|

|

|

|

|||||

|

|

Dell Technologies DELL and Nutanix NTNX are major players in the cloud infrastructure space, within the hyperconverged infrastructure (HCI) market. While Dell Technologies offers its own HCI solutions, such as VxRail, Nutanix provides software-defined HCI and hybrid cloud platforms. Both companies are positioned to support the growing adoption of hybrid cloud at scale.

Per the Mordor Intelligence report, the HCI market size is estimated to be $16.72 billion in 2025 and is expected to reach $51.22 billion by 2030, at a CAGR of 25.09% during the forecast period from 2025 to 2030. This growth presents a major opportunity for both Dell and Nutanix.

So, DELL or NTNX — Which of these Cloud Infrastructure stocks has the greater upside potential? Let’s find out.

Dell Technologies is expanding its cloud services through its infrastructure solutions and rich partner base that provides essential hardware and services that support cloud environments.

Building on the strength of these offerings, in the first quarter of fiscal 2026, Infrastructure Solutions Group (ISG) revenues, which include its cloud offerings, increased 12% year over year to $10.31 billion.

Dell’s expanding portfolio of solutions further bolsters this momentum. In March 2025, Dell partnered with Singapore’s Institute of Technical Education to launch a hybrid cloud VDI Center powered by Dell VxRail, aimed at closing the AI skills gap and enhancing digital learning through accessible, flexible, and scalable infrastructure.

Dell’s AI prospects remain strong, with AI expanding from major cloud service providers to large-scale enterprise deployments and edge computing with PCs. The company is benefiting from the strong demand for AI servers, which are driven by ongoing digital transformation and heightened interest in generative AI applications. Its PowerEdge XE9680L AI-optimized server is in high demand. Strong demand from enterprises for AI-optimized servers is supporting Dell.

Nutanix’s software-defined HCI solutions support multi-hypervisor and multi-cloud with unified management. Nutanix’s solutions are primarily deployed in large and centralized data centers. The company’s built-in hypervisor has been gaining significant traction as customers continue to select it as a low-cost alternative to other vendor offerings.

Nutanix is benefiting from extending partnerships and clientele, as well as the solid adoption of its new capabilities and hybrid cloud solutions. In the third quarter of fiscal 2025, Nutanix added 620 customers, bringing the total number of clients to 27,490, and demonstrated strong recurring revenue momentum, backed by large enterprise and federal sector wins.

Further expanding its portfolio in the third quarter of 2025, Nutanix introduced solutions such as Cloud Native AOS and Nutanix Kubernetes Platform to support modern applications and hybrid multi-cloud environments. The company also expanded its AI infrastructure platform by launching Nutanix Enterprise AI, a cloud-native solution. The offering supports deployment across Kubernetes platforms at the edge, in core data centers, and on public clouds like AWS EKS, Azure AKS, and Google GKE.

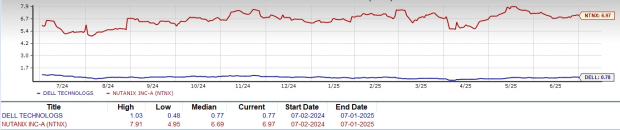

Year to date, shares of DELL and NTNX have appreciated 5.7% and 22.9%, respectively. The outperformance of Nutanix can be attributed to growth in the company’s expanding partnerships and clientele, as well as the solid adoption of its new capabilities and hybrid cloud solutions.Despite Dell’s expanding portfolio and rich partner base, it is suffering from a challenging macroeconomic environment.

Valuation-wise, DELL shares are currently cheap, as suggested by a Value Score of B. NTNX shares are currently overvalued, as suggested by a Value Score of F.

In terms of forward 12-month Price/Sales, DELL’s shares are trading at 0.77X, lower than NTNX’s 6.97X.

The Zacks Consensus Estimate for DELL’s fiscal 2026 earnings is pegged at $9.44 per share, which has increased 0.53% over the past 30 days. This indicates a 15.97% increase year over year.

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

The Zacks Consensus Estimate for NTNX’s fiscal 2025 earnings is pegged at $1.74 per share, which has remained unchanged over the past 30 days. This indicates a 32.82% increase year over year.

Nutanix price-consensus-chart | Nutanix Quote

Despite PC market challenges and macroeconomic headwinds, Dell Technologies’ innovation in AI infrastructure and positive earnings outlook, along with cheaper valuation, support long-term strength.

While Nutanix boasts strong growth, innovative cloud-native solutions, and impressive client expansion, its high valuation may limit near-term upside. Lower hardware revenues are also expected to drag down the top line in the near term. The ongoing transition to a subscription-based business model is expected to hurt the top-line growth.

Dell Technologies sports a Zacks Rank #1 (Strong Buy), making the stock a stronger pick compared to Nutanix, which has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

A Memory-Chip Shortage Is Squeezing Consumer Techand Its Set to Get Worse

DELL -9.13%

The Wall Street Journal

|

| Feb-12 |

Cisco Memory Chip Warning Sends Down Dell, HPE, Arista, NetApp Shares

DELL -9.13%

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Cisco Profit Margin Outlook Sends Down Dell, HPE, Arista, NetApp Shares

DELL -9.13%

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite