|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Barclays PLC BCS and HSBC Holdings PLC HSBC are often the first names that come to mind when discussing prominent foreign banks. Both are based in London and have been streamlining their operations to enhance efficiency and focus on their core businesses.

HSBC and Barclays have been reallocating their capital into higher-growth markets, with HSBC being particularly focused on the Asia-Pacific region. Can Barclays’ streamlining initiatives outperform HSBC’s strategic pivot to Asia to drive growth?

To find out which stock presents a better investment opportunity, let’s evaluate the underlying factors driving each bank’s performance.

Barclays has been striving to simplify operations and focus on its core businesses. In February 2024, the bank unveiled a three-year cost savings plan to enhance operating efficiency and focus on higher-growth markets. In sync with this, Barclays sold its consumer finance business in Germany in February 2025.

Last year, the company transformed its operating divisions and divested its Italy mortgage portfolio and $1.1 billion in credit card receivables. Through these efforts, Barclays recorded gross savings of £1 billion in 2024 and £150 million in the first quarter of 2025. The company aims to achieve gross efficiency savings of £0.5 billion this year. By 2026, management expects total gross efficiency savings to be £2 billion and the cost-to-income ratio to be in the high 50s. Its first-quarter 2025 cost-to-income ratio was 57%.

The company is reallocating these savings in high-growth businesses and markets. In April, Barclays entered into a collaboration with Brookfield Asset Management Ltd. to reshape its payment acceptance business with plans to inject roughly £400 million. In March, the bank announced a capital injection of more than INR 2,300 crore (£210 million) into its India operations. Last year, the company acquired Tesco’s retail banking business, which complements its existing business. In 2023, Barclays acquired Kensington Mortgage, which bolstered its mortgage business.

While BCS’ core operating performance remained unimpressive, net interest income (NII) and net fee, commission, and other income rose in 2024 and in the first quarter of 2025 on the back of structural hedges and Tesco Bank buyout, which indicates that Barclays’ efforts to refocus on core operations have begun to bear fruits.

The redeployment of capital into higher-growth businesses and markets through improving efficiency is a multifaceted approach to boosting profitability. Barclays remains committed to this approach, which is likely to help improve profitability over time.

HSBC is taking steps to streamline and refocus its global operations. In early 2025, it announced a $1.5 billion cost-saving plan tied to organizational simplification, with estimated upfront charges of $1.8 billion by 2026. The bank is planning to redeploy another $1.5 billion from underperforming or non-core areas into strategic priorities.

As part of its global restructuring, HSBC has exited or divested operations in the United States, Canada, Argentina, Russia, Greece, New Zealand, Armenia and retail banking in France and Mauritius. It is also winding down certain investment banking activities in the U.K., Europe and the United States, and reviewing its operations in markets like Germany, South Africa, Bahrain and Malta to sharpen its focus and improve returns.

Further, HSBC is doubling down on its Asia-focused strategy as the core of its long-term growth plan. It aims to become a leading wealth manager for high-net-worth and ultra-high-net-worth clients in the region, which now accounts for more than half of its operations. In mainland China, HSBC is rapidly expanding its wealth business by launching integrated lifestyle-based wealth centers in key cities, acquiring Citigroup’s retail wealth portfolio, investing in digital capabilities and hiring talent to strengthen its Premier Banking, Private Banking and Asset Management services.

In India, HSBC is aggressively scaling up its presence. The bank received approval from the Reserve Bank of India to open 20 new branches, significantly expanding beyond its current footprint of 26 branches in 14 cities. With India’s ultra-high-net-worth population projected to surge 50% by 2028, HSBC is positioning itself to capture this growth through its Global Private Banking, the acquisition of L&T Investment Management (2022) and ongoing enhancements to its Premier Banking offering.

Nonetheless, revenue generation at HSBC has been subdued over the past several quarters. While the interest rate environment across the world improved, the financial impact of the challenging macroeconomic backdrop continues to weigh on the company’s top-line growth. Not-so-impressive loan demand and a tough macroeconomic environment in many of its markets are concerns.

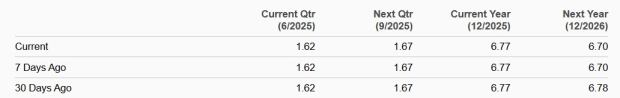

The Zacks Consensus Estimate for BCS’ 2025 and 2026 earnings indicates 21.2% and 23.3% growth, respectively. Over the past week, earnings estimates for 2025 and 2026 have been revised marginally downward.

Earnings Trend

On the contrary, the consensus mark for HSBC for 2025 suggests an increase of just 4.2% while the same for 2026 earnings indicates a decline of roughly 1%. Over the past seven days, earnings estimates for 2025 and 2026 have remained unchanged.

Earnings Trend

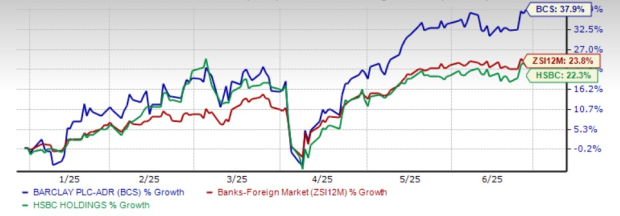

This year, Barclays’ shares have performed quite well on the bourses compared with HSBC. The BCS stock has risen 37.9% on the NYSE, while HSBC has gained 22.3%. The industry has rallied 23.8% in the same time frame.

YTD Price Performance

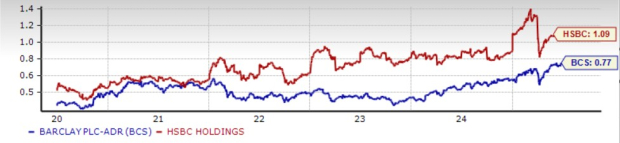

Valuation-wise, HSBC is currently trading at a 12-month trailing price/tangible book (P/TB) of 1.09X, higher than its five-year median of 0.76X. BCS stock, on the other hand, is currently trading at a 12-month trailing P/TB of 0.77X, which is higher than its five-year median of 0.45X. Further, both are trading at a discount to the industry average of 1.70X.

P/TB TTM

Thus, Barclays is inexpensive compared to HSBC.

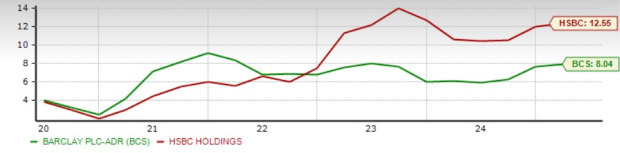

HSBC’s return on equity (ROE) of 12.55% is above Barclays’ 8.04%. This reflects HSBC’s efficient use of shareholder funds to generate profits.

ROE

Barclays appears to be the better investment opportunity, given its stronger near-term earnings outlook, attractive valuation and superior stock performance. The company’s strategic capital redeployment to boost core businesses and restructuring efforts to improve efficiency paves the way for sustained profitability. Furthermore, its year-to-date stock rally demonstrates solid investor confidence relative to HSBC’s modest gain.

Meanwhile, HSBC’s pivot to Asia and high-net-worth wealth management could yield significant long-term gains, especially as India and China’s affluent classes expand. Its disciplined global exit strategy and cost-saving plan may improve returns. Yet, muted revenue growth and weak earnings performance expectations raise near-term concerns. While HSBC has a slightly better ROE, Barclays’ higher growth momentum and aggressive capital return strategy make it the better bet now.

At present, BCS carries a Zacks Rank #2 (Buy) while HSBC has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite