|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Intuitive Surgical ISRG received the CE-mark for its latest surgical robot system, da Vinci 5, earlier this month. This fifth-generation system includes over 150 enhancements such as Force Feedback technology, an ergonomic surgeon console, improved 3D vision and greater computing power, aimed at improving surgical outcomes and operational efficiency. It is cleared for minimally invasive endoscopic procedures across adult and pediatric patients in specialties including urologic, gynecologic, general laparoscopic, abdominopelvic and thoracoscopic surgeries.

The da Vinci 5’s approval in Europe marks a major regulatory step, expanding the clinical reach of Intuitive Surgical’s most advanced surgical platform to date. Building on the foundation of the da Vinci Xi Surgical System, the da Vinci 5 introduces enhanced integration, refined ergonomics, and next-generation capabilities to support surgeon precision and patient outcomes. This expansion enhances Intuitive Surgical’s competitive moat in robotic-assisted surgery while aligning with hospital needs for surgical efficiency, workforce sustainability and value-based care.

Several other companies, including Medtronic MDT and Stryker SYK, also commercialize surgical robots in Europe. However, intelligent computing is likely to be a key differentiator, with da Vinci 5 offering 10,000 times more processing power than earlier generations. The system integrates advanced sensors and software that deliver real-time, actionable insights to help surgeons quantify and improve their performance. This data-driven approach supports continuous improvement and performance benchmarking, particularly valuable as hospital systems seek to optimize surgical efficiency and outcomes.

Per a report by Grand View Research, the surgical robots market size in Europe was estimated at $1.89 billion in 2024 and is projected to reach $3.31 billion by 2030, registering a CAGR of 10.3% from 2025 to 2030.

Industry growth is driven by technological innovation, increasing investments from global and regional players, and a rise in chronic conditions and joint replacement procedures.

In the first quarter of 2025, the adoption of Intuitive Surgical’s da Vinci 5 system in the United States demonstrated strong early momentum. Of the 367 da Vinci systems placed globally during the quarter, 147 were da Vinci 5 units, reflecting solid U.S. demand. More than 32,000 procedures were performed using da Vinci 5, showcasing broad multidisciplinary uptake. Notably, force feedback instruments — a hallmark of the latest device — were associated with significant clinical benefits, including faster bowel recovery post-nephrectomy and improved suturing proficiency among novice surgeons. Additionally, “case insight” tools were applied in over 22,000 da Vinci 5 procedures, offering real-time analytics and performance feedback.

The Zacks Consensus Estimate for Intuitive Surgical for 2025 and 2026 has moved southwards by 1.6% and 3.4%, respectively, to an earnings per share of $7.84 and $9.05 over the past 90 days. The negative estimate revision reflects rising costs for the company as it continues to launch the latest da Vinci 5 in the United States and other geographies amid macro headwinds like supply constraints.

Intuitive Surgical delivered solid performance in Europe during the first quarter of 2025, placing 88 earlier versions of da Vinci systems, up from 84 in the prior year. These systems have been widely used in Europe, with more than 410,000 procedures performed in 2024 alone. Despite macroeconomic pressures and constrained healthcare budgets in key markets like Germany and the United Kingdom, procedure growth remained strong, supported by increased utilization of existing systems. While capital constraints persist, Intuitive’s focus on training and operational optimization continues to support robust procedural and commercial momentum. The launch of the latest da Vinci system is likely to drive adoption higher in Europe, backed by ISRG’s market-leading position in the region.

However, we expect ISRG to face competition from rival surgical robots. Medtronic’s Hugo is reported to be 20-25% less expensive than da Vinci at some European centers, with modular arms offering greater flexibility for certain abdominal procedures. However, some users note a steeper learning curve and early software bugs in MDT’s Hugo. Meanwhile, Stryker’s Hugo leads in orthopedic (joint replacement) robotic surgery and is unlikely to be a direct competitor in soft tissue surgery.

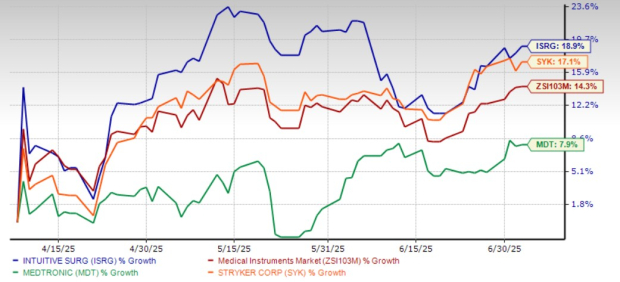

ISRG has gained 18.9% over the past three months compared with the industry’s growth of 14.3%. It has also outperformed its peers like Medtronic and Stryker over this period. While MDT has gained 7.9%, SYK has improved 17.1%.

Intuitive Surgical’s near-term growth prospects may face headwinds from supply and capital budget constraints. Limited availability of force feedback instruments for the da Vinci 5 system, a key innovation, is delaying broader adoption despite demonstrated clinical benefits and strong demand. The company expects full availability only by late 2025, potentially curbing near-term procedure volume growth and revenue acceleration from premium features.

Simultaneously, healthcare capital budget constraints in key markets like Germany, the U.K., and Japan are restraining system placements. Economic pressures and shifting government priorities, such as post-COVID austerity and defense spending in Europe, are prompting hospitals to delay or reprioritize investments in surgical robotics. While ISRG is promoting increased system utilization and flexible leasing models to mitigate these challenges, prolonged constraints may dampen global system expansion. Together, these factors could limit the pace of da Vinci 5’s scaling and affect ISRG’s ability to fully capitalize on its innovation pipeline in 2025.

Intuitive Surgical is currently trading at a forward 12-month price-to-earnings multiple of 64.32X, significantly higher than the industry average of 28.81X. However, the current valuation is lower than its five-year median of 71.52X. The company currently carries a Zacks Value Score of ‘D.’

Despite near-term cost pressures and macroeconomic headwinds, Intuitive Surgical remains a compelling long-term investment. The CE mark approval of the da Vinci 5 system opens significant revenue potential in Europe’s growing $3.31 billion surgical robotics market. This next-generation platform, offering advanced computing power, force feedback, and intelligent analytics, is well-positioned to meet rising demand for minimally invasive, value-based care. Early U.S. adoption trends indicate strong clinician confidence, which is likely to be mirrored in Europe. While supply and capital constraints may temper immediate gains, ISRG’s dominant market share, robust clinical backing, and strategic focus on training, utilization, and operational efficiency ensure resilience. Though the valuation appears premium, it reflects ISRG’s innovation leadership and long-term growth prospects.

Intuitive Surgical currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite