|

|

|

|

|||||

|

|

Axon Enterprise, Inc. AXON and Kratos Defense & Security Solutions, Inc. KTOS are two prominent names operating in the aerospace and defense equipment industry. As rivals, both companies are engaged in producing highly engineered public security and defense solutions in the United States and internationally. Both companies have been enjoying significant growth opportunities in the public safety and defense industries on account of growing instances of terrorism and criminal activities and the expansionary U.S. budgetary policy. Let’s take a closer look at their fundamentals, growth prospects and challenges.

Axon Enterprise has been witnessing persistent strength in its Connected Devices segment. The company continues to witness growing popularity for its next-generation TASER 10 products, whose shipment began a couple of years back. Growth in cartridge revenues, supported by the higher adoption of the TASER products, has also been driving the segment’s performance. The segment’s revenues increased 26.1% year over year in the first quarter of 2025.

Axon Enterprise introduced its next-generation body-worn camera, Axon Body 4, in 2023. With upgraded features such as a bi-directional communications facility and a point-of-view camera module option, this body camera is generating significant demand, thus bolstering the segment’s growth.

The Software & Services segment has been benefiting from solid growth in the aggregate number of users to the Axon Enterprise network. After witnessing a year-over-year 33.4% jump in 2024, revenues from the segment also increased 39% in the first quarter. The segment’s growth has been bolstered by continued momentum in digital evidence management and increased demand for premium add-on features.

The company remains focused on strategic partnerships to expand its product offerings and customer base. In June 2024, Axon Enterprise entered into a partnership with Skydio (a leading U.S. drone manufacturer) to introduce a comprehensive line of drones in public safety that includes a scalable Drone as First Responder (DFR) solution. The combined offering supports AXON’s DFR programs and strengthens its market position in this category.

On the flip side, escalating costs and expenses are a concern for Axon Enterprise’s bottom line. In the first quarter, its cost of sales and SG&A expenses increased 18.2% and 48%, respectively, year over year. The company incurred high costs and expenses related to business integration activities, an increase in headcount and higher wages and stock-based compensation expenses.

Kratos is the primary unmanned aerial target drone system provider for the U.S. Air Force, Navy, Army and numerous allied foreign defense agencies. To enhance its footprint in this space, the company has been making significant efforts. It is currently under contract with a U.S. Government Agency for a Next Generation Target Drone (5GAT). In January 2025, Kratos obtained a $34.8 million contract for Valkyrie Mission System Integration from the U.S. Marine Corps to support the XQ-58A UAS mission systems and subsystems. In March 2025, the company won a $59.3 million contract for additional 70 BQM-177A Surface Launched Aerial Targets (SSAT).

The U.S. Navy also awarded KTOS a contract worth nearly $19.1 million for contractor logistical support and engineering services for the BQM-177A Subsonic Aerial Target System. With it being the sole source provider of the BQM-177A to the U.S. Navy, such contract wins reflect the solid demand that Kratos enjoys in the unmanned aerial market.

Apart from manufacturing unmanned aerial drone systems, Kratos also focuses on expanding its product portfolio with other products, especially in hypersonics. In January 2025, the company won a five-year contract worth $1.45 billion for the Multi-Service Advanced Capability Hypersonic Test Bed (MACH-TB) 2.0. This constituted the largest single award in its history.

Such a diverse product portfolio ushers in solid order flows for the company, which, in turn, resulted in a robust backlog worth $1.51 billion at the end of the first-quarter 2025. This implies solid revenue generation prospects for the company. KTOS expects to recognize nearly 48% of the total backlog as revenues in 2025, an additional 25% in 2026 and the balance thereafter.

However, Kratos continues to be affected by supply-chain disruptions that have been plaguing industries across the globe. This might impact the company’s production and top line in the quarters ahead.

In the past six months, Axon Enterprise shares have risen 23.2%, while Kratos stock has gained 61.7%.

The Zacks Consensus Estimate for AXON’s 2025 sales and earnings per share (EPS) implies year-over-year growth of 27.2% and 6.6%, respectively. Although the EPS estimates for 2025 have decreased over the past 30 days, the estimate for 2026 has increased.

The Zacks Consensus Estimate for KTOS’ 2025 sales implies growth of 12.8% year over year, while the EPS estimate implies breakeven level. KTOS’ EPS estimates have been stable for 2025, while the same is trending northward for 2026 over the past 30 days.

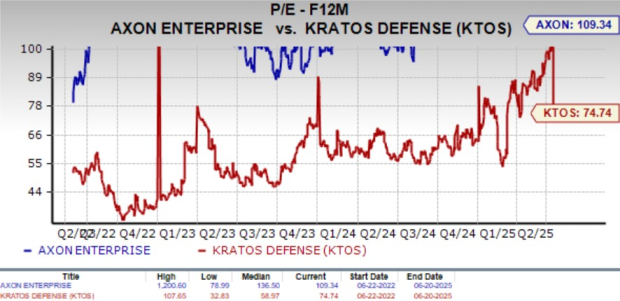

Kratos is trading at a forward 12-month price-to-earnings ratio of 74.74X, while Axon Enterprise’s forward earnings multiple sits much higher at 109.34X.

Axon Enterprise and Kratos have a Zacks Rank #3 (Hold) each, which makes choosing one stock a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axon Enterprise’s strength in both the segments has been dented by rising costs and expenses, which might affect its margins and profitability. Also, AXON’s expensive valuation warrants a cautious approach for existing investors.

In Contrast, Kratos’ growth prospects remain solid, backed by the U.S. administration’s stable funding provisions. Additionally, KTOS’ attractive valuation is more appealing and its upwardly revised earnings estimates instill confidence. Given these factors, KTOS seems a better pick for investors than AXON currently.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite