|

|

|

|

|||||

|

|

Both Palantir Technologies Inc. PLTR and UiPath Inc. PATH are prominent companies at the forefront of AI-centric software innovation.

Palantir is renowned for its expertise in large-scale data analytics and decision intelligence platforms, serving government agencies, defense sectors and large enterprises with complex data integration and real-time situational awareness. UiPath focuses on robotic process automation (RPA), leveraging artificial intelligence to automate repetitive business processes and enhance operational efficiency across various industries.

While Palantir empowers strategic decision-making through advanced analytics, UiPath streamlines workflows, making both essential players in the evolving AI ecosystem.

Palantir Technologies is experiencing explosive growth driven by the rapid adoption of its Artificial Intelligence Platform (AIP), which has quickly become its most powerful engine for commercial expansion. In the first quarter of 2025, AIP significantly propelled U.S. commercial revenues, which soared 71% year over year and 19% sequentially. This strong performance pushed the company past a $1 billion annual run rate in U.S. commercial sales for the first time.

The momentum is also reflected in the total contract value of the commercial segment, which surged 239% YoY. Deal sizes have grown meaningfully, with the number of contracts worth over $1 million more than doubling compared to the previous year.

A key driver of this adoption is the popularity of Palantir’s AIP bootcamps, short, focused training programs that help customers rapidly onboard and deploy AIP within their organizations. These bootcamps enable clients to quickly implement production-grade AI workflows, dramatically reducing time-to-value and showcasing AIP’s simplicity and real-world applicability.

Palantir’s AIP empowers enterprises to deploy autonomous AI agents that not only speed up decision-making but also multiply productivity gains. Unlike peers focused on building AI models, Palantir is dominating the application layer, delivering practical, enterprise-ready AI systems that deliver measurable value from day one. As a result, the U.S. commercial segment is now the company’s most dynamic and scalable growth driver, with AIP at the heart of that acceleration.

UiPath continues to be a global leader in the fast-growing RPA market, leveraging AI to automate rule-based and repetitive digital tasks across enterprise environments. Its platform facilitates end-to-end automation, excelling in areas such as task mining, workflow orchestration, and process optimization. This has led to broad adoption across diverse industries, including finance, healthcare, insurance and the public sector.

UiPath’s strength is amplified through strategic partnerships with technology giants like Microsoft MSFT, Amazon AMZN, and Salesforce CRM. These alliances not only expand UiPath’s integration within enterprise IT ecosystems — such as Azure, AWS and Salesforce Cloud — but also reinforce its credibility and market reach in an increasingly competitive automation landscape.

The company boasts high customer retention, with net retention rates ranging between 110% and 115%, underscoring its ability to expand usage within existing accounts. In the first quarter of fiscal 2026, UiPath reported a 6% increase in revenues year over year, reaching $357 million. Additionally, its annual recurring revenue rose 12% to $1.69 billion, reflecting the strength of its subscription-based business model and customer loyalty.

With a strong global presence, a robust partner network, and a continued focus on intelligent automation, UiPath remains well-positioned to lead in the evolving RPA and enterprise automation market.

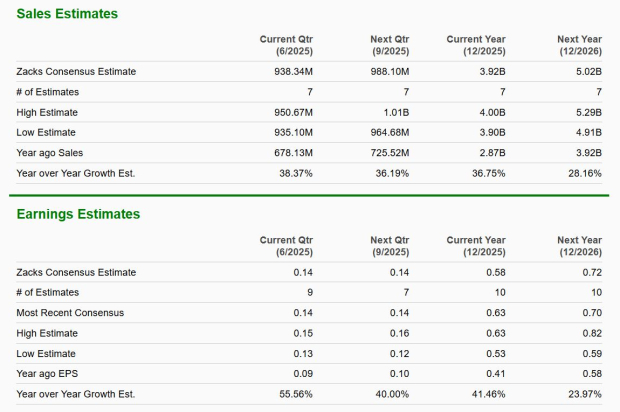

The Zacks Consensus Estimate for PLTR’s 2025 sales and EPS indicates year-over-year growth of 37% and 41%, respectively. EPS estimates have been trending upward over the past 60 days.

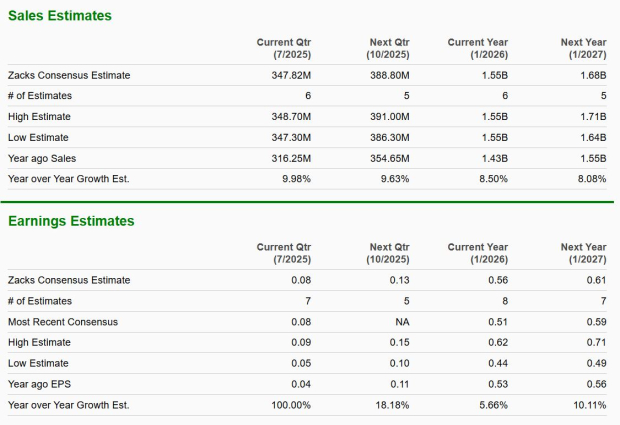

The Zacks Consensus Estimate for UiPath’s 2025 sales suggests 8.5% year-over-year growth, while EPS is expected to grow 6%. EPS estimates have been trending downward over the past 60 days.

UiPath is trading at a forward sales multiple of 4.07X, below its 12-month median of 4.5X. Palantir’s forward sales multiple stands at 72.9X, above its median of 46.76X.

While Palantir boasts impressive AIP-driven growth, UiPath offers a more balanced and sustainable investment profile. Its leadership in RPA, strong customer retention, and strategic partnerships with tech giants like Microsoft and Amazon provide long-term stability. With consistent revenue growth, a robust subscription model, and a forward sales multiple well below Palantir’s lofty one, UiPath presents a more attractive valuation and lower-risk entry point. Moreover, rising EPS estimates favor PLTR, but PATH’s proven enterprise stickiness and ecosystem integration make it the smarter AI-first software stock to bet on in today’s automation-driven business landscape.

While PATH carries a Zacks Rank #2 (Buy), PLTR carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 30 min | |

| 46 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Walmart To Report Results, Fresh Off New Highs, A New CEO And $1 Trillion Market Cap

AMZN

Investor's Business Daily

|

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite