|

|

|

|

|||||

|

|

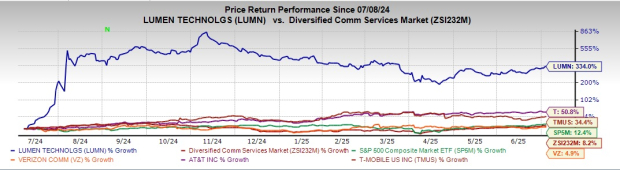

Lumen Technologies, Inc.’s LUMN shares have skyrocketed 334% in the past year, outpacing the S&P 500 composite and Diversified Communications Services' rise of 12.4% and 8.2%, respectively.

Lumen also topped several of its peers, including Verizon Communications VZ, AT&T T, and T-Mobile US, Inc. TMUS. Verizon and AT&T rose 4.9% and 50.8% respectively, while T-Mobile surged 34.4% during the same period. Closing at $4.60 as of last day’s trading session (July 3, 2025), LUMN stock is currently trading way below its 52-week high of $10.33.

Monroe, LA-based LUMN offers clients across its business and mass markets segments a wide range of integrated products and services necessary to keep pace with the rapidly evolving digital world. The company’s terrestrial and subsea fiber optic long-haul network across North America, Europe, Latin America and the Asia Pacific connects to the metropolitan fiber networks it operates. It provides services in more than 60 countries, with a significant portion of its revenue generated in the United States.

Lumen’s 2025 goals aim to reach strong financial targets in revenue, EBITDA and free cash flow by pursuing three main strategies. First, it seeks to drive operational excellence by improving sales execution, customer experience and modernizing key systems like ERP and operations, while simplifying through network unification and clearer product offerings. Next, management plans to establish a foundation for the AI economy by fulfilling Big Tech and AI commitments, maintaining a high-performance, extensive network and encouraging Private Connectivity Fabric (PCF) adoption to connect data centers.

Finally, to “cloudify telecom”, Lumen looks to reshape telecom economics by overcoming physical port constraints, expanding its digital platform and launching new multi-cloud capabilities to fuel revenue growth, while continuing to transform the workforce and culture. LUMN’s strong network and integrated hosting solutions are helping drive its cloud growth. Its managed and cloud services set it apart from competitors.

Lumen’s new multi-cloud, AI-ready network architecture replaces the old model of single network ports and multiple cross-connects with a fabric port approach, reducing cross-connects by up to 10% and ports by 50% for lower cost and latency. Powered by ExaSwitch, this design enables seamless, scalable and secure connectivity between customers, edge and multiple clouds through a single port, offering unmatched flexibility for enterprises, wholesalers and the public sector. Driven by booming AI demand, Lumen secured $8.5 billion in PCF deals in 2024. As big companies rush to get more fiber, LUMN has signed major agreements with Microsoft, Amazon, Google Cloud and Meta.

Demand for its services, especially Waves and IP, is strong across large and mid-sized enterprises. These PCF investments are poised to boost future revenues and solidify Lumen’s role as a key infrastructure provider.

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

The company is speeding up the adoption of its Digital platform, offering network-as-a-service (NaaS) solutions that deliver real-time, customizable connectivity with control over bandwidth, latency and security, all within a cloud-based consumption model. Management emphasized that it has more than 500 customers currently using its NaaS services in 2024. Some of its NaaS solutions with private connections include Lumen Ethernet On-Demand and Lumen IP-VPN (Internet Protocol Virtual Private Network) On-Demand. These solutions are designed to give users private cloud connections along with enhanced data safety and security.

Lumen has launched the Lumen Cloud Communications (LCC) platform, a next-generation unified communications solution designed to capture a larger share of the $47 billion and growing cloud voice total addressable market.

Moreover, it is making steady progress on its turnaround, aiming to save $1 billion by 2027 by streamlining its network, IT, and product lineup. It plans to merge four network types into a single, simplified system and cut its products from thousands to about 300. By using AI for smarter, automated operations, Lumen expects to see more than $250 million in cost savings this year alone.

Lumen’s legacy business remains weak, weighing on near-term growth as it shifts to fiber and cloud. For 2025, Lumen expects adjusted EBITDA of $3.2–$3.4 billion, down from 2024 due to transformation costs, PCF ramp-up and legacy declines. Capital spending is set at $4.1–$4.3 billion, with free cash flow between $700 million and $900 million, likely uneven across quarters due to PCF projects.

Lumen has a leveraged balance sheet. As of March 31, 2024, the company had $1.9 billion in cash and cash equivalents with $17.334 billion of long-term debt compared with the respective figures of $1.889 billion and $17.494 billion as of Dec. 31, 2024. Investing in AI and cloudifying telecom is a smart move for Lumen, but cut-throat competition might limit its top-line gains.

From a valuation perspective, LUMN is trading at a lucrative discount. Going by its trailing 12-month price-to-sales ratio, LUMN is trading at a multiple of 0.35, way below the industry’s 1.57.

In comparison, VZ, T and TMUS are trading at multiples of 1.36, 1.67 and 3.33, respectively, compared with the Wireless National Industry’s multiple of 2.33.

Lumen is moving forward with its strategy, focusing on efficiency, AI-led network growth and a strong digital platform. It plans to save $250 million by 2025 through upgrades and partnerships like Google Cloud. With solid revenue growth and more fiber investment, Lumen expects EBITDA to rise in 2026, aiming for long-term strength in AI and telecom. However, broader macro uncertainties, debt overhang and legacy revenue decline pose concerns.

With a Zacks Rank #3 (Hold), Lumen appears to be treading in the middle of the road, and investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 18 hours | |

| 21 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite