|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Take-Two Interactive Software TTWO has experienced a remarkable 32% surge year to date, but investors should view this rally with extreme caution. Despite the recent momentum driven by anticipation around upcoming releases, fundamental weaknesses and concerning financial metrics suggest the stock is significantly overvalued and poised for a correction.

The most glaring red flag for Take-Two investors is the disconnect between the stock's premium valuation and the company's deteriorating financial performance. The gaming giant reported a staggering GAAP net loss of $4.48 billion for fiscal 2025, representing a significant deterioration from the previous year's $3.74 billion loss. This massive deficit was primarily due to goodwill impairment charges of $3.55 billion, signaling that previous acquisitions have failed to deliver expected value.

Even more concerning is the company's operational cash flow, which turned negative at $45.2 million for fiscal 2025. For a company trading at current elevated levels following the 32% surge, these metrics paint a picture of fundamental weakness that cannot be ignored. The market appears to be pricing in perfection based on future potential rather than current reality, creating an unsustainable valuation bubble.

The company's management reporting shows adjusted EBITDA of only $199.1 million for the full year, a figure that pales in comparison to the market capitalization gains. This disconnect between financial performance and stock price appreciation suggests investors are paying an increasingly premium price for deteriorating fundamentals.

The Zacks Consensus Estimate for fiscal 2026 revenues is pegged at $5.99 billion, indicating 6.1% year-over-year growth, with earnings expected to increase 42.93% to $2.93 per share.

Take-Two Interactive Software, Inc. price-consensus-chart | Take-Two Interactive Software, Inc. Quote

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Take-Two's business model has become dangerously dependent on a handful of blockbuster releases, creating significant execution risk that the current valuation fails to account for. The much-anticipated Grand Theft Auto VI, originally expected to drive fiscal 2026 performance, has been pushed to May 26, 2026, falling into fiscal 2027.

This delay represents a critical blow to near-term revenue expectations and highlights the company's inability to maintain consistent release schedules. The company's fiscal 2026 guidance of $5.9-$6 billion in net bookings represents merely 5% growth, hardly justifying the stock's recent surge.

Furthermore, the concentration risk is evident in the company's revenue breakdown, where a small number of franchises generate the majority of income. NBA 2K, Grand Theft Auto and mobile titles carry the entire operation, leaving little room for diversification when these properties underperform or face delays.

Take-Two's decelerating growth trajectory, combined with increasing cost pressures, has created long-term concerns for investors. The company's guidance indicates that recurrent consumer spending will remain flat in fiscal 2026, a concerning development for a business model that relies heavily on ongoing player engagement and monetization.

Mobile revenues, a key growth driver for the industry, are expected to decline, along with Grand Theft Auto Online performance. This dual headwind creates a challenging environment where the company must rely increasingly on new releases to drive growth, rather than building sustainable, recurring revenue streams.

Operating expenses have also surged, with management reporting a 3% year-over-year increase in fiscal 2026 expectations, primarily driven by higher marketing costs. This expense growth, combined with modest revenue expansion, suggests margin compression that will pressure profitability metrics further.

The company's development costs continue escalating, with capital expenditures of approximately $140 million planned for fiscal 2026. These investments may not yield immediate returns, creating additional pressure on near-term financial performance.

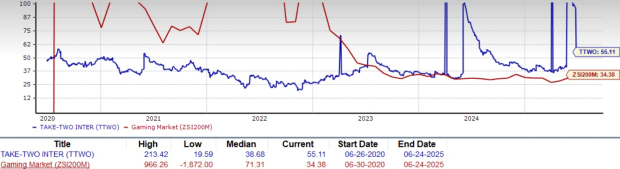

Despite its operational challenges, Take-Two trades at a premium valuation that appears disconnected from its fundamental performance. TTWO’s P/E ratio hovers around 55.11, well above the industry’s 34.38, suggesting that it is not a great pick for a value investor. The Value Score of F further reinforces a stretched valuation for Take-Two at this moment.

The stock's 32% year-to-date gain, outperforming the Zacks Consumer Discretionary sector and its rivals, has created an expensive entry point for new investors, particularly given the company's negative earnings and cash flow generation.

The gaming industry landscape has become increasingly competitive, with major technology companies like Microsoft MSFT, Sony SONY and emerging mobile-first developers capturing market share. Traditional publishers like Take-Two face pressure from subscription gaming services, free-to-play models, and changing consumer preferences toward live-service games.

Companies like Electronic Arts EA and Activision Blizzard (now part of Microsoft) have demonstrated superior execution in live-service gaming and consistent cash generation. Take-Two's inability to match these operational metrics while trading at comparable or higher valuations suggests significant downside risk.

Despite the 32% year-to-date surge, Take-Two Interactive presents a selling opportunity for risk-conscious investors. The combination of unsustainable valuation metrics, dangerous dependence on delayed blockbuster releases, and a declining growth trajectory creates a perfect storm for disappointment. Smart investors should consider taking profits from the recent rally and seeking opportunities in companies with more sustainable business models and reasonable valuations. Take-Two currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite