|

|

|

|

|||||

|

|

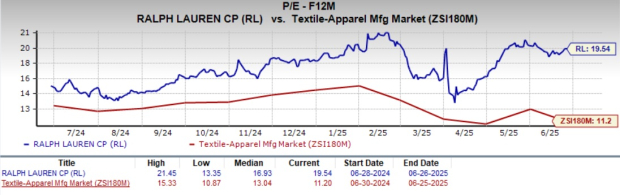

Ralph Lauren Corporation RL is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 19.54x, notably higher than the industry average of 11.2x. This premium valuation reflects investor confidence in the company’s robust brand equity, successful execution of its strategic transformation, and consistent performance across geographies and channels. RL’s strong pricing power, margin expansion, disciplined inventory and real estate management further support its elevated valuation.

In contrast, peers such as Duluth Holdings DLTH, Guess? Inc. GES and Gildan Activewear GIL trade at lower forward P/E ratios of 7.59x, 7.59x and 13.21x, respectively. These lower valuations of Duluth Holdings, Guess? and Gildan Activewear are a reflection of the company-specific challenges, such as inconsistent earnings performance, lower pricing power, greater exposure to price-sensitive customers or weaker brand resonance.

Unlike Ralph Lauren, which has successfully leaned into premiumization and digital transformation, these peers operate with more constrained growth profiles, narrower international footprints and less diversified product offerings.

A key factor behind Ralph Lauren's elevated P/E ratio is its impressive stock performance. In the past year, shares of the company have climbed 55.5%, significantly outperforming the industry, which declined by 13.5%. It has also outperformed the broader sector and the S&P 500 index, which posted growth of 19.8% and 10.8%, respectively.

RL's stock performance stands out among apparel stocks. In the past year, Duluth Holdings and Guess? have declined 48.3% and 41%, respectively, whereas Gildan Activewear gained 27.6%.

Ralph Lauren continues to demonstrate exceptional strength, closing fiscal 2025 with robust performance that exceeded expectations across all regions and channels. The company’s global desirability remains its most powerful asset, underpinned by its iconic brand identity and elevated product portfolio. With a lifestyle approach that resonates across generations and geographies, Ralph Lauren has effectively executed its key city ecosystem model, combining physical stores, digital flagships and selective wholesale presence.

Ralph Lauren’s digital transformation continues to be a significant growth lever, with direct-to-consumer (DTC) channels now making up two-thirds of the business. Digital comps grew in the double digits globally in the fourth quarter, supported by targeted marketing activations, improved site experiences and increasing traction on social media platforms. The company added nearly 6 million new DTC consumers in fiscal 2025, with growth led by younger, female and less price-sensitive cohorts.

Innovations like predictive buying and AI-enabled planning are improving inventory efficiency and responsiveness. Across platforms owned, wholesale and social, Ralph Lauren is not just keeping pace with digital trends but actively shaping them, creating immersive, emotionally resonant brand experiences that fuel both consumer loyalty and higher-margin sales.

The company’s multi-year strategy, centered on three pillars — brand elevation, driving the core while expanding for more and winning in key cities — has delivered tangible results. Ralph Lauren’s core products, which represent about 70% of the business, saw low double-digit growth in the fourth quarter, led by strong demand for knitwear, outerwear and accessories.

The company’s strategic pricing actions, product elevation and discount discipline helped drive average unit retail growth while reinforcing luxury and value perceptions. Ralph Lauren is also making smart investments in prime real estate to future-proof its presence, such as acquiring its Polo flagship in SoHo, aligning with a broader DTC-led growth strategy that continues to strengthen profitability.

Reflecting positive sentiment around Ralph Lauren, the Zacks Consensus Estimate for earnings per share has seen upward revisions. In the past 30 days, the consensus estimate has risen 6 cents to $13.69 and 7 cents to $15.03 for 2026 and 2027, respectively. These estimates indicate expected year-over-year growth rates of around 11% and 9.8% for 2026 and 2027, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Despite its strong performance, Ralph Lauren faces mounting challenges from an increasingly volatile global macroeconomic environment. Consumer sentiment remains pressured across key markets such as the United States, the U.K. and China due to persistent inflation, geopolitical tensions and uncertainty around trade policy, particularly new tariffs.

Tariff-related cost inflation is an evolving concern, with the company expecting gross margin pressures to intensify in the second half of fiscal 2026. Ralph Lauren has proactively implemented selective pricing actions and diversified its supply chain, ensuring no single country exceeds 20% of production tariffs. However, tariffs are expected to pose risks to its cost structure and pricing power in the near term.

Ralph Lauren remains a compelling investment, supported by its strong brand positioning, lifestyle-driven product strategy and expanding global footprint. The company’s focus on premiumization, digital transformation and disciplined execution has fueled consistent performance across regions and channels. Its success in driving brand desirability, coupled with ongoing investments in high-growth categories and key markets, underpins long-term growth potential.

However, the stock’s premium valuation reflects high investor expectations, which could be tested amid ongoing macroeconomic uncertainty, shifting consumer sentiment and evolving tariff risks. Current investors should retain their positions in RL stock, while new investors might wait for a more favorable entry point. Ralph Lauren currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite