|

|

|

|

|||||

|

|

Novo Nordisk A/S NVO reported second-quarter 2025 earnings of 97 cents per American Depositary Receipt (ADR), which beat the Zacks Consensus Estimate of 93 cents. The company had reported earnings of 65 cents per ADR in the year-ago quarter.

Revenues of $11.68 billion increased 13% year over year in the Danish kroner (DKK) and 18% at the constant exchange rate (CER) in the reported quarter, driven by higher Diabetes and Obesity Care sales as GLP-1 product sales increased year over year, along with greater Rare disease sales. However, total revenues missed the Zacks Consensus Estimate of $11.79 billion.

All growth rates mentioned below are on a year-over-year basis and at CER.

Novo Nordisk operates under two segments: Diabetes and Obesity Care, and Rare disease.

The Diabetes and Obesity Care segment reported sales of DKK 71.94 billion in the quarter under review, representing a 17% increase. In Diabetes Care, fast-acting insulin Fiasp’s revenues were down 5%. NovoRapid revenues increased 26% and Human insulin revenues decreased 26%. Premix insulin (Ryzodeg and NovoMix) revenues rose 11%. Sales of long-acting insulins (Tresiba, Xultophy, Levemir and Awiqli) decreased 2% in the second quarter.

Ozempic, which has witnessed a strong launch and solid uptake so far, recorded sales of DKK 31.8 billion for the quarter, up 15%. Rybelsus recorded sales of DKK 5.65 billion for the quarter, down 1%. Victoza sales declined 57% during the reported quarter.

Obesity Care (Saxenda and Wegovy) sales were up 53% to DKK 20.37 billion. Wegovy’s sales growth rate continues to slow, with second-quarter sales reaching DKK 19.53 billion, up 75%, as growth was impacted by the availability of illegal compounded versions in Novo Nordisk’s largest obesity market, the United States.

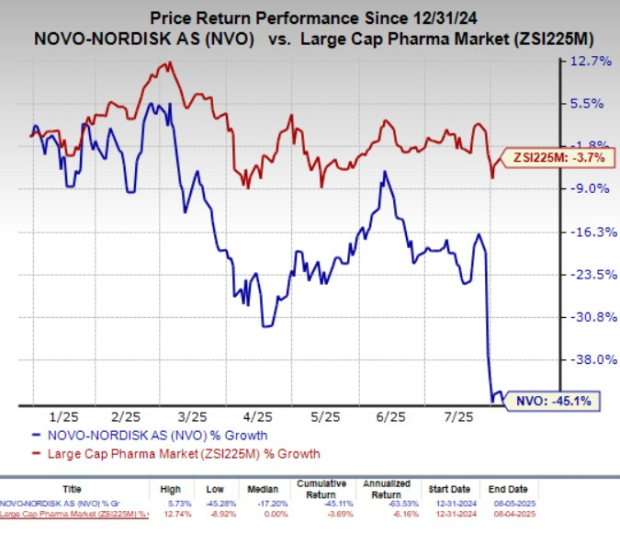

Year to date, shares of NVO have plunged 45.1% compared with the industry’s 3.7% decline.

Sales in the Rare disease segment were up 28% to DKK 4.92 billion in the second quarter of 2025. Sales of rare blood disorder products were DKK 3.1 billion, up 13%. Sales of hemophilia A products declined 1%. Hemophilia B products’ sales declined 4%. Sales of NovoSeven increased 16% to DKK 2 billion. Sales of Novo Nordisk’s rare endocrine disorder products jumped 100% to DKK 1.42 billion.

Sales and distribution costs climbed 19% in the reported quarter to DKK 17.53 billion. This increase was due to promotional activities related to Wegovy in the United States. In International Operations, costs related to the Wegovy launch and promotional activities for Ozempic contributed to the increase.

Research and development (R&D) costs were down 26% to DKK 11.69 billion. The decrease was primarily attributed to a DKK 5.7 billion impairment loss related to ocedurenone and other intangible asset impairments recorded in the year-ago period, partially offset by increased investment in late-stage clinical studies and research activities, mainly within the Obesity Care segment.

Novo Nordisk already announced slashing its 2025 guidance for both sales and operating profit growth last week, following which its shares tumbled. It now expects sales to increase 8-14%, down from the previous 13-21% range, and operating profit to grow 10-16% compared to the earlier 16-24% estimate, all at CER.

The revision reflects weaker-than-anticipated momentum for key drugs Wegovy and Ozempic, particularly in the U.S. market, where Wegovy is struggling with the continued use of unregulated, compounded GLP-1 alternatives. Despite the FDA ending its compounding grace period in May 2025, illegal semaglutide sales persist under the guise of “personalized medicine,” prompting NVO to take legal and regulatory action.

The company also cited slower-than-expected Wegovy uptake across both insured and cash-pay channels, limited by modest market expansion and growing competition. While efforts through NovoCare and telehealth have spurred some growth, overall adoption remains below expectations. Ozempic is similarly seeing increased competitive pressure in the U.S. diabetes market. International Wegovy rollouts are underway, but demand in certain regions has been slower than projected. On the profit front, Novo Nordisk’s lower operating profit outlook is tied to reduced sales expectations, though partially cushioned by cost controls. The updated forecast also reflects a mid-single-digit drag from its acquisition of three Catalent manufacturing sites.

Novo Nordisk’s global diabetes value market share declined 1.4% over the past year to 32.6% due to increased competition from arch-rival Eli Lilly LLY, which markets its tirzepatide medicines as Mounjaro for diabetes and Zepbound for obesity. Despite being on the market for less than three years, Lilly’s Mounjaro and Zepbound have witnessed strong sales driven by rapid demand. LLY is scheduled to report second-quarter results on Aug. 7, before the opening bell. However, Novo Nordisk remains focused on reinforcing its leadership in diabetes care, targeting a global market share of over one-third by 2025.

Novo Nordisk reported weaker-than-expected second-quarter revenues. Despite year-over-year increases in the sales of its Diabetes and Obesity Care and Rare disease products, the company’s total revenues fell short of expectations, primarily due to a slowdown in sales of its flagship GLP-1 obesity drug, Wegovy, amid increased availability of compounded alternatives.

Novo Nordisk is eyeing a comeback on the back of expanded indications of its semaglutide drugs as well as good pipeline progress with several other new candidates for diabetes and obesity. These are part of the company’s efforts to tackle increasing competition from Eli Lilly, especially in the U.S. market. The FDA is currently reviewing Novo Nordisk’s application for a 25 mg oral Wegovy for obesity, with a decision expected by year-end. A positive outcome should boost Novo Nordisk’s revenues as no other oral GLP-1 treatments for obesity are currently on the market. Oral pills, being more convenient than injectables, tend to boost patient adherence.

Another filing seeking approval for Wegovy to treat metabolic dysfunction-associated steatohepatitis is also currently under FDA review. NVO has also filed Rybelsus for cardiac event prevention in diabetes. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU. Beyond metabolic diseases, NVO is also building out its rare disease segment, with late-stage progress on Mim8 for hemophilia A and recent FDA approval of a broader label for its Alhemo injection for hemophilia A or B with/without inhibitors, further strengthening its position in the hemophilia space.

Novo Nordisk remains optimistic about an increase in volume of Wegovy sales in the second half of 2025 through initiatives like NovoCare Pharmacy and CVS’ exclusive formulary coverage, effective 1 July 2025, where the drug is now the only GLP-1 medicine covered for obesity.

Novo Nordisk A/S price-consensus-eps-surprise-chart | Novo Nordisk A/S Quote

Novo Nordisk currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector are Arvinas ARVN and Immunocore IMCR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Arvinas’ 2025 loss per share have narrowed from $1.51 to $1.50. Loss per share estimates for 2026 have narrowed from $3.08 to $2.98 during the same period. ARVN stock has plunged 60.3% year to date.

Arvinas’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 82.09%.

In the past 60 days, estimates for Immunocore’s 2025 loss per share have narrowed from 86 cents to 68 cents. Loss per share estimates for 2026 have narrowed from $1.34 to $1.10 during the same period. IMCR stock has increased 10.2% year to date.

Immunocore’s earnings beat estimates in three of the trailing four quarters while missing the same on the remaining occasion, the average surprise being 76.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 hours | |

| 18 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite