|

|

|

|

|||||

|

|

DexCom, Inc. DXCM reported second-quarter 2025 adjusted earnings per share (EPS) of 48 cents, which beat the Zacks Consensus Estimate of 45 cents by 6.7%. The company reported earnings of 43 cents per share in the prior-year quarter.

DXCM registered GAAP net income per share of 45 cents, up from the year-ago quarter’s figure of 35 cents.

Total revenues grew 15.2% (15% on an organic basis) to $1.16 billion year over year. Sales beat the Zacks Consensus Estimate by 3.1%. The year-over-year revenue growth was driven by continued strong category demand, focused execution and a growing contribution from recent access wins, especially for type 2 diabetes.

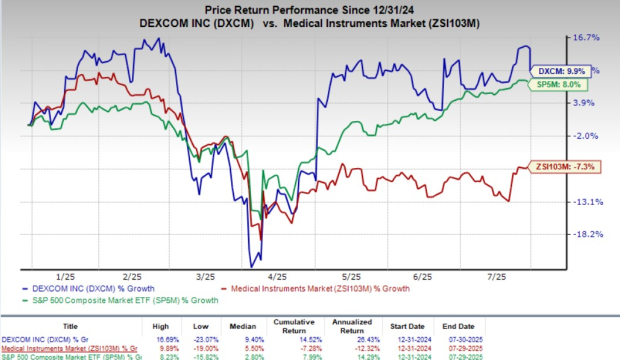

Despite better-than-expected results, shares of DXCM declined almost 5.5% during after-hours trading on July 30. The stock has gained 9.9% year to date against a 7.3% decline in the industry. The broader S&P 500 Index has moved up 8% in the same period.

Sensor and other revenues (97% of total revenues) increased 18% on a year-over-year basis to $1.12 billion. Hardware revenues (3%) decreased 31% year over year to $39.3 million.

U.S. revenues (73% of total revenues) increased 15% on a year-over-year basis to $841 million. International revenues (27%) improved 16% (14% on an organic basis) year over year to $316.1 million.

Adjusted gross profit totaled $695.9 million, up 9.1% from the prior-year quarter’s level. DexCom reported an adjusted gross margin (as a percentage of revenues) of 60.1%, down 340 basis points year over year.

Research and development expenses totaled $148.2 million, up 9% year over year. Selling, general, and administrative expenses totaled $328 million, down 1.4%.

The company reported total adjusted operating income of $221.8 million, up 13.5% from the prior-year period’s recorded number. Adjusted operating margin (as a percentage of revenues) was 19.2%, down 30 basis points year over year.

DXCM exited the second quarter with cash, cash equivalents, and marketable securities worth $2.93 billion compared with $2.7 billion in the first quarter of 2025.

Total assets amounted to $7.33 billion, up sequentially from $6.75 billion.

DexCom raised its outlook for 2025 revenues. The company now expects revenues to be in the range of $4.6-$4.625 billion (previously $4.6 billion), implying 14-15% year-over-year growth. The Zacks Consensus Estimate was pegged at $4.61 billion.

DXCM expects adjusted gross margin to be approximately 62%. Adjusted operating margin is projected to be approximately 21%.

DexCom, Inc. price-consensus-eps-surprise-chart | DexCom, Inc. Quote

DexCom delivered a solid second-quarter update, marked by double-digit top-line growth and a confident raise in full-year guidance, as it executes on broadening access to CGM and scaling its innovation engine.

Strong new customer additions on the back of expanded reimbursement for the fast-growing type 2 non-insulin population drove U.S. sales. Meanwhile, momentum in international markets was driven by key coverage wins such as Ontario’s Drug Benefit program in Canada and continued traction for the cost-effective DexCom ONE+ platform across Europe.

On the product front, DexCom is leveraging both hardware and software to to keep its business afloat amid rising competition. The upcoming 15-day G7 sensor, cleared by the FDA, is set to be launched in the second half of 2025, while development on the next-gen G8 platform is underway, promising smaller, multi-analyte-ready wearables. Meanwhile, over 400,000 downloads of DexCom’s new Stelo biosensor app highlight consumer adoption beyond diabetes, with integrations like Oura Ring enabling a more personalized health ecosystem.

DXCM’s new AI-powered Smart Food Logging feature for G7 and Stelo enables users to snap meal photos, automatically log details, and assess glycemic impact — enhancing personalization, improving dietary awareness and simplifying diabetes management.

Margins faced near-term pressure, with gross margin at 60.1% due to expedited logistics costs as inventory was being rebuilt. Still, DexCom reaffirmed its 2025 gross margin guidance of 62% and raised full-year revenue guidance.

Management also flagged a succession plan — current CEO Kevin Sayer will step down in early 2026, passing the reins to long-time executive Jake Leach. The transition comes as DexCom doubles down on expanding CGM access, scaling globally and integrating AI-driven features across its platforms.

While CMS’s proposed competitive bidding program for Medicare CGM could emerge as a future headwind, DexCom believes the 2027 start timeline and its differentiated clinical data give it a strong footing. The company’s CGM sensors are now covered by the three largest pharmacy benefit managers. With access opened to approximately 6 million new lives, DexCom sees this as the first step toward a 25 million-person opportunity. With ample cash reserves and a steadily growing base of prescribers and end-users, the company appears well-positioned to maintain leadership in a rapidly expanding CGM market.

DXCM carries a Zacks Rank #2 (Buy) at present.

Some other top-ranked stocks from the broader medical space that are expected to report earnings soon are Align Technology ALGN, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

The Zacks Consensus Estimate for Align Technology’s second-quarter 2025 adjusted EPS is currently pegged at $2.57. The consensus estimate for revenues is pegged at $1.06 billion. ALGN currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has an estimated long-term growth rate of 11.2%. However, ALGN’s earnings yield is 5.1% compared with the industry’s 5.4%.

Cardinal Health currently has a Zacks Rank #2. The Zacks Consensus Estimate for fourth-quarter fiscal 2025 adjusted EPS is currently pegged at $2.03 and the same for revenues is pinned at $60.67 billion.

Cardinal Health has an estimated long-term growth rate of 10.9%. CAH’s earnings yield of 5.7% compares favorably with the industry’s 5.5%.

Cencora currently carries a Zacks Rank #2. The Zacks Consensus Estimate for third-quarter fiscal 2025 adjusted EPS is currently pegged at $3.78 and the same for revenues is pinned at $80.33 billion.

Cencora has an estimated long-term growth rate of 12.8%. COR’s earnings yield of 5.4% compares favorably with the industry’s 4.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| 15 hours | |

| 18 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite