|

|

|

|

|||||

|

|

In the competitive world of fresh produce, a few names are as prominent as Mission Produce, Inc. AVO and Dole plc DOLE. These two companies have carved distinct paths in the global fruit market. While AVO is a focused avocado powerhouse, leveraging vertical integration and ripening technology to dominate the superfruit’s supply chain, DOLE boasts a diversified portfolio spanning bananas, pineapples, fresh vegetables and packaged goods, making it one of the world’s largest produce giants.

As consumer preferences evolve and supply-chain dynamics shift, the battle for market share and shelf space intensifies. AVO is aggressively expanding its global footprint, banking on the rising demand for avocados, especially in Asia and Europe. DOLE, meanwhile, relies on its scale and multi-fruit portfolio to maintain dominance in key markets despite facing margin pressures in a fragmented industry.

Which company is better positioned in today’s volatile fresh produce landscape? Let us dig into the numbers, strategy and market reach to see how AVO stacks up against DOLE.

Mission Produce has established itself as a global leader in the fresh produce industry, with a sharp focus on avocados and an expanding presence in mangos and blueberries. The company’s vertically integrated model enables it to control sourcing, ripening, distribution and marketing, ensuring product quality and reliability for customers across retail, foodservice and wholesale channels. AVO’s broad geographic reach, supported by sourcing in premium growing regions and distribution hubs across North America, Europe and Asia, positions it to serve global demand with consistency.

Strategically, the company is leaning into growth through geographic expansion and supply-chain agility. Its recent gains in Europe and the U.K. reflect smart investments in local infrastructure and customer relationships. By diversifying sourcing across Peru, Mexico and Guatemala, Mission Produce manages seasonal variability and responds quickly to external pressures.

A short-lived tariff episode in early 2025 briefly impacted margins, but the company’s swift response and the exemption of USMCA-compliant goods underscored its ability to navigate shifting trade dynamics without significant disruption.

Despite a challenging pricing and supply environment, Mission Produce continues to deliver solid financial results. The business benefits from premium pricing, steady demand and disciplined execution. Its digital capabilities, including real-time tracking, ripening optimization and logistics efficiency, enhance its competitive edge.

Mission Produce’s brand is increasingly resonating with health-conscious, sustainability-focused consumers, particularly younger demographics seeking fresh, functional foods. With its scale, supply-chain expertise and strategic focus, Mission Produce is well-positioned for continued leadership in the global avocado market and long-term growth in the broader fresh produce category.

Dole remains a powerhouse in the global fresh produce market, with unmatched category breadth and geographic reach. As one of the world’s largest suppliers of bananas and pineapples, and a meaningful player in avocados, berries, citrus and value-added vegetables, Dole’s scale allows it to serve diverse consumer segments and remain resilient amid market fluctuations. While avocados are a smaller slice of Dole’s portfolio, the company’s presence in that space continues to grow through strong performance in North America and export markets, benefiting from integrated logistics and broad retail relationships.

Strategically, Dole’s strength lies in diversification. Its fresh fruit, EMEA and Americas segments all delivered solid results in first-quarter 2025, with notable momentum in kiwis, citrus and avocados. Despite challenges from Tropical Storm Sarah and pressure on Southern Hemisphere exports, Dole’s balanced business model helped offset regional weakness.

The company continues to invest in production recovery, infrastructure and automation, while enhancing efficiencies across its supply chain. Its recent $1.2-billion refinancing has boosted financial flexibility, allowing DOLE to explore both internal improvements and external growth opportunities across core markets like Europe, North America and Latin America.

Dole’s global operations naturally expose it to trade-related risks, including currency swings and tariffs. However, management has already factored current tariff dynamics into its 2025 outlook and remains confident in the durability of trade agreements. With raised full-year guidance and a dividend increase signaling confidence, DOLE offers investors a stable, yield-generating option in the food sector. Its brand recognition, operational scale and category diversity make it a standout in the fresh produce aisle and beyond.

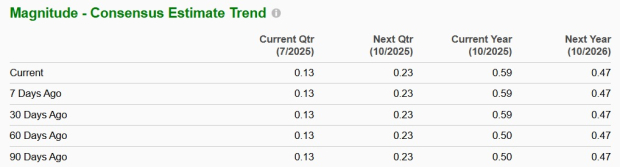

The Zacks Consensus Estimate for Mission Produce’s fiscal 2025 sales implies year-over-year growth of 8.1%, while that for EPS suggests a decline of 20.3%. EPS estimates have been unchanged in the past 30 days. AVO’s annual sales and earnings are slated to decrease 8% and 20.3% year over year, respectively, in fiscal 2026.

The Zacks Consensus Estimate for Dole’s 2025 sales suggests year-over-year growth of 1.8%, while EPS indicates a decline of 0.8%. EPS estimates have been unchanged in the past 30 days. Dole’s annual sales and earnings are slated to increase 3.1% and 18.8% year over year, respectively, in fiscal 2026.

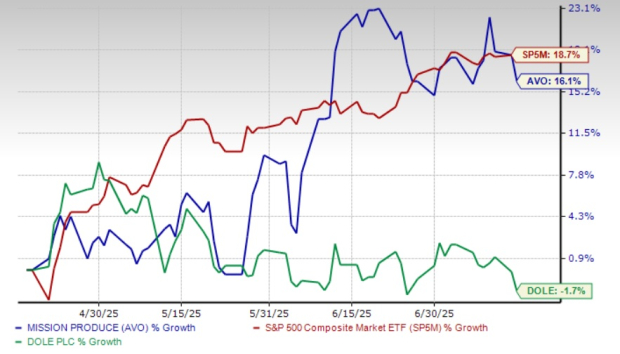

In the past three months, the AVO stock had the edge in terms of performance, recording a total return of 16.1%. This has noticeably outpaced DOLE’s decline of 1.7% but underperformed the benchmark S&P 500’s return of 18.7%.

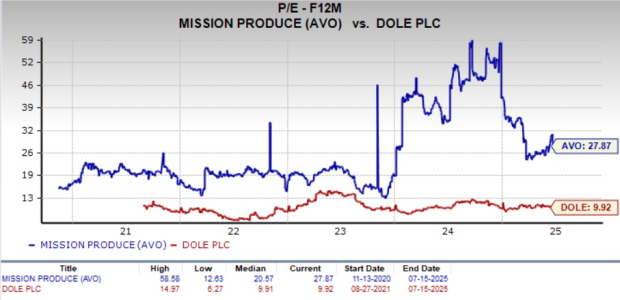

From a valuation perspective, Mission Produce trades at a forward price-to-earnings (P/E) multiple of 27.87X, which is above its 5-year median of 20.6X. Moreover, the AVO stock trades above Dole’s forward 12-month P/E multiple of 9.9X and a 5-year median of 9.91X.

At current levels, AVO is trading at a noticeable premium compared with Dole, suggesting that investors view Mission Produce as a higher-growth, more specialized business. AVO’s valuation is a sign that the market is rewarding its focused strategy in the avocado category, vertically integrated operations and global expansion efforts. In contrast, DOLE’s valuation reflects a more value-oriented, diversified produce business.

While AVO commands a higher multiple due to its growth profile and category leadership, the valuation gap is stark. Mission Produce has the edge in growth potential, with the market pricing in continued category expansion and international momentum.

DOLE’s lower multiple may appear more attractive to value-focused investors, especially considering its broader revenue base, strong cash flow generation and global brand presence across multiple produce categories. However, its diversified nature can also mean slower growth and greater exposure to commodity pressures.

In short, AVO is for investors seeking premium growth in a niche space, while DOLE appeals to those looking for stability, income and a relative bargain.

Mission Produce edges out Dole, thanks to its focused strategy, category leadership and stronger recent stock performance. AVO's streamlined business model, centered around avocados, backed by vertical integration, global sourcing and targeted expansion, gives it a sharper growth profile compared with Dole's more sprawling operations. Its growing presence in high-potential markets and adjacent categories, like mangoes and blueberries, adds to its long-term appeal. The market seems to agree, as reflected in AVO's premium valuation and three-month outperformance, indicating investor confidence in its trajectory.

While DOLE remains a global heavyweight with impressive scale and stability, its diversified model can dilute growth momentum. The company continues to show solid execution, particularly in bananas, citrus and kiwis, and it offers income-oriented appeal through dividends and a lower valuation. However, in an environment where investors are rewarding clarity, specialization and expansion potential, AVO stands out.

For investors looking to capture both growth and value in the fresh produce sector, Mission Produce is emerging as a compelling name to watch. Backed by a focused strategy and expanding global footprint, AVO currently has a Zacks Rank #2 (Buy), reflecting positive earnings momentum and investor sentiment. In comparison, Dole carries a Zacks Rank #3 (Hold), indicating a more neutral outlook. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite