|

|

|

|

|||||

|

|

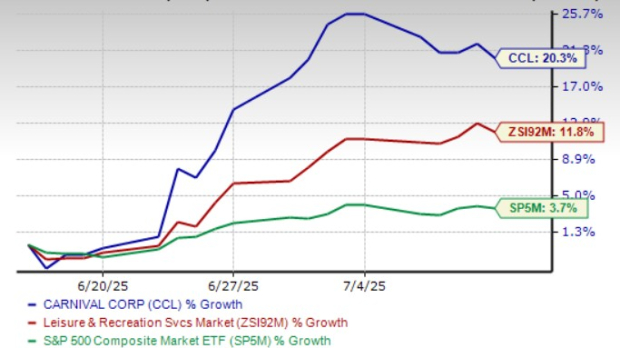

Shares of Carnival Corporation & plc CCL have rallied 20.3% in the past month compared with the Zacks Leisure and Recreation Services industry’s 11.8% growth. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 3.7%.

Carnival’s recent stock surge has been driven by a combination of record-breaking earnings, early achievement of long-term strategic targets, and continued momentum in demand and pricing. Investor enthusiasm has also been fueled by improving credit metrics and renewed optimism surrounding the broader cruise sector.

With the cruise giant now boasting its highest margins in two decades and having already met its 2026 financial targets well ahead of schedule, investors are weighing whether to capitalize on this strength or wait for a potential pullback. Let us take a closer look.

Carnival has demonstrated impressive resilience and momentum in 2025, marked by robust fiscal second-quarter performance and operational milestones. The cruise giant posted its eighth consecutive quarter of record revenues and yields, with EBITDA rising 26% year over year and net income more than tripling. Carnival achieved its 2026 SEA Change targets for EBITDA per ALBD growth and return on invested capital a full 18 months ahead of schedule, underscoring the strength of its commercial execution and operational discipline.

Yield growth remains a key driver of Carnival’s outperformance. In the fiscal second quarter, net yields rose 6.5%, courtesy of strong ticket pricing and robust onboard spending. These trends were consistent across core programs and geographies. With 93% of 2025 capacity already booked and pricing at historically high levels, the company anticipates the momentum to continue in the upcoming periods. Carnival’s elongated booking window and limited capacity growth pave a path for pricing flexibility and maintaining occupancy levels.

Carnival is also making notable strides in financial flexibility. The company continues to reduce its leverage, with a net debt-to-EBITDA ratio of 3.7X, down from 4.1X in the fiscal first quarter, and over $20 million in expected interest savings through 2026 due to proactive refinancing. With favorable booking trends, improving margins, expanding strategic assets and a healthier balance sheet, Carnival is positioned to navigate near-term uncertainties while steering toward sustained long-term growth.

Heading into the second half of 2025 and beyond, Carnival is well-positioned to build on its recent momentum. The anticipated July debut of Celebration Key is a major milestone for the company. Designed as a game-changing private destination with the largest lagoon in the Caribbean and the world’s largest swim-up bar, Celebration Key is generating strong consumer interest and is expected to command pricing premiums. Carnival plans to augment this with strategic expansions at RelaxAway, Half Moon Cay and Isla Tropicale, underscoring its focus on premium beach experiences as a core growth pillar.

In parallel, Carnival is enhancing its fleet and guest experience. The rollout of the AIDA Evolution program is underway, modernizing ships with upgraded dining and entertainment options. The upcoming launch of the Star Princess, a sister ship to the award-winning Sun Princess, will likely further elevate Carnival’s premium offerings. Looking ahead, new Excel-class ships — Carnival Festivale and Carnival Tropicale — featuring family-friendly amenities like nighttime waterparks, are expected to debut in 2027 and 2028.

On the customer loyalty front, Carnival is preparing to launch an overhauled Carnival Rewards program in mid-2026. The redesigned program will link rewards more directly to overall guest spend. While it may have a slight short-term impact on reported yields, management expects the program to drive higher guest lifetime value and become yield-accretive within two years.

Carnival has upgraded its full-year fiscal 2025 guidance. The company now anticipates adjusted EBITDA to be approximately $6.9 billion (up from the previous expectation of about $6.7 billion), reflecting more than 10% growth year over year. Adjusted net income is now anticipated to be about $2.69 billion, up from the previously expected value of $2.49 billion. CCL now expects adjusted earnings per share (EPS) to be approximately $1.97, up from $1.83 expected earlier.

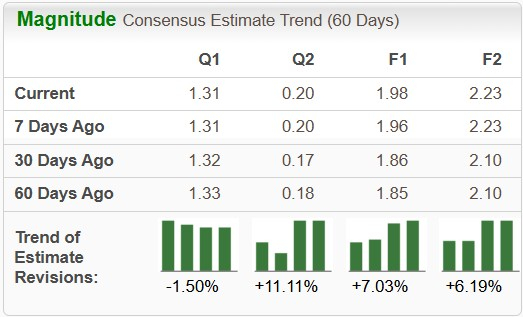

Over the past 60 days, the Zacks Consensus Estimate for Carnival’s fiscal 2025 EPS has been revised upward, increasing from $1.85 to $1.98. This upward trend reflects strong analyst confidence in the stock’s near-term prospects.

The 60-day earnings estimate growth trend for CCL remains higher for 2025 compared with other industry players, including Royal Caribbean Cruises Ltd. RCL, Norwegian Cruise Line Holdings Ltd. NCLH, and OneSpaWorld Holdings Limited OSW. Over the past 60 days, earnings estimates for 2025 for RCL and OSW have increased 1.3% and 2.1% respectively. Meanwhile, estimates for NCLH have declined by 1% in the same time frame.

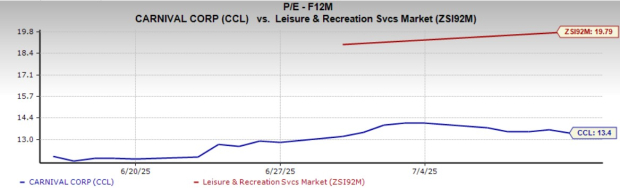

Carnival stock is currently trading at a discount. CCL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 13.40X, well below the industry average of 19.79X, reflecting an attractive investment opportunity. Other industry players, such as Royal Caribbean, Norwegian Cruise and OneSpaWorld, have P/E ratios of 20.28X, 10.21X and 20.26X, respectively.

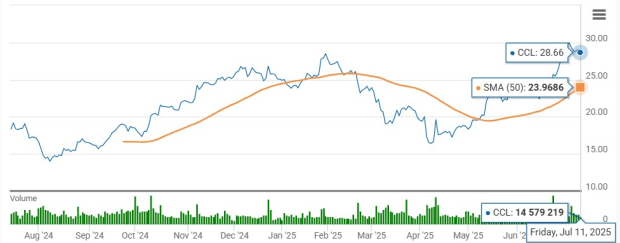

From a technical perspective, CCL is currently trading above its 50-day moving average, indicating solid upward momentum and price stability.

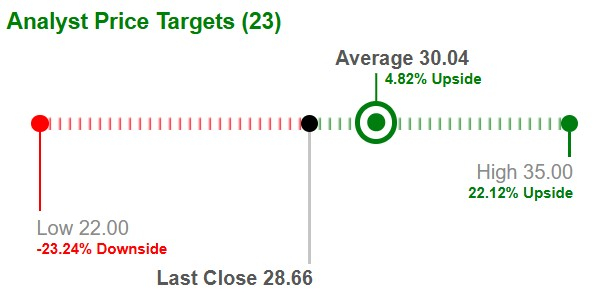

Analysts remain constructive on Carnival, forecasting meaningful upside despite recent market volatility. Based on short-term projections from 24 analysts, the average price target for Carnival stock stands at $30.04, representing a potential upside of 4.8% from its last closing price of $28.66. Target estimates range from a low of $22.00 (implying a downside risk of 23.2%) to a high of $35.00, suggesting a sizable upside potential of 22.1%.

Broker sentiment toward CCL remains firmly positive. The company holds an average brokerage recommendation (ABR) of 1.60 on a scale of 1 (Strong Buy) to 5 (Strong Sell), reflecting a favorable outlook. The consensus rating is derived from 25 firms, 17 of which have issued Strong Buy recommendations, while one rates it a Buy.

The persistently strong analyst support and a wide range of price targets — weighted toward the upside — highlight optimism surrounding Carnival’s recovery trajectory and long-term potential.

While the recent rally may tempt some investors to wait for a better entry point, Carnival’s strong fundamentals, expanding destination portfolio, and upgraded 2025 outlook make it a compelling opportunity for long-term investors. The company’s early achievement of its 2026 financial targets, combined with robust booking trends, improving margins, and strategic fleet enhancements, signals durable growth potential.

Carnival’s focus on moderate capacity additions, disciplined cost controls, and yield optimization continues to drive sustainable shareholder value. Furthermore, rising EPS estimates and favorable technical indicators, such as the stock trading above its 50-day moving average, underscore the ongoing strength behind the rally.

We believe that this Zacks Rank #2 (Buy) stock is an ideal candidate for those looking to capitalize on the booming cruise industry. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 46 min | |

| 4 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite