magnitude of cuts to 2025 Q2 estimates since the start of the period is larger and more widespread than what we have become accustomed to seeing in the post-COVID period.

Since the start of April, Q2 estimates have declined for 14 of the 16 Zacks sectors (Aerospace and Utilities are the only sectors whose estimates have gone up), with the biggest cuts to Conglomerates, Autos, Transportation, Energy, Basic Materials, and Construction sectors.

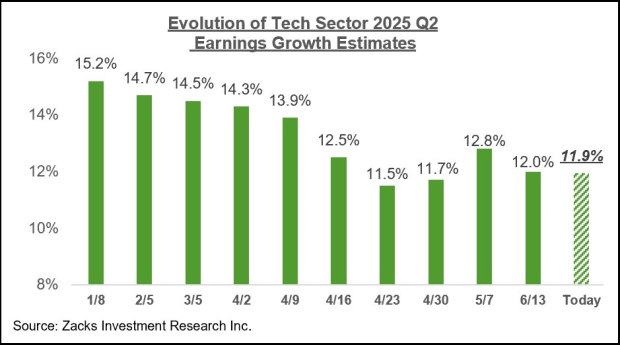

Estimates for the Tech and Finance sectors, the largest earnings contributors to the S&P 500 index, accounting for more than 50% of all index earnings, have also been cut since the quarter got underway. But as we have been pointing out recently, the revisions trend for the Tech sector has notably stabilized in recent weeks, as shown in the chart below.

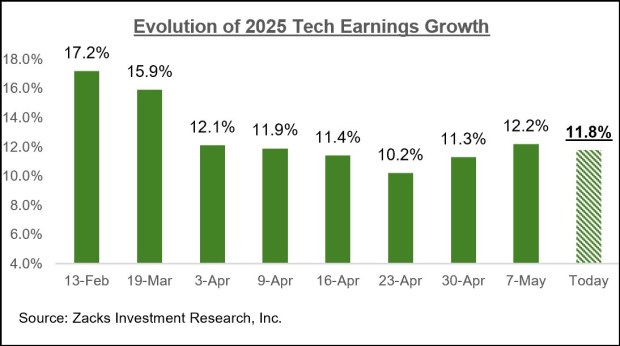

We see this same trend at play in annual estimates as well. The chart below shows the Tech sector’s evolving earnings expectations for full-year 2025.

A likely explanation for this stabilization in the revisions trend is the easing in the tariff uncertainty after the more punitive version of the tariff regime was delayed. Analysts started revising their estimates lower in the immediate aftermath of the early April tariff announcements, but appear to have since concluded that those punitive tariff levels are unlikely to get levied, helping stabilize the revisions trend.

The chart below shows current Q2 earnings and revenue growth expectations in the context of the preceding four quarters and the coming three quarters.

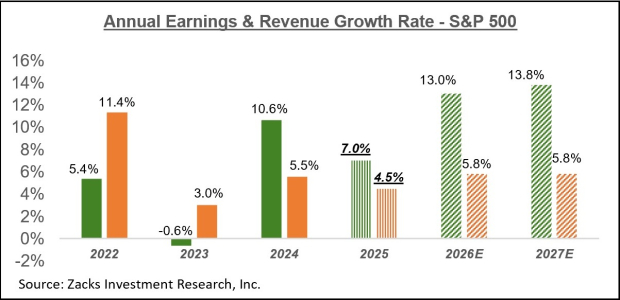

The chart below shows the overall earnings picture on a calendar-year basis.

In terms of S&P 500 index ‘EPS’, these growth rates approximate to $253.84 for 2025 and $286.87 for 2026.

The chart below shows how these calendar year 2025 earnings growth expectations have evolved since the start of Q2. As you can see below, estimates fell sharply at the start of the quarter, which coincided with the tariff announcements, but have notably stabilized over the last four to six weeks.

The June-quarter reporting cycle will really get going when the big banks come out with their results on July 15th. But we will have officially counted almost two dozen quarterly reports from S&P 500 members by then. All of those reports will be from companies with fiscal quarters ending in May, which we and other research organizations count as part of the June-quarter tally.

We have seen such fiscal May-quarter results from 9 S&P 500 members already and are on track to see another 8 index members come out with results this week. The notable companies reporting this week include FedEx FDX, Nike NKE, Micron MU, and others.

FedEx shares were down big in response to the March 20th quarterly release when it missed estimates. But the stock has been struggling for the last couple of years, with the onset of uncertainty around international trade adding to muted demand trends in the industrial sector. FedEx has been actively working to reduce its cost base and lower the business’s capital intensity. The board’s announcement to spin off the LTL business (less-than-truckload business) is part of that repositioning.

FedEx is scheduled to report after the market’s close on Tuesday, June 24th. The company is expected to earn $5.94 per share on $21.7 billion in revenues, representing year-over-year changes of +9.8% and -1.9%, respectively. Estimates for the period have steadily come down, with the current $5.94 per share estimate down from $5.98 a month back and $6.32 three months ago.

FedEx shares have lost roughly a fifth of their value this year, roughly in line with UPS’s performance, but materially below the S&P 500 index’s +1.2% gain. The stock is down -2.1% over the last three years, while the S&P 500 index has gained +60.3%.

Just like FedEx, Nike is another bellwether that has been struggling lately, with the stock down -21.1% this year when the market as a whole is up +1.2%. Expectations for Nike’s quarterly release after the market’s close on Thursday, June 26th, remain low, with EPS and revenues expected to decline -89.1% and -15.4% from the same period last year, respectively

The headwinds facing Nike include perceptions of a stale product line that has been weighing on demand and the resulting inventory build that needs to be rightsized. The inventory overhang is expected to persist for a few more quarters, but the market will eagerly seek incremental information on the reception of new products and updates on the product pipeline. The margin squeeze is primarily a result of clearing stale inventory, but also reflects the new management team’s renewed focus on the wholesale business, which had been neglected in recent years.

Micron Technology shares have literally been on fire lately, up +46.2% in the year-to-date period, handily outperforming the Zacks Tech sector’s +1.5% gain and the S&P 500 index’s +1.2% gain. Driving the stock’s impressive momentum is Micron’s leadership position in the high-bandwidth memory (HBM) space, a mission-critical input for high-performance computing (HPC) and artificial intelligence (AI) applications.

The combination of stable demand trends in legacy products like DRAM and continued strength in HBM is expected to result in strong numbers when Micron reports results after the market’s close on Wednesday, June 25th. The expectation is that Micron will report $1.57 per share in earnings on $8.81 billion in revenues, representing year-over-year changes of +153.2% and +29.3%, respectively. Estimates for the fiscal May quarter have remained unchanged over the last three months, although they have increased modestly for the August period and for next year as well.

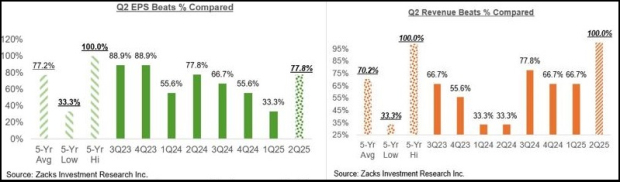

As noted earlier, we have already seen fiscal May-quarter results from 9 S&P 500 members, which we count as part of our Q2 tally. Total earnings for these 9 index members that have reported results are up +2.4% from the same period last year on +7.9% revenue gains, with 77.8% of the companies beating EPS estimates and all of them beating revenue estimates.

The comparison charts below put the Q2 earnings and revenue growth rates for these index members in a historical context.

The comparison charts below put the Q2 EPS and revenue beats percentages in a historical context.

We are not drawing any conclusions from these results, given the small sample size at this stage. But we nevertheless wanted to put these early results in a historical context.

For a detailed view of the evolving earnings picture, please check out our weekly Earnings Trends report here >>>> Earnings Estimates Stabilize: A Closer Look

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow Rises, But Tech Stocks Fall; Palantir, Tesla Extend Losses (Live Coverage)

MU

Investor's Business Daily

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite