|

|

|

|

|||||

|

|

The Kraft Heinz Company KHC posted second-quarter 2025 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. However, both metrics showed a year-over-year decline. Also, organic sales dipped year over year.

The company continues to focus on delivering high-quality, affordable and accessible products, supported by ongoing investments in product innovation and manufacturing capabilities. These efforts are enhancing brand and product appeal, reflecting the strength of its Brand Growth System and Go-To-Market model.

Looking ahead, Kraft Heinz expects to drive long-term profitable growth, supported by strong cash flow generation, disciplined management of its net leverage ratio and consistent capital returns to its shareholders — all contributing to solid financial flexibility.

Kraft Heinz Company price-consensus-eps-surprise-chart | Kraft Heinz Company Quote

Kraft Heinz posted adjusted earnings of 69 cents per share, beating the Zacks Consensus Estimate of 64 cents. However, quarterly earnings fell 11.5% year over year, mainly due to lower adjusted operating income and increased taxes on adjusted earnings. This was partially offset by fewer shares outstanding.

The company generated net sales of $6,352 million, down 1.9% year over year. The metric beat the Zacks Consensus Estimate of $6,286 million. Net sales include a slight 0.1 percentage point benefit from favorable foreign currency exchange rates. Organic net sales were down 2% year over year. Our model expected a 3.2% dip in organic sales.

Pricing rose by 0.7 percentage points across all reportable segments, primarily due to strategic price increases in certain categories — most notably coffee — to offset higher input costs. However, this was outweighed by a 2.7 percentage point decline in volume/mix, driven mainly by lower sales in North America and International Developed Markets. These declines were partially offset by volume/mix growth in Emerging Markets. The unfavorable volume/mix was mainly attributed to declines in cold cuts, coffee, Lunchables, frozen snacks and powdered beverages.

The adjusted gross profit of $2.17 billion decreased 5.6% from the $2.30 million reported in the year-ago quarter. The adjusted gross margin contracted 140 bps to 34.1%. We had expected an adjusted gross margin decline of 190 bps to 33.6%.

Adjusted operating income fell 7.5% year over year to $1.3 billion, primarily due to higher commodity cost inflation, which outweighed gains from efficiency initiatives and negatively impacted volume/mix. These pressures were partially offset by higher pricing, lower selling, general, and administrative expenses (mainly due to reduced advertising), and a modest 0.2 percentage point benefit from foreign currency exchange.

North America: Net sales of $4.76 billion declined 3.3% year over year. Organic sales fell 3.2%. We expected a 4.9% decline in segment organic sales. During the quarter, pricing moved up 0.2 percentage points, but the volume/mix fell 3.4 percentage points.

International Developed Markets: Net sales of $897 million were up 1.3% year over year. Organic sales declined 2.2%, with pricing moving up 0.7 percentage points and volume/mix dipping 2.9 percentage points, respectively.

Emerging Markets: Net sales of $698 million increased 4.2% year over year. Also, organic sales grew 7.6%. We expected 4.5% growth in segment organic sales. Pricing is up 5.2 percentage points and volume/mix is up 2.4 percentage points.

Kraft Heinz ended the quarter with cash and cash equivalents of $1.57 billion, long-term debt of $19.3 billion and total shareholders’ equity (excluding noncontrolling interest) of $41.4 billion. Net cash provided by operating activities was $1.93 billion for the six months ended June 28, 2025, and free cash flow was $1.5 billion.

During the year-to-date period, Kraft Heinz paid cash dividends worth $951 million and made share buybacks worth $435 million. As of June 28, 2025, the company had shares worth $1.5 billion remaining under its buyback plan.

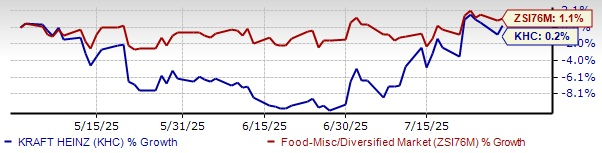

KHC Stock Past Three-Month Performance

For 2025, the company continues to expect organic net sales to decline between 1.5% and 3.5% year over year. Management anticipates organic sales to improve sequentially throughout the year, with pricing expected to contribute flat to slightly positive.

Constant currency adjusted operating income is forecasted to decline 5% to 10% year over year. This includes a 150-basis-point headwind from lapping lower variable compensation in 2024. Adjusted gross margin is expected to be at the lower end of down 25 basis points to down 75 basis points.

The company continues to project adjusted earnings per share in the range of $2.51 to $2.67.

Shares of this Zacks Rank #3 (Hold) company have gained 0.2% in the past three months compared with the industry’s growth of 1.1%.

We have highlighted three better-ranked stocks from the Consumer Staples sector, namely Post Holdings POST, Ingredion Incorporated INGR and Medifast, Inc. MED.

Post Holdings is a consumer packaged goods holding company. POST presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current sales and earnings indicates growth of 2.7% and 7.3%, respectively, from the year-ago period’s reported figures. POST delivered a trailing four-quarter earnings surprise of 22.9%, on average.

Ingredion Incorporated is an ingredient solutions provider specializing in nature-based sweeteners, starches and nutrition ingredients. It currently has a Zacks Rank of 2 (Buy).

INGR delivered a trailing four-quarter earnings surprise of 13.6%, on average. The consensus estimate for Ingredion Incorporated’s current financial-year sales and earnings indicates growth of 1% and 6.8%, respectively, from the year-ago period’s reported figures.

Medifast is a leading manufacturer and distributor of clinically proven healthy living products. It currently carries a Zacks Rank of 2. MED delivered a trailing four-quarter average earnings surprise of 142.2%.

The consensus estimate for MED’s current financial-year sales and earnings indicates a decline of 31.9% and 125.5%, respectively, from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite