|

|

|

|

|||||

|

|

Snowflake SNOW and Microsoft MSFT are major players in the expanding cloud data platform market. Snowflake provides a scalable data warehouse with integrated AI and machine learning. Microsoft delivers a suite of data services on Azure, such as Synapse Analytics, Cosmos DB, Power BI and AI tools.

Per Datainsights Market, the global cloud data platform market was valued at $22.78 billion in 2025 and is expected to reach $104.50 billion by 2033, reflecting a CAGR of 24.3%. Both SNOW and MSFT are positioned to benefit as enterprises invest in scalable, AI-ready infrastructure.

However, SNOW or MSFT - which of these cloud data platform stocks has the greater upside potential?

Let’s find out.

Microsoft continues to grow its presence in the enterprise data platform space, driven by Azure and broader integration across cloud services. During the third quarter of fiscal 2025, Microsoft Cloud revenue reached $42.4 billion, up 20% year over year. Azure and other cloud services grew 33% year over year, implying ongoing demand for Microsoft’s data services across storage, analytics and AI workloads.

Microsoft’s portfolio supports the full enterprise data lifecycle, including storage, analytics and AI integration. Azure Cosmos DB offers globally distributed, low-latency performance for modern applications. Azure PostgreSQL provides a managed relational database with enterprise-grade capabilities.

Nearly 60% of Fortune 500 companies now use PostgreSQL on Azure. Cosmos DB maintained steady growth in the reported quarter, supported by usage from customers like CarMax and DocuSign. These workloads increasingly integrate with Power BI, Dynamics 365 and Copilot, allowing enterprises to manage data across a unified platform.

As part of its broader data platform offering, Microsoft provides Fabric, a unified analytics solution for data movement, real-time analytics and reporting. In the reported quarter, Fabric served over 21,000 paid customers, up 80% year over year. OneLake, its centralized storage layer, saw data volumes increase more than six times compared to the prior year, reflecting growing adoption across industries.

With strong enterprise demand and an integrated platform, Microsoft remains well-positioned to lead in cloud data infrastructure.

Snowflake is expanding in the enterprise data space, backed by growing customer adoption and deeper platform usage. In the first quarter of fiscal 2026, product revenues rose 26% year over year to $996.8 million. SNOW had 11,578 total customers, including 606 customers contributing more than $1 million in trailing 12-month product revenues. The net revenue retention rate stood at 124%, reflecting consistent upsell momentum.

Snowflake enables a unified data experience across storage, processing, governance and AI. Core offerings like Snowpark and the Native App Framework allow developers to build within the platform. The Marketplace enables native distribution of apps and data, while Polaris Catalog and Apache Iceberg enhance interoperability, thus helping enterprises streamline data workflows.

Snowflake has been strengthening its platform to support modern analytics and AI-driven workloads. Cortex AI and Cortex Functions enable natural language queries and embedded LLM support for business users. Gen2 Warehouses and Adaptive Compute improve cost efficiency and performance. The Acxiom partnership adds integrated customer identity and campaign analytics to the platform, helping enterprises activate marketing data natively within Snowflake.

As organizations continue investing in scalable, AI-ready data infrastructure, Snowflake’s expanding platform depth, customer growth and focus on unifying data and AI workflows support its positioning in the evolving data platform landscape.

In the year-to-date period, SNOW shares have rallied 43.5%, while MSFT shares have appreciated 18.3%.

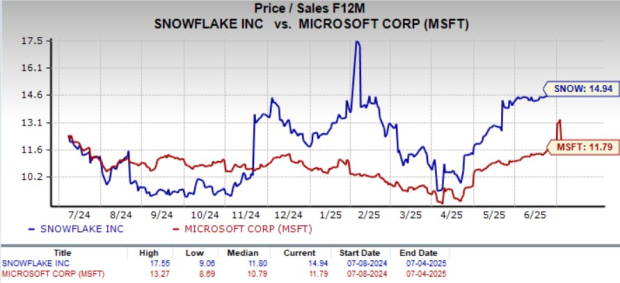

In terms of valuation, Snowflake appears more expensive, trading at 14.94X forward 12-month Price/Sales, compared with Microsoft’s 11.7X.

Snowflake holds a Value Score of F, while Microsoft carries a Value Score of D.

The Zacks Consensus Estimate for SNOW’s fiscal 2026 earnings is pegged at $1.06 per share, unchanged over the past 30 days. The figure indicates a 27.71% increase year over year.

Snowflake Inc. price-consensus-chart | Snowflake Inc. Quote

The Zacks Consensus Estimate for MSFT’s 2025 earnings is pegged at $13.36 per share, unchanged over the past 30 days. This indicates a 13.22% increase year over year.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Both Microsoft and Snowflake are key players in the enterprise data platform space. However, Microsoft’s broader product ecosystem, strong Azure-led growth, and integration across services give it a more durable advantage.

Snowflake, while expanding its product set and AI offerings, continues to face near-term concerns around valuation, rising costs and growing competition from large incumbents.

Currently, Microsoft carries a Zacks Rank #2 (Buy), making it a more attractive pick than Snowflake, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 8 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite