|

|

|

|

|||||

|

|

Shares of Cogent Biosciences COGT soared 23.4% on Monday after the company reported positive top-line data from a late-stage study of its investigational candidate, bezuclastinib, for treating non-advanced systemic mastocytosis (SM) patients.

The registration-enabling phase III SUMMIT study achieved the primary and all key secondary endpoints, demonstrating clinically meaningful and highly statistically significant improvements upon treatment of the SM patient population with bezuclastinib, over placebo. The data readout also includes significant improvements in patient-reported symptoms and objective measures of mast cell burden.

SM is a rare hematological disease impacting the immune system with debilitating symptoms that take a serious toll on the physical and psychological quality of life of patients.

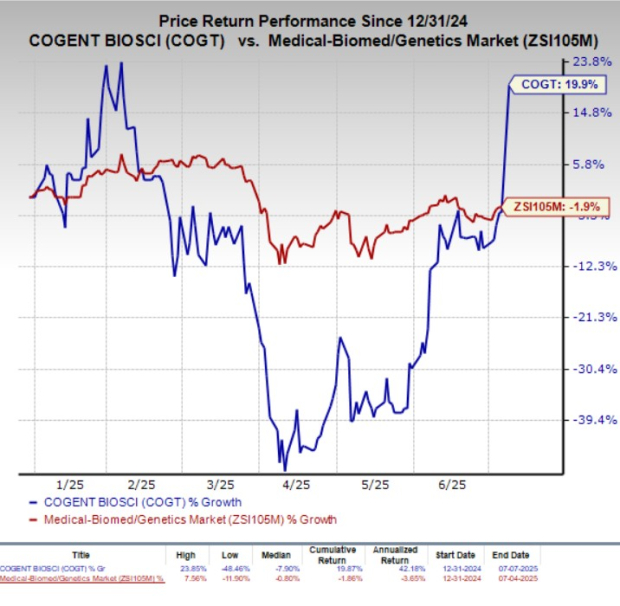

Year to date, shares of Cogent Biosciences have gained 19.9% against the industry’s 1.9% decline.

Per the data readout from Part 2 of Cogent Biosciences’ SUMMIT study, treatment with bezuclastinib showed a highly statistically significant improvement in total symptom score (TSS) at 24 weeks. TSS was measured using the Mastocytosis Symptom Severity Daily Diary. Patients in the bezuclastinib group experienced a mean TSS reduction of 24.3 points compared to a 15.4-point reduction in the placebo group. This resulted in a placebo-adjusted improvement of 8.91 points in favor of bezuclastinib.

Beyond the primary endpoint, the study also achieved highly statistically significant results across all key secondary endpoints. Notably, 87.4% of patients treated with bezuclastinib saw a ≥50% reduction in serum tryptase levels — a biomarker of mast cell activity — while no patients in the placebo group achieved this level of reduction. These results underscore the broad clinical benefit of bezuclastinib in treating symptoms and biological markers of disease.

Cogent Biosciences also reported that bezuclastinib was overall well-tolerated and demonstrated a favorable safety profile, supporting chronic use in this patient population. Most adverse events related to treatment were mild to moderate in severity.

Based on the encouraging data readout, Cogent Biosciences is gearing up to submit its first new drug application to the FDA, seeking the approval of bezuclastinib for non-advanced SM, by the end of 2025. Subject to approval, management believes that the candidate has the potential to become a new standard of care for this patient population, where there is a significant unmet medical need.

A comprehensive analysis of the full SUMMIT Part 2 data is currently underway and COGT intends to present the detailed findings at a major medical conference later this year.

Apart from the non-advanced SM indication, Cogent Biosciences is simultaneously evaluating bezuclastinib for advanced SM and gastrointestinal stromal tumors in separate pivotal late-stage studies, APEX and PEAK, respectively. Top-line data from both phase III studies are anticipated in the second half of 2025.

Cogent Biosciences, Inc. price-consensus-chart | Cogent Biosciences, Inc. Quote

Cogent Biosciences currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Immunocore IMCR, Verona Pharma VRNA and Bayer BAYRY. While IMCR and VRNA sport a Zacks Rank #1 (Strong Buy) each, BAYRY carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, loss per share estimates for Immunocore’s 2025 have improved from $1.44 to 70 cents. Loss per share estimates for 2026 have narrowed from $1.45 to $1.08 during the same period. IMCR stock has gained 9.9% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters and missed the mark once, delivering an average surprise of 76.18%.

In the past 90 days, Verona Pharma’s bottom-line estimates for 2025 have significantly improved from a loss of 7 cents per share to earnings of 22 cents. During the same timeframe, estimates for 2026 earnings per share have improved from $2.21 to $2.88. VRNA stock has soared 96.4% so far this year.

Verona Pharma’s earnings beat estimates in one of the trailing four quarters and missed the mark on the other three occasions, delivering an average negative surprise of 6.76%.

BAYRY’s 2025 earnings per share estimate has increased from $1.19 to $1.27 for 2025 over the past 90 days, while that for 2026 has gone up from $1.28 to $1.34 over the same timeframe. Year to date, shares of Bayer have surged 56.6%.

BAYRY’s earnings beat estimates in one of the trailing four quarters, matched twice and missed on the remaining occasion, the average negative surprise being 13.91%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-10 | |

| Feb-06 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Jan-30 | |

| Jan-30 | |

| Jan-30 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite