|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

Reassuring Bank Results

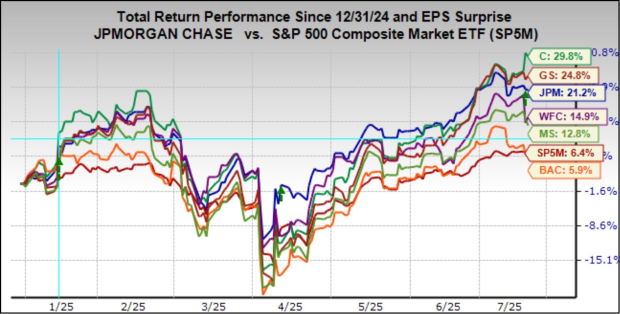

Stocks of the big Wall Street firms have been stellar market performers lately. This had increased the odds in our eyes that the companies’ June-quarter results may prove to be sell-the-news type of developments, particularly since these banks weren’t expected to show much strength in their numbers.

As you can see in the chart below of the year-to-date performance of JPMorgan JPM, Bank of America BAC, Citigroup C, Wells Fargo WFC, Goldman Sachs GS, and Morgan Stanley MS. As you can see here, each of these Wall Street firms has outperformed the market this year, except for Bank of America, which has modestly lagged behind the market.

It is reassuring to see that the actual results from Q2 have largely been very strong and better than expected. Importantly, management commentaries on business trends, the coming quarters, and the overall health of the economy have been broadly positive.

We should note, however, that results at Bank of America and Wells Fargo were mixed at best, with both coming up short of net interest income and the latter also guiding lower on that front. Net interest income, which is the money banks earn from their lending operations, decreased by -2.6% at Wells Fargo and increased by +7% at Bank of America.

Net interest income was up +2% at JPMorgan and an impressive +12% at the seemingly resurgent Citigroup. The favorable performance of Citigroup shares in the above chart not only anticipated the bank’s strong results but also reflects the market’s confidence in the new management team’s strategy.

Citigroup also had impressive results in the trading and investment banking businesses. Trading revenues were up +16% at Citigroup, while JPMorgan, Bank of America, Goldman Sachs, and Morgan Stanley reported gains of +15%, +15%, +22%, and +18%, respectively. Goldman Sachs’ equity trading volumes were a new all-time quarterly record.

While the trading business benefited from the elevated tariffs-centric market volatility, the resulting business uncertainty chilled investment banking activities, particularly in the immediate aftermath of the tariff announcements at the start of Q2. However, as JPMorgan noted on its earnings call, the pace of activity notably picked up later in the quarter, resulting in all of these companies exiting the quarter in a much better position. Investment banking revenues increased +15% at Citigroup, while the same at Goldman Sachs and JPMorgan increased +26% and +7% from the year-earlier level, respectively. Please note that JPMorgan’s +7% increase in investment banking revenues compares to management’s earlier guidance of a mid-teens decline. Investment banking revenues were down at Morgan Stanley and Bank of America.

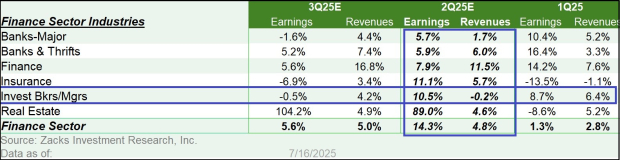

For the Zacks Investment Brokers & Managers industry at the mezzanine level, which includes all of these Wall Street firms, total Q2 earnings are now expected to be up +10.5%, which compares to the -2.8% decline that was expected before these results came out. The table below shows the constituent industries for the Zacks Finance sector, with Q2 expectations contrasted with what was actually achieved in the preceding period and what is currently expected for 2025 Q3.

Q2 earnings growth for the Zacks Finance sector is now expected to be +14.3% on +4.8% revenue growth. With about two-thirds of the sector’s market capitalization still to report Q2 results, the Q2 earnings growth pace should go up further in the days ahead.

Importantly, the positive and reassuring management commentary from these Wall Street firms should help push estimates higher for Q3 and beyond.

Expectations for 2025 Q2 & Beyond

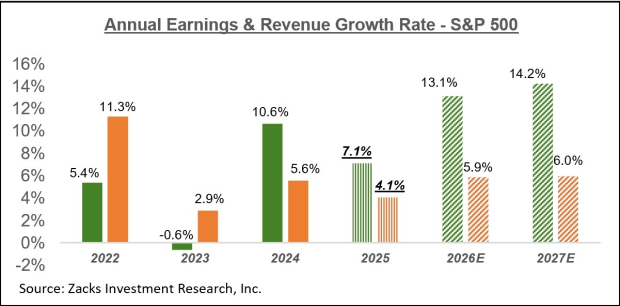

The strong bank results have helped push the Q2 earnings growth expectation higher, with earnings for the S&P 500 index now expected to increase by +5.7% from the same period last year on +4.2% higher revenues.

The chart below shows expectations for 2025 Q2 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

The market’s rebound from the post-tariffs April lows has been very impressive, likely suggesting that market participants don’t see the tariff uncertainty as presenting a significant threat. This view is also confirmed by commentary from management teams during their earnings calls.

We find ourselves a bit skeptical of this sanguine view. Whatever the final level of tariffs turns out to be, it will have an impact on the earnings picture.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite