|

|

|

|

|||||

|

|

Let’s dig into the relative performance of Amdocs (NASDAQ:DOX) and its peers as we unravel the now-completed Q1 it services & other tech earnings season.

The IT and tech services subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products like switches and firewalls as well as implementation services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

The 19 it services & other tech stocks we track reported a mixed Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, it services & other tech stocks have performed well with share prices up 12.6% on average since the latest earnings results.

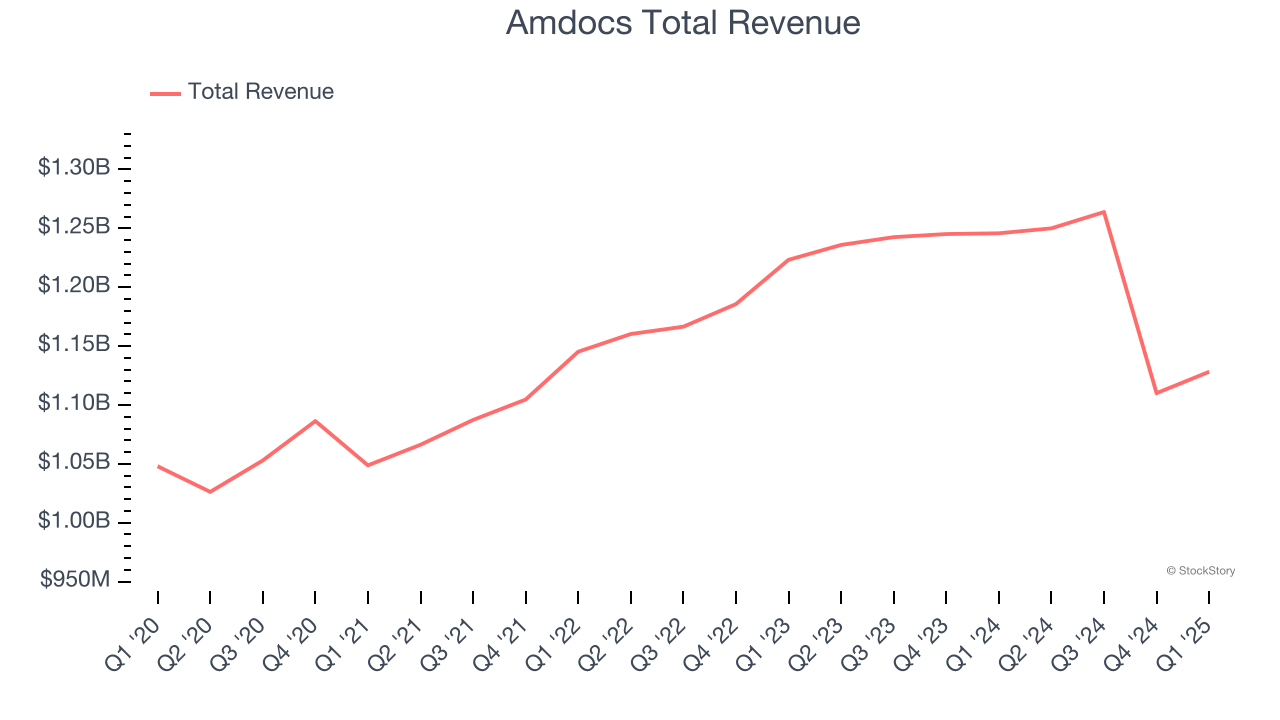

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ:DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Amdocs reported revenues of $1.13 billion, down 9.4% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ full-year EPS guidance estimates.

"Q2 was a good quarter for Amdocs as we executed our strategy to deliver the cloud, digital, and AI-based solutions our customers need to ensure amazing experiences and seamless connectivity for billions of people each day. Revenue of $1.13 billion was up 4% from a year ago in pro forma(1) constant currency(2), and deal conversion was strong, led by continued sales momentum in cloud. Amdocs has won a deal to facilitate the migration of both Amdocs and non-Amdocs applications to Microsoft Azure for a Tier-1 European service provider, and we were also selected for the next phase of PLDT's cloud modernization journey in Philippines. Consumer Cellular, a new US client for Amdocs, has chosen our SaaS-based connectX solution to expedite the launch of new digital brands. We also extended our collaboration with NVIDIA and other GenAI partners to further evolve Amdocs' amAIz platform and to support the data and GenAI requirements of our customers," said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Amdocs delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 1.4% since reporting and currently trades at $88.15.

Is now the time to buy Amdocs? Access our full analysis of the earnings results here, it’s free.

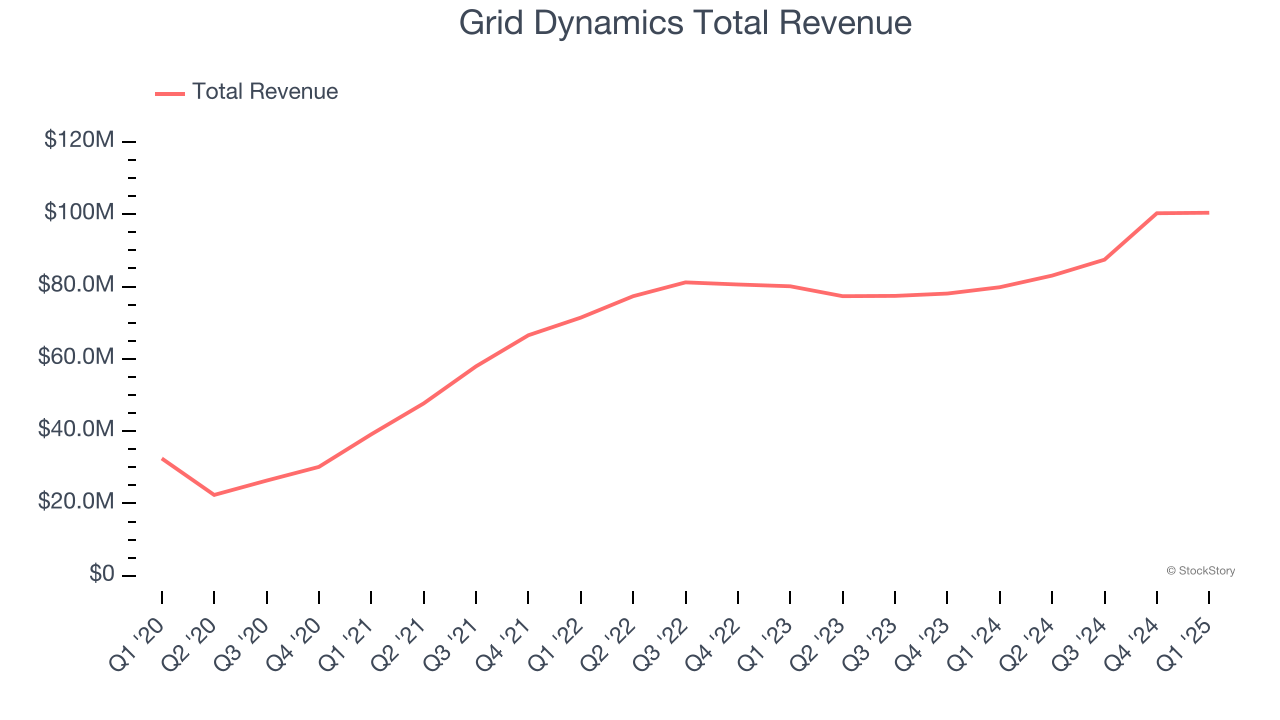

With engineering centers across the Americas, Europe, and India serving Fortune 1000 companies, Grid Dynamics (NASDAQ:GDYN) provides technology consulting, engineering, and analytics services to help large enterprises modernize their technology systems and business processes.

Grid Dynamics reported revenues of $100.4 million, up 25.8% year on year, outperforming analysts’ expectations by 2%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

Grid Dynamics pulled off the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 19.7% since reporting. It currently trades at $11.30.

Is now the time to buy Grid Dynamics? Access our full analysis of the earnings results here, it’s free.

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE:HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

HP reported revenues of $13.22 billion, up 3.3% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 6.7% since the results and currently trades at $25.45.

Read our full analysis of HP’s results here.

Founded in Silicon Valley in 1993 and known for its modular "building block" approach to server design, Super Micro Computer (NASDAQ:SMCI) designs and manufactures high-performance, energy-efficient server and storage systems for data centers, cloud computing, AI, and edge computing applications.

Super Micro reported revenues of $4.6 billion, up 19.5% year on year. This number missed analysts’ expectations by 2.7%. It was a slower quarter as it also recorded a significant miss of analysts’ operating income estimates.

The stock is up 49.7% since reporting and currently trades at $49.24.

Read our full, actionable report on Super Micro here, it’s free.

With a corporate history spanning over a century and once known for its iconic mainframe computers, IBM (NYSE:IBM) provides hybrid cloud computing platforms, AI solutions, consulting services, and enterprise infrastructure to help businesses modernize their operations.

IBM reported revenues of $14.54 billion, flat year on year. This result beat analysts’ expectations by 1%. It was a strong quarter as it also recorded an impressive beat of analysts’ operating income estimates and a solid beat of analysts’ EPS estimates.

The stock is up 15.6% since reporting and currently trades at $283.57.

Read our full, actionable report on IBM here, it’s free.

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| Feb-23 | |

| Feb-22 | |

| Feb-19 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite