|

|

|

|

|||||

|

|

Super Micro Computer, Inc. SMCI is set to report its fourth-quarter fiscal 2025 results on Aug. 5.

For the fiscal fourth quarter, the company expects revenues between $5.6 billion and $6.4 billion. The Zacks Consensus Estimate is pegged at $5.99 billion, indicating growth of 12.76% from the year-ago quarter.

Super Micro Computer expects non-GAAP earnings per share between 40 cents and 50 cents. The Zacks Consensus Estimate for earnings is pegged at 44 cents per share, suggesting a decline of 30.2% from the year-ago reported figure. The figure has remained unchanged over the past 60 days.

SMCI’s earnings beat the Zacks Consensus Estimate twice in the trailing four quarters while missing once and matching the same on the other, delivering an average negative surprise of 5.72%.

Super Micro Computer, Inc. price-eps-surprise | Super Micro Computer, Inc. Quote

Our proven model does not conclusively predict an earnings beat for SMCI this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

SMCI has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell) at present. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Super Micro Computer’s fourth-quarter fiscal 2025 top line is likely to have benefited from the momentum in its direct liquid cooling (DLC) and server offerings, which have been experiencing robust traction from hyperscalers, high-performance computing and artificial intelligence (AI) customers.

Its new offerings, including Supermicro 4-Socket X14 Servers, data center building blocks solution (DCBBS), DLC-2, AMD Instinct MI350 series GPU-based Liquid-Cooled and Air-Cooled AI Solutions, and its collaboration with NVIDIA NVDA to deploy Blackwell-powered AI Factory Deployments, are likely to have boosted the server and storage system segment’s growth in the to-be-reported quarter.

Super Micro Computer’s strong foothold in the DLC space, where it holds approximately 70% of the market share, is likely to have provided stability to its top line in the to-be-reported quarter. Furthermore, as SMCI focuses on ramping up its production facilities in Malaysia, Taiwan, Europe, and the United States, it is likely to reflect positively in the fourth quarter of fiscal 2025 results.

However, SMCI’s perpetual contraction of margin due to a variety of reasons like unfavorable product and customer mix, competitive pricing to acquire more customers, cost rise due to DLC AI GPU cluster deployments and higher upfront costs associated with ramping up production for its DLC technology is a matter of concern for the investors in the to be reported quarter.

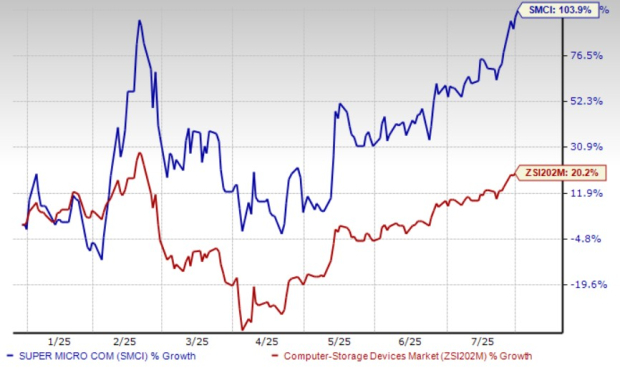

Super Micro Computer shares have gained 103.9% over the past year, outperforming the Zacks Computer – Storage Devices industry’s gain of 20.2%.

Now, let us look at the value Super Micro Computer offers to its investors at current levels. Currently, SMCI is trading at a premium with a forward 12-month price-to-earnings (P/E) of 23.71X compared with the industry’s 19.94X.

SMCI is emerging as a dominant force in AI infrastructure on the back of its liquid cooling technology, scalable manufacturing and broad AI product portfolio that is promising enough to drive sustained long-term growth. The latest announcement of ramping up the production of its latest AI data server solution that features NVIDIA’s Blackwell platform will boost Super Micro Computer’s revenue growth in the upcoming quarters.

SMCI has also enhanced its expertise in the scalable AI training and inference infrastructure space by leveraging Intel INTC Gaudi 3 accelerators and Advanced Micro Devices AMD-based accelerators to deliver performance for AI, high-performance computing and data-intensive workloads.

Super Micro has established a high reliability with the integration of AMD and Intel processors, which is likely to reflect in its fourth-quarter results. SMCI has integrated Intel’s built-in accelerator engines in SMCI’s X13 Systems. Super Micro Computer’s H14 Series servers use Advanced Micro Devices’ EPYC 9005 CPUs and its GPU-Accelerated Systems utilize Advanced Micro Devices’ Instinct MI325X GPUs.

However, Super Micro Computer’s financial performance is being affected by customers delaying their purchasing decisions. A pause in demand caused by customers choosing to wait for newer AI platforms, such as NVIDIA’s Blackwell, before placing orders is weighing on its top line. SMCI recorded a significant inventory write-down in the third quarter of fiscal 2025 tied to older-generation GPUs and components. This points to poor timing or over-forecasting of customer demand.

Although SMCI is emerging as a strong player in the AI infrastructure space with its revolutionary offerings, its shrinking margins and revenue slowdown are a matter of concern for investors. Considering these factors, we suggest that investors should stay away from SMCI stock at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 min | |

| 37 min | |

| 52 min |

Asian shares are mixed after Nvidia's losses pull Wall St lower, as AI-linked layoffs rattle markets

NVDA

Associated Press Finance

|

| 1 hour | |

| 1 hour | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Dow Jones Futures Fall As AI Fears Revive; Block, Netflix, Applied Opto Jump

AMD

Investor's Business Daily

|

| Feb-26 |

Dow Jones Futures Fall; Nvidia Hits AI Stocks, But S&P 500 Holds Key Support

NVDA -5.46% AMD

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite