|

|

|

|

|||||

|

|

Wells Fargo & Company WFC is slated to report second-quarter 2025 results on July 15, 2025, before market open.

Among Wells Fargo’s close peers, Bank of America BAC is slated to announce quarterly numbers on July 16 while Citigroup Inc. C will announce its quarterly numbers on July 15.

WFC’s first-quarter performance benefited from a slight improvement in non-interest income. Declines in provisions and non-interest expenses were other positives. However, the decrease in net interest income (NII) was an undermining factor. The Zacks Consensus Estimate for second-quarter 2025 revenues of $20.7 billion suggests a slight year-over-year rise.

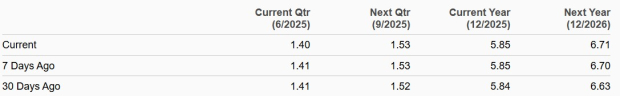

In the past 30 days, the consensus estimate for earnings for the to-be-reported quarter has been revised downward to $1.40. This indicates a 5.3% rise from the prior-year quarter’s actual.

Estimate Revision Trend

WFC has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average earnings surprise of 8.41%. Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Earnings Surprise History

In June 2025, WFC cleared a major obstacle to its growth plans as the Federal Reserve removed the $1.95-trillion asset cap on the company after years of restrictions imposed in 2018 related to its fake account scandal. The Fed has determined that WFC has met all the conditions required by the 2018 enforcement action for the removal of the growth restriction.

Loans & NII: In the second quarter, the Federal Reserve kept interest rates unchanged at 4.25-4.5%, given uncertainty surrounding the impacts of Trump’s tariff policy. Thus, Wells Fargo’s NII is likely to have witnessed modest growth, given that funding/deposit costs stabilized.

Despite an uncertain macroeconomic backdrop, the lending scenario was decent. Per the Fed’s latest data, the demand for commercial and industrial, real estate, and consumer loans was solid in the first two months of the quarter. Thus, the company’s lending activity is likely to have witnessed an improvement in the quarter to be reported.

The Zacks Consensus Estimate for NII is pegged at $11.94 billion, which indicates a slight rise from the previous year's quarter reported number.

Non-Interest Revenues: Despite interest rate cuts by the Federal Reserve in 2024, mortgage rates did not come down meaningfully. In the second quarter, mortgage rates fluctuated, but they remained in the mid-to-upper 6% range. As such, refinancing activities and origination volume witnessed were decent.

Given this, Wells Fargo’s mortgage banking fees are likely to have witnessed some improvement in the quarter to be reported. The Zacks Consensus Estimate for mortgage banking revenues for the second quarter of 2025 is pegged at $271.2 million, suggesting a 11.6% rise from the year-ago quarter’s reported level.

The company’s investment advisory and other asset-based fee revenues are likely to have improved from transactional activities. The consensus mark for investment advisory and other asset-based fee revenues is pegged at $2.5 billion, indicating a year-over-year rise of 1.6%.

Global mergers and acquisitions (M&As) in the second quarter of 2025 were impressive than previously expected. Markets plunged in early April after Trump announced sweeping tariffs, rattling business confidence. But as trade demands eased and policy direction became clearer, deal-making activities resumed in the last month of the quarter. This is likely to have supported WFC’s investment banking (IB) revenues in the second quarter.

The Zacks Consensus Estimate for IB income is pegged at $721.3 million, which indicates a rise of 12.5% on a year-over-year basis.

The Zacks Consensus Estimate for Card fees is pegged at $1.08 billion, suggesting a 1.5% decline from the year-ago quarter’s reported level.

The Zacks Consensus Estimate for Wells Fargo’s total non-interest income is pegged at $8.80 billion, indicating a marginal increase from the year-ago quarter reported figure.

Expenses: WFC’s expenses are expected to have witnessed a modest decline in the second quarter of 2025, given its prudent expense management initiatives, including the streamlining of its organizational structure, closure of branches, and reduction in headcount.

Asset Quality: As Wells Fargo had kept a substantial amount of money for potential delinquent loans (mainly commercial loan defaults) in the prior quarters, we expect the company to keep a modest reserve this time, given the expectations of higher for longer interest rates and the impacts of Trump’s tariffs on inflation.

The consensus mark for total non-accrual loans is pegged at $8.1 billion, suggesting a year-over-year decline of 4.1%. The Zacks Consensus Estimate for non-performing assets of $8.3 billion indicates a 3.9% fall from the year-ago quarter.

Per our proven model, the chances of WFC beating estimates this time are high. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as you can see below.

WFC has an Earnings ESP of +0.50%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Wells Fargo carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

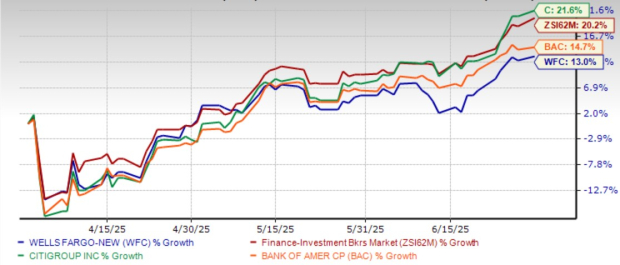

In the second quarter of 2025, WFC shares rose 13% compared with the industry’s rally of 20.2%. Its peers, Bank of America and Citigroup, rose 14.7% and 21.6%, respectively, over the same time frame.

Price Performance

Now, let us look at the value WFC offers investors at current levels.

Currently, Wells Fargo is trading at the forward 12 months' price/earnings (P/E) of 12.99X, below the industry’s forward earnings multiple of 14.58X. The company’s valuation looks inexpensive compared with the industry average.

Price-to-Earnings F12M

Wells Fargo's stock is trading at a premium compared with its peers Bank of America and Citigroup’s forward P/E of 11.74X and 10.23X, respectively.

WFC reached a turning point as the asset cap lifted, unleashing potential that has been muted ever since the Federal Reserve imposed it in 2018. With the removal of the asset cap, WFC can now boost deposits, grow its loan portfolio and broaden its securities holdings. Hence, the company can witness a rise in NII and overall profitability in the upcoming quarters.

Additionally, Wells Fargo has been actively engaged in cost-cutting measures, including streamlining organizational structure, branch closures and headcount reductions. These strategic moves aim to lower operating expenses and enhance profitability over the long term.

However, the uncertainty regarding the Fed rate cuts trajectory and the volatile macroenvironment is concerning. The bank's performance in the near term will be greatly influenced by its capacity to navigate these challenges to improve its financial performance.

Hence, investors should not rush to buy the Wells Fargo stock now. To get clarity and possibly an appealing entry point, those interested in adding it to their portfolios may be better off waiting until after the quarterly results are out. Those who already have the WFC stock can consider retaining it because it is less likely to disappoint over the long term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite