|

|

|

|

|||||

|

|

Shopify SHOP and Adobe ADBE are strong players in the e-commerce industry. While Shopify is expanding its presence in the e-commerce domain by offering user-friendly tools and an extensive app marketplace, Adobe, via Adobe Commerce (formerly Magento), provides enterprise-level e-commerce platforms and digital marketing tools.

According to the Morder Intelligence report, the e-commerce market is projected to be worth $10.19 trillion in 2025. It is expected to reach $21.22 trillion by 2030, with a compound annual growth rate of 15.8% over the 2025-2030 period. Both SHOP and ADBE are likely to gain from the massive growth opportunity.

So, Shopify or Adobe— Which of these e-commerce stocks has the greater upside potential? Let’s find out.

Shopify’s robust growth in its merchant base is driven by its merchant-friendly tools, including Shop Pay, Shopify Pay Instalments, Sign in with Shop and the Shop App. The strong adoption of these solutions holds promise for Shopify’s prospects. In the first quarter of 2025, Merchant Solutions’ revenues were $1.74 billion and accounted for 73.7% of Shopify’s total revenues.

SHOP’s expanding portfolio has been a major growth driver for its success. Its merchant-friendly tool, Shop Pay, stands out as a key driver. The app processed $22 billion in Gross Merchandise Value in the first quarter of 2025, up 57% year over year. Large brands like Birkenstock, Lilly Pulitzer, and Johnny were among those that adopted Shop Pay, enhancing Shopify’s portfolio.

Further expanding its portfolio, Shopify recently partnered with Coinbase and Stripe to enable merchants worldwide to accept USDC stablecoin payments through Shopify Payments. This integration offers fast, borderless transactions on the Base network, with no added fees and seamless checkout experiences.

The company’s investment in AI-driven tools, such as Shopify Sidekick and tariffguide.ai, is also helping merchants improve customer engagement and streamline operations.

Adobe is expanding its e-commerce capabilities by transforming its Adobe Commerce, an end-to-end platform designed to manage, personalize, and optimize commerce experiences for both B2B and B2C customers, into a more scalable, cloud-native solution.

Adobe’s expanding portfolio has been noteworthy. Adobe recently launched Adobe Commerce as a Cloud Service, a scalable and AI-powered e-commerce platform designed to boost conversions and reduce costs through faster performance, automated updates, and streamlined operations.

Adobe’s e-commerce efforts are primarily reflected in the financial performance of its Digital Experience segment, which includes Adobe Commerce as part of its offerings. In the second quarter of fiscal 2025, Digital Experience revenues of $1.46 billion (which accounted for 25% of total revenues) increased 10% year over year, both on a reported and cc basis.

Adobe’s expanding partner ecosystem, which includes companies such as PayPal, FedEx, and Walmart, has been noteworthy. These partnerships introduce features such as integrated payment solutions, logistics services, and in-store pickup options, thereby enriching the Adobe Commerce platform’s capabilities and offering merchants comprehensive tools to enhance customer experiences.

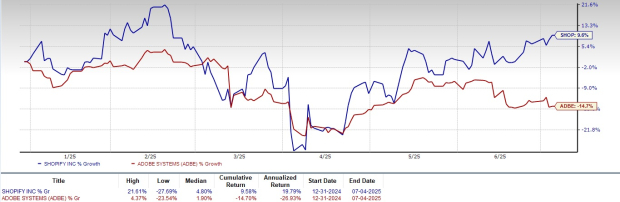

Year to date, SHOP shares have gained 9.6%, while ADBE shares have lost 14.7%.

The increase in SHOP shares can be attributed to robust growth in its merchant base, driven by its merchant-friendly tools. However, Adobe’s shares declined due to the stiff competition and challenging macroeconomic environment.

Valuation-wise, SHOP and ADBE’s shares are currently overvalued, as suggested by a Value Score of F and C, respectively.

In terms of forward 12-month Price/Sales, SHOP shares are trading at 12.69X, higher than ADBE’s 6.48X.

The Zacks Consensus Estimate for SHOP’s 2025 earnings is pegged at $1.40 per share, which has remained unchanged over the past 30 days, indicating a 7.69% increase year over year.

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

The Zacks Consensus Estimate for ADBE’s 2025 earnings is pegged at $20.61 per share, which has increased 1.17% over the past 30 days, indicating a 11.89% increase year over year.

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Both Shopify and Adobe present compelling opportunities in the rapidly growing e-commerce market. Shopify’s strong merchant growth and innovative payment solutions offer high growth potential, but challenging macroeconomic uncertainties, persistent inflation and cautious consumer spending are headwinds.

Despite recent share underperformance, Adobe appears to be the stronger pick due to its enterprise-grade, cloud-native commerce platform, growing partner ecosystem, and stronger earnings growth potential, making it a more compelling long-term investment.

Currently, Adobe carries a Zacks Rank #2 (Buy), making the stock a stronger pick than Shopify, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours | |

| 14 hours | |

| 17 hours | |

| 21 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite