|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Urban Outfitters Inc. URBN began fiscal 2026 with record first-quarter sales of $1.33 billion, up 10.7% year over year. All five brands in the portfolio delivered positive comparable sales, fueled by disciplined execution, lower markdowns and more targeted marketing. Operating profit surged 71.8% to $128.2 million, bringing the company closer to its long-term goal of a 10% operating margin.

The strong performance reflected balanced strength across stores and digital channels, supported by continued customer engagement.

Free People led the quarter with 11% overall sales growth, driven by retail and wholesale gains. The brand posted a 3.1% retail comparable sales increase and a robust 25.6% wholesale revenue rise. FP Movement was a major growth engine, delivering a 29% year-over-year rise, supported by strong demand, store openings and wholesale expansion.

Over the past year, URBN opened 43 locations under Free People and FP Movement combined. Free People Group is expected to deliver a mid-single-digit retail comp gain in the fiscal second quarter.

Nuuly, URBN’s fast-growing apparel rental subscription business, added more than 110,000 subscribers year over year to surpass 380,000 by May. This drove a 59.5% revenue increase for the brand in the quarter. Management reaffirmed Nuuly’s profitability trajectory and market leadership in rentals, projecting sustained double-digit revenue and profit growth into the fiscal second quarter, as subscriber momentum continues.

Anthropologie posted its 10th consecutive quarter of double-digit operating profit growth, supported by a 6.9% retail comp. Latest launches like the resort-wear label Celandine, along with continued strength in home, beauty and intimates, helped reinforce Anthropologie’s lifestyle appeal. Strong in-store and digital traffic fueled the brand’s performance, and management expects a mid-single-digit comp gain for Anthropologie in the fiscal second quarter.

The Urban Outfitters brand recorded a 2.1% global retail comp, led by a 14% gain in Europe, which offset a 4% decline in North America. The U.S. business showed encouraging signs of recovery through refreshed assortments, collaborations with brands like Nike, and reduced markdown activity. Low-single-digit growth is expected for the brand in the fiscal second quarter, as the turnaround continues.

Company-wide, URBN projects high-single-digit sales growth in the fiscal second quarter, with gross margin improvement of 50-100 basis points for the year. Despite tariff and supply-chain challenges, URBN remains confident in its ability to grow sales, expand margins and invest in its brands throughout fiscal 2026.

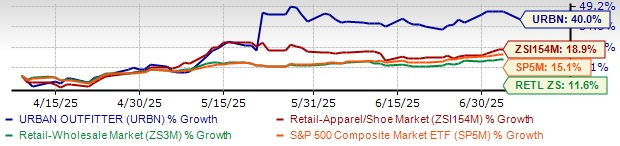

Shares of this Zacks Rank #1 (Strong Buy) company have rallied 40% in the past three months compared with the Zacks Retail-Apparel and Shoes industry’s modest 18.9% growth. This leading lifestyle specialty retailer’s ongoing strategic initiative and operational efficiencies have enabled it to outperform the broader Retail-Wholesale sector and the S&P 500 index’s growth of 11.6% and 15.1%, respectively, during the same period.

Closing at $70.64 as of yesterday, the URBN stock is trading 6.8% below its 52-week high of $75.80 attained on May 28, 2025. Technical indicators support Urban Outfitters’ strong performance. The stock is trading above its 50 and 200-day simple moving averages (SMAs) of $64.74 and $52.06, respectively, highlighting a continued uptrend. This technical strength, along with sustained momentum, indicates positive market sentiment and investors’ confidence in URBN’s financial health and growth prospects.

Urban Outfitters stands out as a compelling value play within the industry, trading at a forward 12-month price-to-sales ratio of 1.02, below the industry average of 1.77 and the sector average of 1.66. This undervaluation highlights its potential for investors seeking attractive entry points in the retail space.

The positive sentiment surrounding URBN is reflected in the upward revisions in the Zacks Consensus Estimate for earnings. In the past 30 days, the consensus estimate has moved up five cents to $4.96 per share for the current fiscal year and by nine cents to $5.45 for the next fiscal year, indicating year-over-year growth of 22.2% and 9.9%, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

The Zacks Consensus Estimate for the current and next fiscal years’ sales is pegged at $6.02 billion and $6.42 billion, implying year-over-year growth of 8.5% and 6.6%, respectively.

Some other top-ranked stocks are Stitch Fix SFIX, Canada Goose GOOS and Allbirds Inc. BIRD.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Stitch Fix’s current fiscal year’s earnings implies a surge of 71.7% from the year-ago actual. SFIX delivered a trailing four-quarter average earnings surprise of 51.4%.

Canada Goose is a global outerwear brand. GOOS is a designer, manufacturer, distributor and retailer of premium outerwear for men, women and children. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Canada Goose’s current fiscal year’s earnings and sales indicates growth of 10% and 2.9%, respectively, from the year-ago actuals. Canada Goose delivered a trailing four-quarter average earnings surprise of 57.2%.

Allbirds is a lifestyle brand that uses naturally derived materials to make footwear and apparel products. It carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for BIRD’s current financial-year earnings implies growth of 16.1% from the year-ago actual. The company delivered a trailing four-quarter average earnings surprise of 21.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-12 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite