|

|

|

|

|||||

|

|

Costco Wholesale Corporation COST and Target Corporation TGT hold prominent positions within the Retail–Discount Stores industry. Costco boasts a substantial market capitalization of approximately $414 billion, operating on a membership-based warehouse model focused on selling bulk goods at discounted prices. The company manages a network of 908 warehouses globally, including 625 in the United States and Puerto Rico.

In comparison, Target commands a market capitalization of about $48 billion and operates 1,981 store locations (as of May 3, 2025) across the United States, blending affordability with style and convenience. With a focus on curated merchandise, private-label brands and a strong omnichannel strategy, Target appeals to a broad demographic seeking quality and value in everyday essentials and discretionary purchases.

Amid evolving consumer spending patterns and changing economic dynamics, evaluating which of these retailers is better positioned for growth becomes crucial.

Costco’s resilient business model, built around its membership-based structure, remains a major growth driver. High membership renewal rates — 92.7% in the United States and Canada and 90.2% globally — combined with efficient supply-chain operations and bulk purchasing power, allow Costco to offer competitive pricing that keeps customers loyal. This robust model has allowed Costco to thrive, even during economic downturns.

Members pay an annual fee for access to Costco’s warehouses, where they enjoy significant discounts on a wide range of products. This structure not only ensures a reliable revenue stream but also fosters a sense of value and exclusivity. In the third quarter of fiscal 2025, membership fee income rose 10.4% year over year, aided by a recent fee hike, which added approximately 4.6% growth in the quarter. The company ended the quarter with 79.6 million paid household members, marking a 6.8% increase year over year.

Costco continuously adapts to market trends and consumer preferences. The company regularly updates its product offerings to include a mix of everyday essentials and unique, high-demand items. Through market analysis and tailored offerings, Costco has expanded its presence, both domestically and internationally. In fiscal 2025, the company plans to open 27 total openings (24 net new), bringing its global warehouse count to 914.

Digitization also plays a key role in Costco’s expansion. E-commerce comparable sales rose 14.8% in the third quarter, reflecting growing online demand. Costco Logistics saw a 31% increase in items delivered, driven by the success of big-ticket product categories. The recent launch of a Buy Now, Pay Later program in partnership with Affirm is another step toward enhancing convenience and flexibility for members. For the five weeks ended July 6, 2025, e-commerce comparable sales jumped 11.5%.

That said, some challenges linger. Currency headwinds and potential tariffs on key imports could pressure margins. Additionally, as consumers become more cautious with spending, demand for non-essential items has softened — a potential drag on discretionary sales.

Target is leveraging its strong brand presence, diverse product portfolio and expanding e-commerce capabilities, alongside a growing store footprint, to solidify its market position and drive sustainable growth. The retailer has adeptly navigated evolving consumer preferences by expanding its offerings across both discretionary and essential categories. By prioritizing innovation and integrating AI technology, the company is laying a solid foundation for long-term success.

To support this growth, the company plans to open around 20 new stores and remodel several existing locations in fiscal 2025. Complementing its physical expansion, Target’s investments in same-day delivery, curbside pickup and personalized digital services continue to enhance customer convenience and loyalty. Digitally originated comparable sales rose 4.7% year over year in the first quarter of fiscal 2025, reflecting a more than 35% jump in same-day delivery powered by Target Circle 360 and continued momentum in Drive Up.

Target’s third-party marketplace, Target Plus, saw impressive growth in the first quarter, with more than a 20% increase in Gross Merchandise Value (“GMV”). The platform added hundreds of new partners, driving both traffic and online conversions. As Target sets an ambitious goal of reaching $5 billion GMV by 2030, this marketplace will play a crucial role in expanding its product offering and increasing consumer engagement.

Despite these strategic efforts, Target has issued a cautious outlook for fiscal 2025. It now expects a low-single-digit decline in sales compared with its earlier forecast of 1% growth. It now foresees adjusted earnings in the band of $7.00-$9.00 per share, down from its prior forecast of $8.80 to $9.80.

Target’s first-quarter performance highlighted mounting challenges as both sales and earnings fell short of expectations. The company faced continued pressure from weakening consumer demand and declining store traffic. Comparable sales declined sharply, driven by softness in in-store performance. Margins contracted due to increased markdowns and higher costs tied to digital fulfillment and supply-chain expansion.

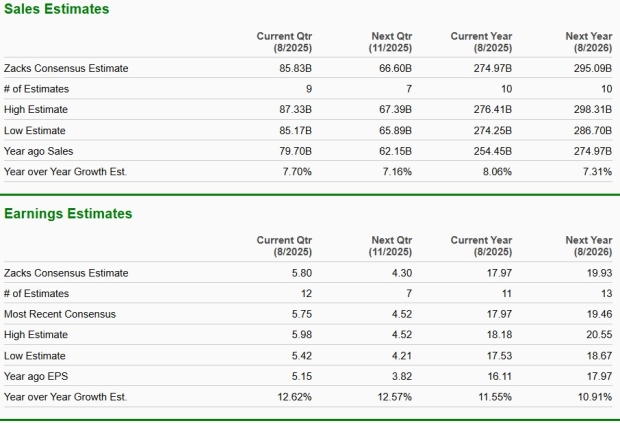

The Zacks Consensus Estimate for Costco’s current fiscal-year sales and EPS implies year-over-year growth of 8.1% and 11.6%, respectively. The consensus estimate for EPS for the current fiscal year has fallen by 9 cents to $17.97 over the past 30 days.

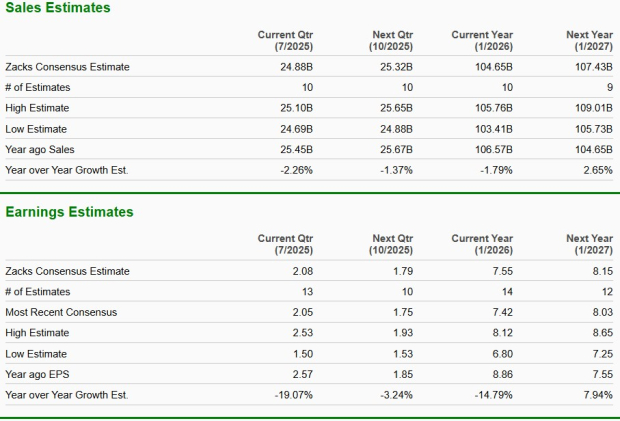

The Zacks Consensus Estimate for Target’s current fiscal-year sales and EPS suggests a year-over-year decline of 1.8% and 14.8%, respectively. However, the consensus estimate for EPS for the current fiscal year has increased by 4 cents to $7.55 over the past 30 days.

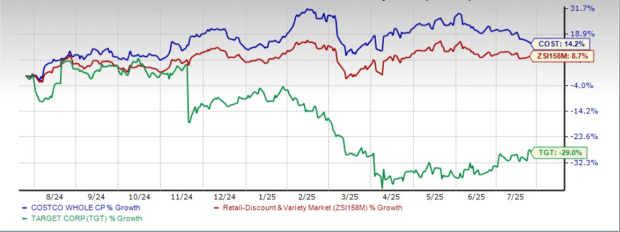

Despite operating in the same industry, the stock trajectories of Costco and Target have moved in starkly opposite directions. Shares of Costco have advanced 14.2% over the past year, outpacing the industry’s modest rise of 8.7%. In contrast, Target shares have plunged 29%, underperforming both its peer and the industry.

Costco is trading at a forward 12-month price-to-earnings (P/E) ratio of 47.34, lower than its one-year median of 50.76. Meanwhile, Target’s forward P/E ratio stands at 13.50, below its median of 13.98.

When compared with Target, Costco proves to be the safer choice in today’s retail environment. Its membership-based model, high renewal rates, and efficient cost structure provide more stability and resilience amid changing consumer habits. While Target is making impressive progress in digital innovation and expanding its marketplace, its short-term challenges — like weakening demand and margin pressures — cast a shadow over its growth prospects. Because of its consistent performance and clear strategy, Costco seems to be the better option for investors at this point. Costco carries a Zacks Rank #3 (Hold), while Target currently has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 4 hours | |

| 8 hours | |

| 9 hours | |

| 12 hours | |

| 14 hours | |

| 18 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite