|

|

|

|

|||||

|

|

Both Nu Holdings NU and Dave DAVE are major players in the digital financial services sector. NU is a prominent digital bank serving more than 118 million customers across Brazil, Colombia and Mexico. DAVE is a U.S.-based financial services platform offering an array of financial products, including ExtraCash and Dave Banking.

This comparative analysis helps investors develop their strategy to choose between these two stocks, allowing them to gain exposure in the fintech space. In conclusion, this analysis aims to make it easier for investors to decide which stock to support right now.

NU is emerging as a formidable player within the fintech space. With 19% year-over-year growth in new customers in the first quarter of 2025 and nearly 100 million active users, the company is confident that it can scale rapidly without compromising its potential to generate revenues. Nu Holdings derives this growth momentum from its expansion in Brazil, where nearly 59% of the adult population is its customers. This ascent underscores the company’s success in tapping into a previously underbanked population.

From a financial perspective, NU’s performance was exceptional in the quarter ending in March. First, the top line grew 40% year over year, with net income increasing 74% from the previous year. Monthly average revenues per active customer rose 5% from the previous quarter and 17% year over year on a FX-neutral basis, highlighting the company’s strong potential for long-term monetization.

Furthermore, the 15-90 NPL ratio increases by 60 basis points (bps), reflecting the continued strength of NU’s underwriting and effective risk management strategy.

There is no denying the fact that the company’s astounding performance was further bolstered by NU’s expansion in Mexico. Nubank Mexico witnessed a 67% year-over-year increase in the customer base to 11 million.

That being said, the company obtained regulatory approval for its banking license in April, which unlocks product capabilities, boosts the ability to scale deposits and reinforces its long-term mission to drive financial inclusion. In doing so, we can expect NU to reap benefits exponentially not only from Brazil but also from Mexico, aiding its growth trajectory. We expect Nu Holdings to capture a greater market share as the Latin American fintech market grows, seeing an 8% CAGR from 2025 to 2030.

DAVE is one of the leading neobanks in the United States that has distinguished itself by providing services like ExtraCash. With the fee structure being revised, ExtraCash has become more popular among the masses, driving the growth narrative of the company. In the first quarter of 2025, DAVE witnessed 46% growth in its ExtraCash originations, which had a positive impact on average revenues per user, as it increased 29% year over year

Moving on, the company’s financial position got solidified as the top line rallied 47% year over year. Adjusted EBITDA skyrocketed 235% year over year, which was certainly impressive, underscoring the company’s robust operating leverage. With the addition of 569,000 members, Dave registered 15% year-over-year growth in its member base, a testament to its growing demand for its offerings.

DAVE’s ability to manage credit risk separates it from the rest. By utilizing CashAI, a proprietary underwriting engine, the company improved its credit performance significantly. It witnessed an 18% year-over-year enhancement in the 28-day delinquency rate and a reduction in the percentage of provision for credit losses to originations to 0.69% from the year-ago quarter’s 0.94%.

CashAI’s ability to improve cost management had a distinct influence on Dave’s profitability position. It led to a 67% year-over-year surge in non-GAAP variable profit, with variable margin growing 950 bps.

Dave’s sole focus on the U.S. market hinders its means of diversification. This provides the company with a bedrock of motive to expand into different markets. With the global fintech market anticipated to grow, witnessing a healthy 15.3% CAGR from 2025 to 2030, DAVE is presented with a massive opportunity to capture a larger market share.

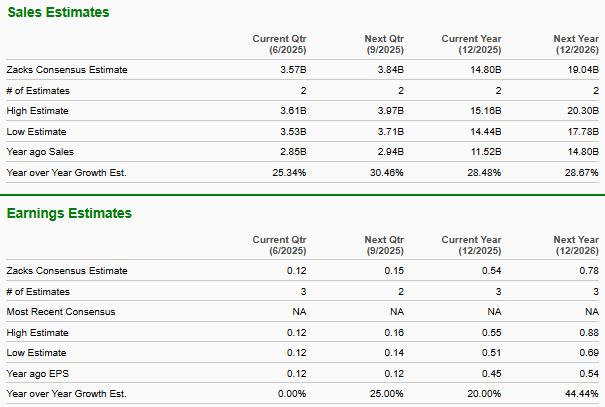

The Zacks Consensus Estimate for Nu Holdings’ 2025 sales is pegged at $14.8 billion, hinting at 28.5% year-over-year growth. The consensus estimate for earnings is pegged at 54 cents, suggesting a 20% rise from the preceding year’s actual. One earnings estimate for 2025 has moved north in the past 60 days, versus two southward revisions.

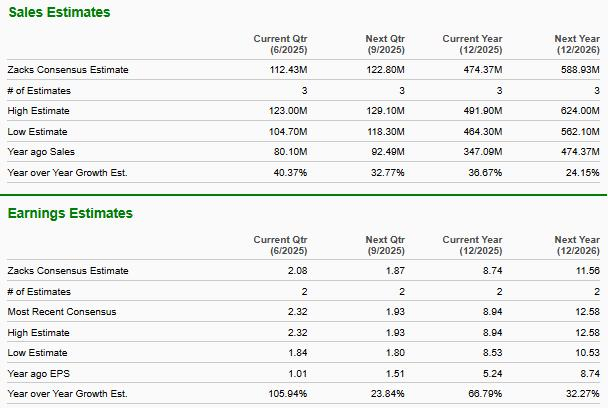

The Zacks Consensus Estimate for Dave’s 2025 sales is pegged at $474.4 million, indicating 36.7% year-over-year growth. The consensus estimate for earnings is $8.74 per share, suggesting a 66.8% year-over-year surge. Two earnings estimates for 2025 have moved north in the past 60 days, versus no southward revisions.

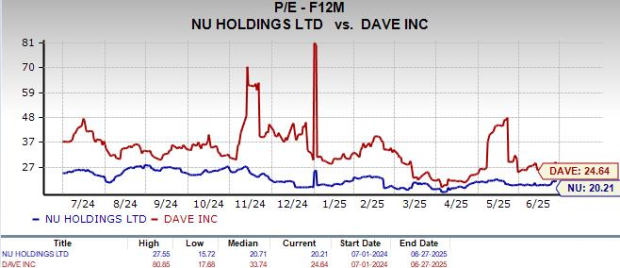

Nu Holdings is currently trading at a forward 12-month P/E ratio of 20.21X, which is slightly below the 12-month median of 20.71X. Dave is trading at 24.64X, substantially lower than the 12-month median of 33.74X. Although both stocks are trading at a discount compared with their historical valuations, NU appears much cheaper than DAVE.

Dave is a “Buy,” driven by ExtraCash’s product improvements and popularity, strong operating leverage and advanced credit risk management with CashAI. While the company focuses on the U.S. market, the growing global fintech landscape positions it to capture a larger market share.

Although Nu Holdings presents a strong case, we urge investors to take a cautious approach and refrain from adding it to their portfolios. Our recommendation for NU is based on its top and bottom-line outlook, which is weaker than that of DAVE and its downward earnings estimates revision, hinting at a lack of analyst confidence.

DAVE flaunts a Zacks Rank #1 (Strong Buy) and NU has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite