|

|

|

|

|||||

|

|

Citigroup Inc. C has passed the Federal Reserve’s 2025 stress test. Post-clearing the stress test, C now has the flexibility to return excess capital to shareholders via dividends and share repurchases.

This indicates that the bank can withstand a severe recession with plenty of capital on hand to absorb hundreds of billions of dollars in losses.

Along with Citigroup, 21 banks with assets of more than $100 billion, including Bank of America BAC and Wells Fargo WFC, cleared the 2025 Fed stress test.

The Fed's 2025 stress test scenario modelled a 10% unemployment rate, a 33% drop in home prices and a 50% equity market decline — a severe simulated recession. Aggregate simulated losses across the group totaled more than $550 billion, yet banks remained well-capitalized with common equity tier 1 (CET1) ratios far above the 4.5% minimum.

Citigroup’s projected CET1 capital ratio stood at a solid 10.4%, more than double the minimum requirement of 4.5%, signaling strong capital health.

Currently, C offers a 2.65% dividend yield, higher than WFC and BAC’s dividend yields of 2.21% and 2.01%, respectively. Further, C has a 35% payout ratio. In July 2024, following the release of stress test results, Citigroup raised its quarterly dividend 6% to 56 cents per share. Given its strong capital position, we anticipate another dividend increase this year.

C Dividend Yield

Dividend aside, it has a share repurchase plan in place. In January 2025, Citigroup’s board authorized a $20-billion share repurchase plan with no expiration. The bank bought back $1.75 billion worth of shares in the first quarter of 2025 and is targeting a similar level for the second quarter, leaving nearly $18 billion available for repurchases. This aggressive buyback initiative underscores the bank’s confidence in its financial position.

Citigroup’s liquidity position reinforces its stability. As of March 31, 2025, it held $761 billion in cash, due from banks and total investments, compared with $317.4 billion in combined short and long-term debt. This substantial liquidity cushion provides flexibility to navigate economic headwinds and invest in strategic initiatives.

Amid economic uncertainty, Citigroup’s successful performance in the Fed’s 2025 stress test reassures investors about the bank’s resilience. Also, its decent liquidity position will support capital distribution activities. But does it make the C stock a strong investment option now? Let us delve deeper and analyze other factors at play.

C has been emphasizing leaner, streamlined operations to reduce expenses. The transformation process included an organizational restructuring that replaced the reportable segment with five new ones. In January 2024, the company announced a plan to eliminate 20,000 jobs as part of its broad-scale restructuring effort over the next two years.

Citigroup remains on track to reduce its workforce. So far, the bank has already made significant progress, reducing its headcount by 10,000. In January 2025, citing people familiar with the matter, Blomberg reported that as part of the sweeping reorganization under CEO Jane Fraser to cut expenses, managing directors in the wealth and technology units are leaving the firm, and the company is axing people from a team that compiles data and analysis on the bank's clients.

For 2025, management expects expenses to be below $53.4 billion. In 2024, the company’s expenses were $53.9 billion.

Citigroup has been focusing on growth in its core businesses by streamlining its overseas operations. In April 2021, the company announced its plan to exit the consumer banking business in 14 markets across Asia and EMEA.

Since then, the company has exited consumer businesses in nine countries. It reached a milestone in December 2024 when it completed the separation of its institutional banking operations in Mexico from the consumer, small business and middle-market segments. In June 2024, Citigroup sold its China-based onshore consumer wealth portfolio to HSBC China, a wholly owned subsidiary of HSBC Holdings plc.

As part of its strategy, Citigroup continued to make progress with the wind-down of its Korea consumer banking operations and its overall operations in Russia, as well as the preparation for a planned initial public offering of its consumer banking and small business and middle-market banking operations in Mexico.

These moves by Citigroup are likely to free up capital to invest in higher-return segments like wealth management and investment banking (IB).

Citigroup expects the performance of its Markets and Banking segments to improve in the second quarter of 2025. The bank projects Markets revenues to grow in the mid to high-single-digit range on a year-over-year basis. Further, IB revenues are expected to increase in the mid-single-digit percentage.

The company anticipates revenues to see a compounded annual growth rate of 4-5% by 2026-end and will further drive $2-2.5 billion of annualized run rate savings by 2026.

With the Federal Reserve cutting interest rates by 100 basis points last year, the company’s net interest income (NII) benefited from it. Given relatively low funding costs, Citigroup’s NII improved. In the first quarter of 2025, C reported a NII of $14 billion, marking a 4% increase from the prior-year quarter.

Though after the 2024 rate cut, the Fed kept the interest rates steady due to ambiguity over Trump’s tariff plans, market participants are increasingly gaining confidence in at least two cuts this year. This will lead to improvement in lending activities and NII.

Citigroup is expected to witness an improvement in NII in 2025, given decent loan demand and higher deposit balances. The company projects NII (ex-Markets) to rise 2-3% in 2025 from the 2024 reported level.

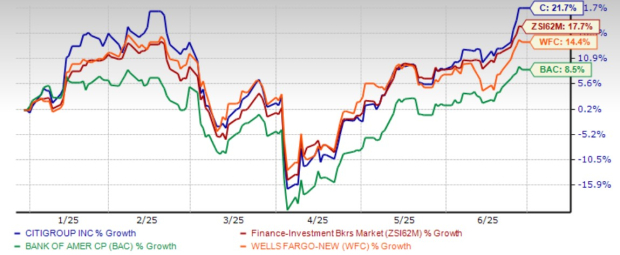

Citigroup shares have gained 21.7% compared with the industry’s growth of 17.7% over the past six months. C also outperformed its peers, BAC and WFC. Bank of America has gained 8.5% while Wells Fargo has risen 14.4% over the same time frame.

Price Performance

From a valuation standpoint, Citigroup appears inexpensive relative to the industry. It is currently trading at a discount with a forward 12-month price-to-earnings (P/E) of 10.13X, well below the industry average of 14.53X.

Price-to-Earnings F12M

Bank of America is trading at a 12-month forward P/E of 11.83X, while Wells Fargo is trading at 12.68X. Hence, C is trading at a discount compared with both.

C’s clearance of the 2025 Fed stress test, strong capital levels and improving operational efficiency support its commitment to reward shareholders handsomely in the form of increased dividends and a share buyback program.

While Citigroup offers profound value with a discounted valuation, the bank remains in the middle of a complex overhaul plan. Though its restructuring strategy is encouraging, it carries execution risk and near-term uncertainty because of tariffs and interest rate fluctuations.

As the interest rates are less likely to come down substantially in the near term, it is expected to hurt the borrowers’ credit profile. Hence, C’s asset quality is expected to remain weak.

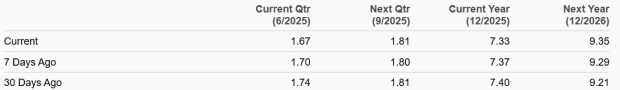

Its earnings estimates for 2025 have been revised downward over the past month, suggesting caution for the near term. However, the same for 2026 has been revised upward, indicating analysts' confidence in the stock's long-term growth.

Estimates Revision Trend

Hence, Citigroup's near-term outlook will depend on how well it manages ongoing macroeconomic and operational challenges.

Though it may not be the ideal time to buy the stock, long-term investors with existing holdings may find value in maintaining their stake, given its solid fundamentals. Currently, the stock has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 53 min | |

| 1 hour |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

BAC

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite