|

|

|

|

|||||

|

|

Novo Nordisk NVO ended its collaboration agreement with telehealth company Hims & Hers Health HIMS to offer its blockbuster obesity drug Wegovy (semaglutide) at a discounted price to cash-paying patients. Following the decision, direct access to Wegovy will no longer be available to HIMS via NVO’s direct-to-patient online pharmacy, NovoCare Pharmacy.

Novo Nordisk cited Hims & Hers Health’s use of custom-compounded versions of Wegovy, along with concerns over the company’s sales and promotional tactics, which put patient safety at risk, as reasons for ending the partnership. HIMS stock crashed 34.6% in response to the news.

Novo Nordisk claimed that Hims & Hers Health’s compounded knock-off Wegovy versions often use semaglutide sourced from foreign suppliers in China, whose manufacturing processes and product quality have not been authorized or approved by the FDA. Citing a Brookings Institute report, NVO warns that many of these suppliers have poor quality assurance records or have never been inspected at all.

Novo Nordisk had signed the partnership agreement with HIMS in late April. Through the deal, the company was also trying to grow its obesity market share by boosting sales through increased patient access to Wegovy. NVO faces intense competition from Eli Lilly LLY, which markets its tirzepatide medicines, Mounjaro (diabetes) and Zepbound (obesity). Despite being on the market for less than three years, Lilly’s Mounjaro and Zepbound have witnessed strong sales driven by rapid demand.

Novo Nordisk’s dominance in the obesity market was being hurt by several pipeline setbacks. The company reported disappointing data from two late-stage studies for CagriSema, demonstrating a lower-than-expected reduction in body weight despite meeting study goals. Lilly’s Zepbound had earlier outperformed Wegovy in a head-to-head weight-loss study, too.

However, following the end of the partnership with Hims & Hers Health, NVO’s objective of increasing Wegovy’s patient access will take a temporary hit, resulting in a slowdown in obesity market share gain. The company remains on the lookout for partnership agreements with other telehealth companies to provide direct access to Wegovy with high standards of patient safety.

Despite the setback with HIMS, CVS Caremark, a major pharmacy benefit manager, had announced that it would make Novo Nordisk’s Wegovy its preferred GLP-1 therapy for weight loss, effective July 1. Such initiatives are likely to give NVO a commercial advantage over Lilly in the obesity market.

Several other companies, like Viking Therapeutics VKTX, are also making rapid progress in the development of weight loss candidates, adding to the competition in the obesity market. Viking Therapeutics’ dual GIPR/GLP-1 RA, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. VKTX’s phase III studies with the subcutaneous formulation of VK2735 are on track to begin this year.

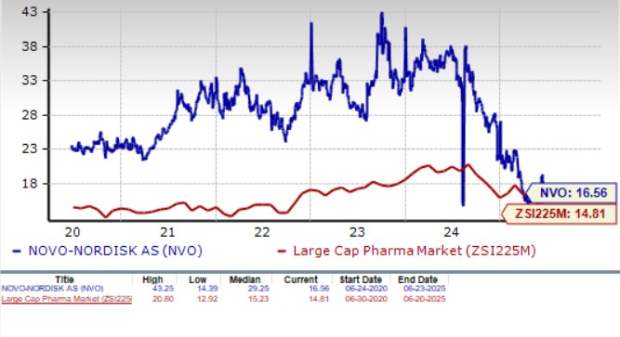

Year to date, Novo Nordisk shares have lost 18.9% compared with the industry’s 2.7% decline. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below. The stock is currently trading slightly above its 50-day moving average, but below its 200-day moving average.

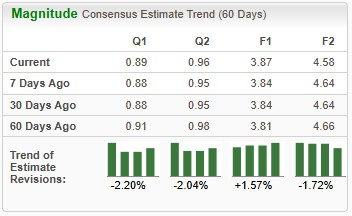

Novo Nordisk is trading at a premium to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 16.56 forward earnings, which is higher than 14.81 for the industry. However, the stock is trading much below its five-year mean of 29.25.

Earnings estimates for 2025 have improved from $3.81 to $3.87 per share over the past 60 days. During the same time frame, Novo Nordisk’s 2026 earnings per share estimates have decreased from $4.66 to $4.58.

The stock’s return on equity on a trailing 12-month basis is 80.95%, which is higher than 33.56% for the large drugmaker industry, as seen in the chart below.

Novo Nordisk currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Stocks to Watch Monday Recap: Diamondback, Netflix, Novo Nordisk, Lilly

NVO -16.43% LLY HIMS

The Wall Street Journal

|

| 2 hours | |

| 2 hours |

Hims & Hers Health Fourth-Quarter Sales Rise, Gives Soft First-Quarter Guidance

NVO -16.43% HIMS

The Wall Street Journal

|

| 2 hours | |

| 2 hours | |

| 2 hours |

Dow Jones Futures: Trump Tariffs Spark Stock Market Sell-Off; Apple, Nvidia, Tesla Are Key Movers

HIMS

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Novo Nordisk Dives As Next-Gen Obesity Drug Lags Eli Lilly's Kingpin

NVO -16.43% VKTX +11.05% LLY

Investor's Business Daily

|

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite