|

|

|

|

|||||

|

|

Novo Nordisk NVO is scheduled to report its second-quarter 2025 results before the opening bell on Aug. 6, 2025. The Zacks Consensus Estimate for quarterly revenues in the to-be-reported quarter is pegged at $11.79 billion, while the same for earnings is pinned at 93 cents per share.

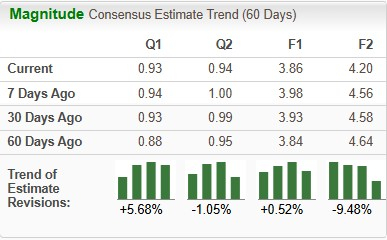

In the past 60 days, the Zacks Consensus Estimate for Novo Nordisk’s 2025 earnings per share (EPS) improved from $3.84 to $3.86. During the same time frame, the company’s 2026 EPS forecast has dropped from $4.64 to $4.20.

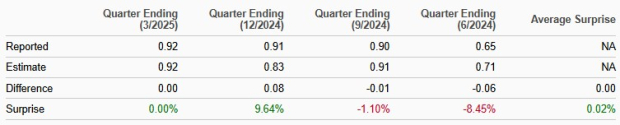

Novo Nordisk’s performance has been mixed over the trailing four quarters, with earnings beating estimates in one quarter, matching once and missing the mark on the remaining two occasions. On average, Novo Nordisk registered an earnings surprise of 0.02% in the trailing four quarters. In the last reported quarter, the company reported EPS that matched estimates.

Novo Nordisk has an Earnings ESP of +0.22% and a Zacks Rank #4 (Sell) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Per our proven model, companies with the combination of a positive Earnings ESP and a Zacks Rank #1, #2 (Buy) or #3 (Hold) have a good chance of delivering an earnings beat, which is not the case for NVO. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Novo Nordisk operates under two segments — Diabetes and Obesity Care and Rare disease.

Novo Nordisk reported preliminary earnings per American Depositary Receipt of 91 cents (DKK 5.96) for the second quarter of 2025. During the same period, the company’s sales increased 18% at constant exchange rate (CER). On the other hand, operating profit increased 40% at CER in the second quarter of 2025, primarily driven by the ocedurenone impairment charge recognized in the year-ago period.

Novo Nordisk’s revenues are expected to have been driven by the sale of its diabetes and obesity treatments, particularly semaglutide-based drugs — Wegovy, Ozempic, and Rybelsus. Wegovy is the largest contributor to the company’s top line. Its label has also been expanded for cardiovascular benefits in the United States and the EU. Ozempic and Rybelsus sales are also likely to have contributed meaningfully, along with solid insulin product sales. Additionally, the Rare Disease segment is expected to have generated incremental revenues for the company.

Novo Nordisk shares tumbled last week after the company slashed its 2025 guidance for both sales and operating profit growth. It now expects sales to increase 8-14%, down from the previous 13-21% range, and operating profit to grow 10-16% compared to the earlier 16-24% estimate. The revision reflects weaker-than-anticipated momentum for key drugs Wegovy and Ozempic, particularly in the U.S. market, where Wegovy is struggling with the continued use of unregulated, compounded GLP-1 alternatives. Despite the FDA ending its compounding grace period in May 2025, illegal semaglutide sales persist under the guise of “personalized medicine,” prompting NVO to take legal and regulatory action.

The company also cited slower-than-expected Wegovy uptake across both insured and cash-pay channels, limited by modest market expansion and growing competition. While efforts through NovoCare and telehealth have spurred some growth, overall adoption remains below expectations. Ozempic is similarly seeing increased competitive pressure in the U.S. diabetes market. International Wegovy rollouts are underway, but demand in certain regions has been slower than projected. On the profit front, Novo Nordisk’s lower operating profit outlook is tied to reduced sales expectations, though partially cushioned by cost controls. The updated forecast also reflects a mid-single-digit drag from its acquisition of three Catalent manufacturing sites.

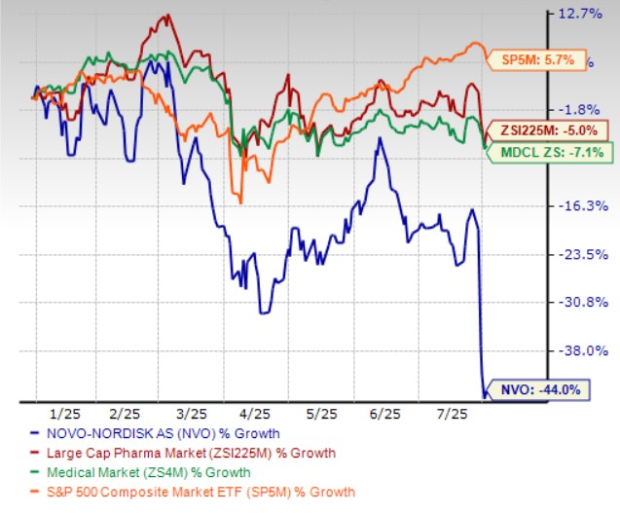

Year to date, Novo Nordisk shares have lost 44% compared with the industry’s 5% decline. The company has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

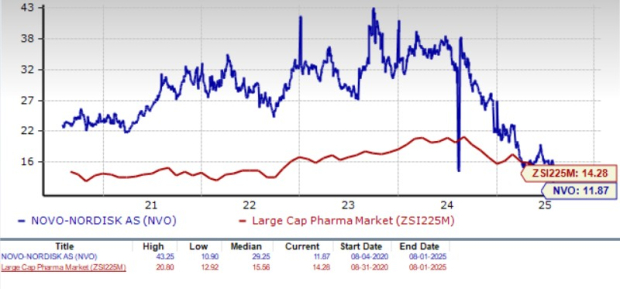

Novo Nordisk is trading at a discount to the industry, as seen in the chart below. Going by the price/earnings ratio, the company’s shares currently trade at 11.87 forward earnings, which is lower than 14.28 for the industry. The stock is also trading much below its five-year mean of 29.25.

Novo Nordisk’s stock decline in 2025 has been driven by a mix of regulatory setbacks, underwhelming pipeline results, and rising competitive pressure. The company reported weaker-than-expected data from two late-stage studies of CagriSema, its next-generation obesity drug, dampening hopes for a strong follow-up to Wegovy. In addition, Medicare’s refusal to cover weight-loss drugs like Wegovy — since obesity is not classified as a disease — has raised concerns over patient access. The situation is further complicated by an ongoing leadership change, with CEO Lars Fruergaard Jørgensen stepping down amid market headwinds and stock underperformance.

Moreover, Novo Nordisk faces intense competition from its arch-rival Eli Lilly LLY in the diabetes and obesity care market. LLY markets its tirzepatide injections as Mounjaro for type II diabetes (T2D) and Zepbound for obesity. Despite being on the market for less than three years, Lilly’s Mounjaro and Zepbound have witnessed strong sales driven by rapid demand. Zepbound had earlier outperformed Novo Nordisk’s Wegovy (20.2% compared with 13.7%, respectively) in a weight-loss head-to-head study. This could lead to a shift in patient preference from Wegovy to Zepbound, potentially resulting in a loss of market share. Lilly has also been taking significant strides in the development of oral therapies for obesity, effectively putting pressure on Novo Nordisk. In April 2025, LLY reported first phase III success for its oral GLP-1 candidate, orforglipron, in lowering blood glucose and promoting weight loss in T2D patients. Oral pills could boost adherence over injections.

Several other companies like Amgen AMGN and Viking Therapeutics VKTX are also making rapid progress in the development of GLP-1-based candidates in their clinical pipeline. Amgen has begun a broad phase III program on its dual GIPR/GLP-1 receptor agonist, MariTide, across obesity, obesity-related conditions and T2D, with the first two phase III studies initiated in March. Viking Therapeutics started two late-stage studies evaluating the subcutaneous formulation of its investigational obesity drug, VK2735. A mid-stage study is currently ongoing, evaluating an oral version of this obesity drug, with a data readout expected later this year.

Additionally, NVO recently ended its collaboration agreement with Hims & Hers Health, which will temporarily hurt its objective of increasing Wegovy’s patient access, resulting in a slowdown in obesity market share gain. Furthermore, the presence of compounded versions of Wegovy in NVO's largest obesity market, the United States, is weighing in on the sales potential of the drug, eating away at its revenues.

Despite recent setbacks, Novo Nordisk is making steady progress across its pipeline. The company is advancing new candidates for T2D and obesity, while also working to expand the approved uses of Wegovy, Ozempic and Rybelsus to drive further growth. Efforts to develop next-generation obesity drugs could help diversify its portfolio. Beyond metabolic diseases, NVO is also building out its rare disease segment, with late-stage progress on Mim8 for hemophilia A and recent FDA approval of a broader label for its Alhemo injection for hemophilia A or B with/without inhibitors, further strengthening its position in the hemophilia space.

Amid growing challenges, we believe investors might want to reduce their exposure to Novo Nordisk, regardless of how its second-quarter results turn out. While the company is still seeing solid demand and revenue growth from its semaglutide-based drugs, it recently cut its 2025 sales and profit forecast due to slowing momentum in key markets. In the United States, sales of Wegovy and Ozempic are being hurt by the continued use of compounded versions, even after FDA restrictions. At the same time, rival Eli Lilly is gaining ground with its competing drugs, Zepbound and Mounjaro, which have shown stronger clinical results and are quickly gaining market share, putting pressure on Novo Nordisk’s core business.

Adding to the headwinds, the stock has underperformed significantly in 2025 and now trades at a steep discount to both its historical average and the broader industry. Disappointing data from CagriSema studies and a major CEO transition amid a turbulent period have further shaken investor confidence. While the long-term potential in obesity and rare diseases remains, heightened volatility, pipeline disappointments, legal and regulatory challenges, and a crowded GLP-1 development landscape suggest that the near-term risk/reward profile is skewed to the downside. These factors may prompt risk-averse investors to consider exiting their position or limiting exposure until clearer visibility emerges.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite