|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

SM Energy SM is an independent exploration and production firm, with its operations focused on the Permian Basin, Uinta Basin and South Texas region. SM Energy owns approximately 111,000 net acres in the Midland Basin and 63,300 net acres in the Uinta Basin. Its South Texas assets comprise approximately 155,000 net acres in the Dimmit and Webb counties. These assets are situated within multiple oil-rich basins in the United States, forming a strong basis for oil-weighted production growth for SM.

Let us delve into the strengths and risk factors associated with the SM stock to determine if this is the right time to buy or hold.

Strong Financial Performance: SM Energy reported robust first-quarter 2025 results, with revenues totaling $844.5 million and net income of $182.3 million. The revenue and net income figures have shown significant improvement from the prior-year quarter level, demonstrating SM’s focus on operational efficiency. Higher revenues and net income can be attributed to increased daily oil production compared to 2024 levels, largely due to the successful integration of its Uinta Basin assets that underscores the strength of the firm’s core assets.

Management believes that its high-quality assets, with low-breakeven costs, particularly in the Midland Basin of West Texas, the Maverick Basin of South Texas and the Uinta Basin of Northeast Utah, should continue to generate strong returns for the company. SM aims for a 30% increase in oil production and a 20% increase in total production for 2025, which is expected to enhance its financial performance.

Successful Integration of Uinta Basin Assets: SM Energy is focusing on the integration of the Uinta Basin assets into the company’s asset portfolio. The acquisition has already contributed to increased production volumes in the first quarter of 2025, compared to prior year levels. The company reported a 63% increase in daily oil production compared to the first quarter of 2024, primarily due to the contribution from the acquired assets. Management has also highlighted that drilling and completion efficiency in the Uinta Basin has exceeded prior expectations, leading to higher capital efficiency gains than expected. Additionally, the company has mentioned that the Uinta Basin wells coming online will contribute to a higher oil mix, particularly in the second half of 2025. These factors are expected to drive sustained growth from these assets in the future.

Strong Balance Sheet & Resilient Cash Flow Generation: SM Energy is strategically allocating its free cash flows toward reducing its debt burden. The company is currently prioritizing debt reduction to reach a leverage ratio of about 1. This should help strengthen its balance sheet, making it more resilient to navigate commodity cycles.

SM is confident about its ability to generate free cash flows even in a challenging commodity price environment. The management stated that even at a flat $55/barrel oil price, the company can generate enough free cash flows to support its capital expenditures and still prioritize debt reduction. By directing free cash flow toward deleveraging, SM Energy is improving its financial flexibility and reducing the interest burden associated with upcoming debt maturities.

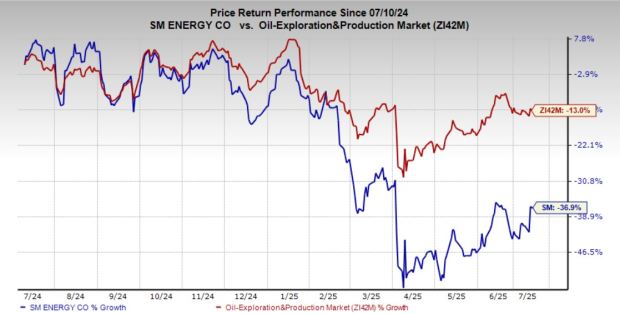

Underperformance of the Stock: SM Energy has relatively underperformed the broader Zacks Exploration and Production industry. SM’s shares fell 36.9% compared with the industry's 13% decline in the past year. The weakness exhibited by the stock may raise investor concerns regarding the near-term prospects of the company, especially in challenging commodity price environments.

Vulnerability to Commodity Price Volatility: Being an independent oil and gas company focused on exploration and production activities, the company’s earnings are heavily dependent on oil and gas prices. Per the U.S. Energy Information Administration (“EIA”), oil prices are expected to remain under pressure over the next two years. Potential output hikes by OPEC+ could exacerbate the existing oversupply in the market, thereby putting downward pressure on prices. The management noted that if oil prices fall below $55 per barrel, the company may need to make adjustments to its capital and operational plans.

Lower Dividend Yield: SM Energy’s current dividend yield lags its industry peers. While the company is confident in generating free cash flows to support its capital plans, shareholder returns and debt reduction objectives, management is currently prioritizing debt reduction objectives over aggressive shareholder return measures. Dividends serve as a crucial component of an investor's returns, providing regular cash payouts from the company's profits. A lower dividend yield may deter income-focused investors, potentially prompting them to explore alternative investments that offer competitive returns.

SM Energy delivered robust financial results in the previous quarter, largely driven by production growth from the successful integration of Uinta Basin assets. However, its appeal may be limited due to vulnerability to commodity price volatility and underperformance relative to the broader exploration and production sub-industry. Given these factors, investors should consider adopting a hold strategy for the stock at present.

SM currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the energy sector are Flotek Industries Inc. FTK, The Williams Companies, Inc. WMB, and Oceaneering International OII. While Flotek Industries sports a Zacks Rank #1 (Strong Buy) at present, The Williams Companies and Oceaneering International carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flotek Industries specializes in green chemistry, which provides innovative solutions aimed at reducing the environmental impact of the energy industry. The company develops specialty chemicals tailored for both domestic and international energy producers, as well as oilfield service companies. These chemicals not only help reduce the environmental impact of hydrocarbon production but also lower operational costs.

The Williams Companies, Inc. is a premier energy infrastructure provider in North America. The company’s core operations include finding, producing, gathering, processing and transporting natural gas and natural gas liquids. Williams boasts a pipeline system of more than 33,000 miles and is one of the largest domestic transporters of natural gas.

Oceaneering International delivers integrated technology solutions across all stages of the offshore oilfield lifecycle. The company is a leading provider of offshore equipment and technology solutions to the energy industry. OII’s proven ability to deliver innovative, integrated solutions supports ongoing client retention and new business opportunities, ensuring steady revenue growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 7 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite