|

|

|

|

|||||

|

|

Molson Coors Beverage Company TAP is expected to register top and bottom-line declines when it reports second-quarter 2025 earnings on Aug. 5, before market open. The Zacks Consensus Estimate for revenues is pegged at $3.1 billion, indicating a 3.8% decline from the prior-year reported figure. The consensus mark for earnings has moved down by a penny in the past seven days to $1.83 per share, indicating a drop of 4.7% from the year-ago reported figure.

In the last reported quarter, this leading alcohol company delivered a negative earnings surprise of 37.5% It has a trailing four-quarter earnings surprise of 0.2%, on average.

Our proven model does not conclusively predict an earnings beat for Molson Coors this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

TAP currently has a Zacks Rank #5 (Strong Sell) and an Earnings ESP of +1.27%.

Molson Coors’ Americas business, which comprises operations in the United States and Canada, has been reeling under the pressures of the tough macroeconomic conditions in the United States. This has significantly impacted the U.S. beer industry and the company’s U.S. financial and brand volumes. The broader industry weakness, the loss of contract brewing volume from Pabst and Labatt, and a difficult comparison to the prior year, which had been bolstered by inventory builds ahead of a brewery strike, are expected to have hurt performance in the second quarter of 2025.

Macroeconomic headwinds, subdued consumer demand and the exit from low-margin contract brewing arrangements have been hurting the company’s performance. Challenges, including inflationary pressures on raw materials and manufacturing costs, as well as an unfavorable product mix, are expected to have weighed on the results in the to-be-reported quarter.

On the last reported quarter’s earnings call, management noted that the global macro landscape is evolving fast, leading to uncertainty. Management expects the impacts of the global macroeconomic landscape on the beer industry and consumer trends in the quarters ahead. The company has reviewed some factors, including the direct cost impacts of tariffs, the indirect impacts of multi-faceted trends and inherent uncertainties. These factors are expected to have collectively weighed on the top and bottom lines in the second quarter.

Molson Coors Beverage Company price-eps-surprise | Molson Coors Beverage Company Quote

However, Molson Coors’ Acceleration Plan has supported market share gains through innovation and premiumization. Strategic investments in core brands and expansion efforts are likely to have cushioned performance in the to-be-reported quarter. TAP’s revitalization plan, focused on streamlining operations and reinvesting in brands, has driven sustainable growth. Investments in iconic brands and the above-premium beer segment, alongside expansion into adjacent markets, are expected to have positively impacted its performance.

TAP has enhanced digital capabilities across commercial, supply chain and workforce functions while expanding brewing and packaging operations in the U.K., driven by the success of its Madri brand.

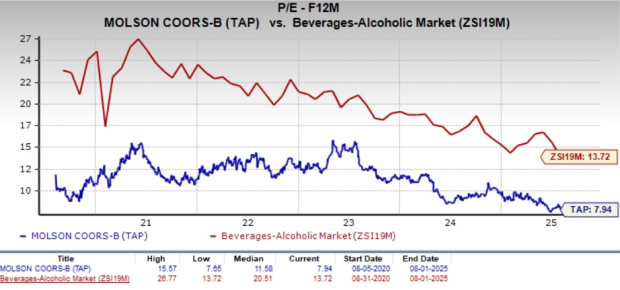

From a valuation perspective, Molson Coors offers an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 7.94X, which is below the five-year high of 15.57X and the Beverages - Alcohol industry’s average of 13.72X, the stock offers compelling value for investors seeking exposure to the sector.

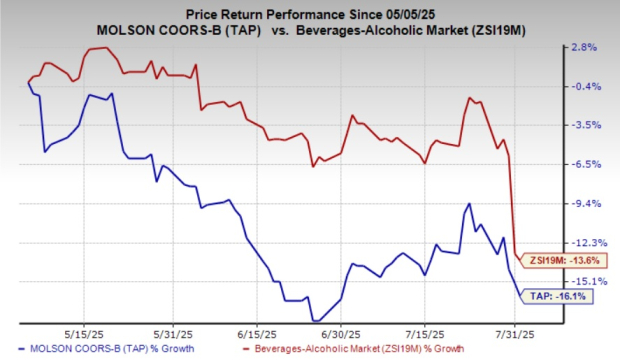

The recent market movements show that TAP shares have lost 16.1% in the past three months compared with the industry's 13.6% decline.

Here are three companies, which, per our model, have the right combination of elements to post an earnings beat this reporting cycle:

Corteva CTVA currently has an Earnings ESP of +2.11% and a Zacks Rank of 3. The Zacks Consensus Estimate for second-quarter 2025 earnings per share (EPS) is pegged at $1.89, which implies a 3.3% year-over-year growth. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Corteva’s quarterly revenues is pegged at $6.2 billion, which indicates growth of 1.9% from the figure reported in the prior-year quarter. CTVA has a trailing four-quarter negative earnings surprise of 7.2%, on average.

Ollie's Bargain Outlet Holdings, Inc. OLLI presently has an Earnings ESP of +4.73% and a Zacks Rank of 3. The Zacks Consensus Estimate for second-quarter fiscal 2025 EPS is pegged at 91 cents, which implies 16.7% year-over-year growth.

The consensus mark for Ollie's Bargain’s quarterly revenues is pegged at $657.8 million, which indicates growth of 13.7% from the figure reported in the prior-year quarter. OLLI delivered a trailing four-quarter earnings surprise of 2%, on average.

Keurig Dr Pepper Inc. KDP currently has an Earnings ESP of +0.09% and a Zacks Rank of 3. The consensus estimate for Keurig’s quarterly revenues is pegged at $4.2 billion, which indicates growth of 6.9% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for second-quarter 2025 EPS is pegged at 54 cents, which implies 5.9% year-over-year growth. KDP delivered a trailing four-quarter earnings surprise of 3.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 28 min | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite