|

|

|

|

|||||

|

|

Nvidia hit records on Wednesday, with the S&P 500 and the Nasdaq on the verge of reaching new all-time highs before July—the stock market has climbed in July for 10 straight years.

The Nasdaq has soared roughly 33% since early April after Wall Street shook off trade war fears as the Trump administration pivoted toward deal-making.

Confident that tensions will cool in the Middle East, Wall Street can once again turn its attention to cooling inflation, trade deals, and the potential for strong second-quarter earnings.

The market might charge higher in July and throughout the summer. That said, Wall Street could start taking some profits heading into Q2 earnings season, considering that Nvidia and other growth stocks have soared 60% or more in less than three months.

Given the broadly bullish backdrop, mixed with the possibility of near-term profit-taking, investors might want to buy strong stocks that are trading far below their all-time highs.

Today’s Full Court Finance at Zacks explores two strong beaten-down stocks—Align Technology, Inc. and Chipotle Mexican Grill—to consider buying on the dip in July.

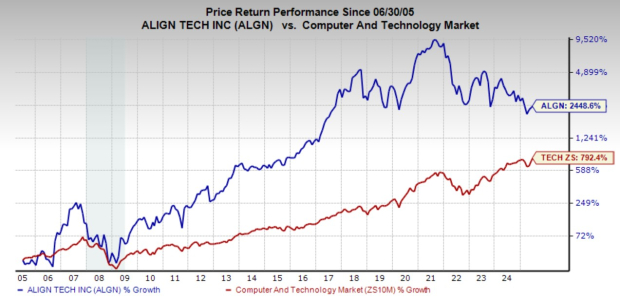

Invisalign maker Align Technology, Inc. ALGN has skyrocketed 2,400% in the past 20 years (vs. Tech’s 800%) as Wall Street embraced its growth and expansion into new demographics and countries. Despite roughly matching the S&P 500 in the past decade as well, Align trades 73% below its highs.

Align’s advanced clear aligner system permanently altered the orthodontics industry. It works directly with dentists, doctors, and orthodontists who help customers through the entire process, utilizing ALGN’s advanced digital services and technologies to scan teeth and more.

ALGN’s success inspired competitors, some of which quickly went out of business. The firm boasted in the first quarter of 2025 that it reached the 20 million patient milestone. It also critically expanded its reach within the teenage demographic, successfully attracting more people who might have used traditional metal braces. Align has also grown its international business.

ALGN’s downturn followed its massive Covid pull-forward, which created an impossible-to-compete-with stretch of growth, leading to plummeting earnings estimates. Higher inflation and a slowing economy also make it harder for people to justify spending on cosmetic dental work. Thankfully, ALGN posted a beat-and-raise first quarter as its business cycle normalizes.

Align got off to a good start to 2025, with clear Aligner volumes up both sequentially and year-over-year, driven by growth across adult, teens, and all of its regions. It said that Q1 was its “highest year-over-year growth rate for both adult and teen patients since 2021.”

Image Source: Zacks Investment Research

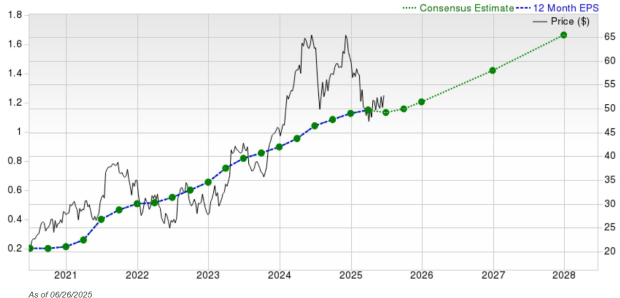

ALGN’s upward earnings revisions land it a Zacks Rank #1 (Strong Buy). The company is projected to grow its adjusted earnings by 11% in 2025 and 9% next year, on 4% and 6%, respective revenue growth. The chart above highlights Align’s bullish long-term earnings growth outlook.

ALGN stock is down 30% in the last five years and 10% in 2025 to help it trade 73% below its peaks. It held its ground at its long-term 200-month moving average earlier this year after buyers stepped up near its initial Covid selloff lows.

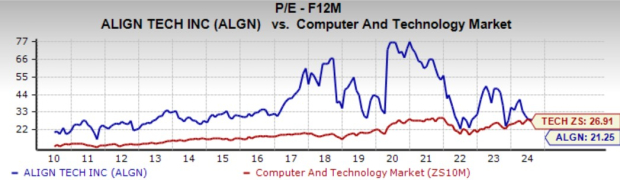

On the valuation front, Align trades at a 33% discount to its 15-year median and 22% below Tech at 21.3X forward 12-month earnings, even though it has crushed the sector.

The company has a robust balance sheet that helped it roll out a $1 billion buyback program in early May. And Align’s Medical-Dental Supplies industry is in the top 11% of 245 Zacks industries.

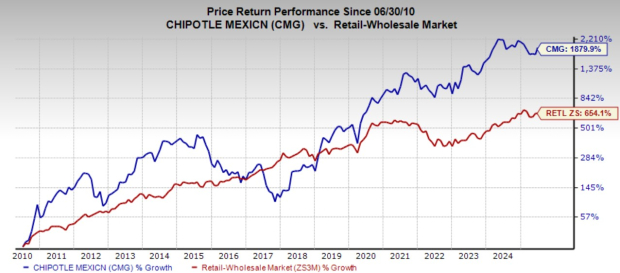

Chipotle Mexican Grill CMG stock has dropped 21% from its June 2024 peaks on the back of slowing comparable store sales growth and a fading earnings outlook. Wall Street also didn’t love that Brian Niccol, who helped turn the company around when he took over in 2018, left for Starbucks in August.

The downturn, its 50-for-1 stock split last June, and its growth outlook, makes Chipotle an enticing buy right now.

Chipotle remains one of the titans of the fast-casual restaurant industry, inspiring many other companies to enter the space in the shifting restaurant landscape. The company averaged 15% revenue growth in the past five years.

Chipotle, under its new boss, remains focused on growing its fast-casual chain through a consistent menu of fresh, quality food. The burrito giant has benefited from its successful push into mobile ordering, delivery, and other digital-focused initiatives.

Its pitch to customers and Wall Street remains as strong as ever since its high-quality, freshly made food is even more competitively priced compared to the likes of McDonald’s and other fast-food chains after several years of high inflation. The company could also benefit from a larger push for more people to start eating healthier.

Chipotle is projected to grow its revenue by 8% in 2025 and 13% next year to reach $13.79 billion. Meanwhile, it is expected to boost its adjusted earnings by 8% and 18%, respectively.

CMG’s earnings outlook has slipped, but it has topped our bottom-line estimates for nine straight quarters. On top of that, its long-term earnings growth outlook remains impressive (see the nearby chart).

CMG shares have skyrocketed roughly 1,900% in the past 15 years to nearly triple its sector. The stock is also up 150% in the last five years vs. its sector’s 42% and the S&P 500’s 100%. Yet, investors can buy Chipotle stock down 21% from its peaks as the market trades near its all-time highs.

It got rejected by its 200-day moving average on Thursday. Some investors might want to wait for Chipotle to report in July to see if it offers a more encouraging outlook for comparable sales, which are currently projected to climb by around 1% after three years of 8% growth.

Wall Street might also need the firm to boost its earnings outlook to help justify paying 42X forward earnings for a fast-casual restaurant stock. Yet, CMG's valuation marks a 50% discount to its peaks and matches its historic median despite its massive run.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Cava Fourth-Quarter Sales Rise on Higher Prices, New Restaurant Openings

CMG

The Wall Street Journal

|

| 1 hour | |

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite