|

|

|

|

|||||

|

|

Zacks Rank #3 (Hold) stock Uber Technologies (UBER) and Zacks Rank #4 (Sell) stock Lyft (LYFT) dominate the American rideshare market. Together, UBER and LYFT have become ubiquitous with ride-sharing, with customers often using ‘Uber’ or ‘Lyft’ as a verb. Currently, Uber dominates the ride-share market, owning roughly three quarters of the ride-share market, and has expanded into the food delivery business (Uber Eats) to compete with DoorDash (DASH). Meanwhile, Lyft mainly focuses on ridesharing but has expanded into bike and scooter rentals.

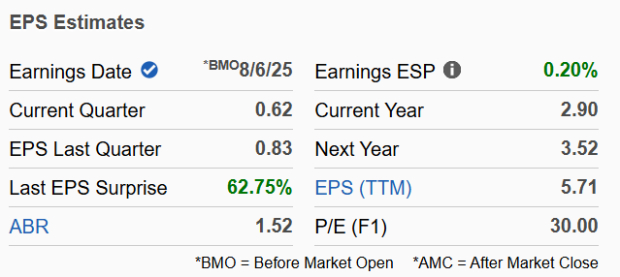

UBER EPS Info:

UBER Earnings Date: UBER will report earnings on Wednesday, August 6th, before the market opens.

· Earnings Per Share (EPS):The Zacks Consensus Estimate for EPS is set at $0.62, which would represent a significant increase of over 31% compared to the $0.47 reported in the same quarter last year.

· Revenue:Analysts are forecasting revenue of approximately $12.46 billion, suggesting a year-over-year increase of over 16% from the $10.7 billion in Q2 2024.

· Gross Bookings:The company's own guidance for the quarter projects Gross Bookings in the range of $45.75 billion to $47.25 billion, which would indicate a strong growth of 16-20% on a constant-currency basis.

· Implied Earnings Move (based on options): +/- 7.8%

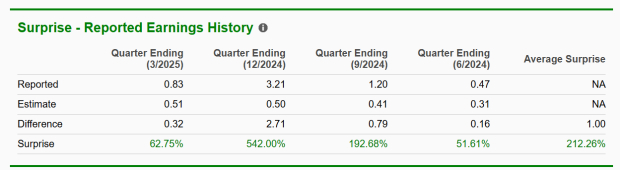

· UBER Earnings Surprise History:Uber has surpassed Zacks Consensus Analyst Estimates in four of the past five quarters. Over the past four quarters, UBER has gained momentum and has smashed Wall Street estimates by an average of 212.26%.

· LYFT Earnings Date: Lyft will report earnings after the market close on Wednesday, August 6th.

· Earnings Per Share (EPS): Zacks Consensus Estimates predict EPS of $0.27. This compares favorably to the $0.03 reported in the same quarter last year. Wall Street’s wide range of estimates suggests a variety of opinions on the company's profitability.

· Revenue:The consensus revenue forecast is approximately $1.61 billion. If achieved, this would represent a notable year-over-year increase from the $1.44 billion reported in Q2 2024.

· Implied Earnings Move (based on options): +/- 14.2%

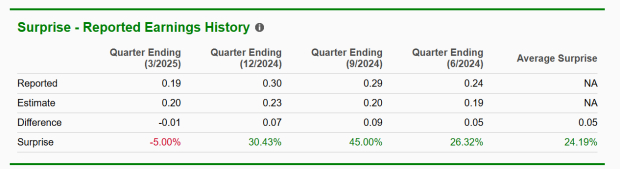

· LYFT Earnings Surprise History: LYFT has beaten Zacks Consensus Analyst Estimates in eight of the past nine quarters. Over the past four quarters, LYFT has beat estimates by an average of 24.19%.

UBER has performed far better than LYFT in 2025, gaining 44.1% compared to LYFT’s 5.6%.

The robotaxi revolution is here, with Alphabet’s (GOOGL) ‘Waymo’ already operating its fully autonomous ride-hailing services in five cities. Meanwhile, Tesla (TSLA) has launched a limited robotaxi rollout in Austin, Texas, with plans to extend it to the Bay Area and possibly Arizona. Depending on who you ask, robotaxis are either a threat or an opportunity for the two ride-sharing incumbents.

Uber Robotaxi Plan: Rather than building the robotaxis themselves, Uber is forging partnerships with robotaxi leaders like Waymo and Baidu (BIDU). Additionally, Uber has inked partnerships with Lucid (LCID) and Nuro to deploy 20,0000 new robotaxis by 2032. Finally, Uber has a partnership with Serve (SERV), using its small autonomous robots to deliver food for its Uber Eats service.

Lyft Robotaxi Plan: Like Uber,Lyft is going for an ‘asset light’ model to save money on building its own robotaxis. Lyft has a partnership with Mobileye (MBLY) to provide autonomous ride-hailing services.

Other things to watch:

A primary driver for Lyft will be to see if the company can maintain the profitability achieved in Q1 with its ‘growth with discipline’ strategy. Additionally, investors will want to know how the company’s European expansion is going thus far. Given UBER’s more aggressive approach in the robotaxi market, the primary focus will be on how the robotaxi revolution is impacting the business.

Bottom Line

Uber and Lyft will each report earnings this week. Investors will be focused on how each company is navigating the emergence of robotaxi vehicles.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Apple To Hold Product Event On March 4. Cheaper iPhone Seen But No AI Siri

GOOGL

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite