|

|

|

|

|||||

|

|

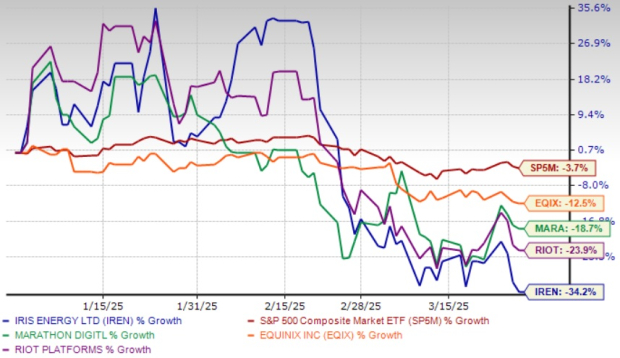

In the rapidly evolving landscape of cryptocurrency and artificial intelligence infrastructure, IREN Limited IREN has established itself as a formidable player with a clear strategic vision. Despite experiencing a 34.2% year-to-date (YTD) drop in stock price, IREN presents a compelling investment opportunity for forward-thinking investors in 2025. Here's why this Australian-based data center business warrants serious consideration for your portfolio.

IREN has solidified its position as an infrastructure powerhouse with the recent announcement of a binding 600MW grid connection agreement for its Sweetwater 2 project. This development brings the company's total secured power in West Texas to an impressive 2.75 gigawatts — not merely speculative capacity, but fully contracted power.

What sets IREN Limited apart is its ability to execute. While competitors discuss theoretical megawatt pipelines, IREN has secured binding agreements for real, deliverable capacity.

The strategic selection of West Texas leverages one of the world's largest renewable energy markets, offering scalable, low-cost electricity with multiple high-bandwidth fiber connections and low latency (~6ms to Dallas) – critical factors for AI and cloud workloads.

Securing this additional 600MW further solidifies the company’s competitive position as a leader in scalable data center infrastructure. The company's upcoming milestones include Sweetwater 1's energization in April 2026 and Sweetwater 2 in late 2027, representing significant catalysts for future growth.

IREN Limited has successfully diversified its business model beyond its Bitcoin mining roots. The second-quarter fiscal 2025 earnings report revealed record revenues and a significant turnaround with $18.9 million in net profit after tax against a loss in the previous quarter. Most notably, operating cash inflow reached $53.7 million, demonstrating strong financial performance.

The company's Bitcoin mining operations are scaling impressively from 31 EH/s to a targeted 52 EH/s, while maintaining industry-leading efficiency at 15 joules per terahash and a hardware profit margin of approximately 75%. This robust mining foundation provides stable cash flow while IREN advances its strategic push into AI infrastructure.

The announcement of Horizon 1, a 75MW liquid-cooled data center specifically designed for AI and high-performance computing workloads, represents IREN's strategic pivot toward higher-value services. This facility will support direct-to-chip liquid cooling and power redundancy with 200kW rack density capabilities — specifically designed to support next-generation NVIDIA Blackwell GPUs. The strategic timing of this development coincides with increased market demand for liquid-cooled infrastructure, positioning IREN at the forefront of a critical technological trend.

The management has successfully balanced immediate revenue generation through Bitcoin mining while methodically building infrastructure for future growth opportunities in AI and high-performance computing.

IREN's financial position remains robust with $427.3 million in cash and cash equivalents as of Dec. 31, 2024. The company successfully issued a $440 million convertible note and implemented a $1 billion ATM facility, providing ample resources to fund its ambitious growth initiatives.

The strategic decision to retain long-term ownership of its Sweetwater sites, rather than pursuing outright sales, demonstrates management's confidence in the long-term value proposition of its infrastructure assets. This approach allows IREN Limited to capture the full value chain of its data center operations while maintaining flexibility to adapt to evolving market demands.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $564.61 million, indicating year-over-year growth of 199.12%. The consensus mark for fiscal 2025 is pegged at 38 cents per share, up 231.03% from the year-ago period, indicating optimism.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

When compared to industry peers, IREN demonstrates key competitive advantages. IREN's hybrid model combines the growth potential of crypto miners with the stability of infrastructure providers, creating a unique value proposition that competitors like Marathon Digital MARA, Equinix EQIX and Riot Platforms RIOT have yet to replicate at scale.

Marathon Digital remains primarily focused on Bitcoin mining without IREN's diversification into AI infrastructure. Traditional data center provider Equinix commands premium valuations but lacks IREN's cryptocurrency exposure and specialized liquid-cooling capabilities critical for next-generation AI workloads. Riot Platforms presents stronger competition with its substantial Texas operations, but IREN's purpose-built AI infrastructure and strategic focus on high-performance computing differentiate its growth trajectory. Shares of Marathon Digital, Equinix and Riot Platforms have plunged 18.7%, 12.5% and 23.9%, respectively, in the YTD period.

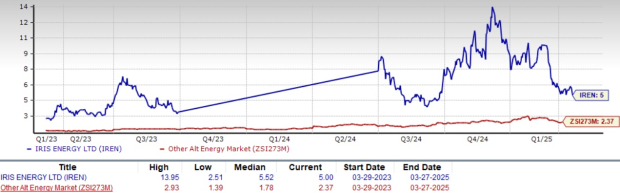

From a valuation standpoint, IREN trades at a two-year trailing 12-month price/sales ratio of 5x, substantially higher than the industry average of 2.37x. This premium valuation reflects high growth expectations by investors.

Despite short-term price volatility, IREN Limited's strategic positioning at the intersection of cryptocurrency and AI infrastructure presents a unique investment opportunity. With secured power capacity, diversified revenue streams, and strong leadership, IREN is well-positioned to capitalize on the growing demand for high-performance computing infrastructure. For investors seeking exposure to both cryptocurrency and AI sectors, IREN offers a compelling entry point at current valuation levels. IREN stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 |

Cipher Rebrand Centers On HPC, Misses Views In Busy Crypto Earnings Week

MARA

Investor's Business Daily

|

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Crypto Industry Readies For Busy Earnings Week; Miner Sells Bitcoin Holdings

MARA

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite