|

|

|

|

|||||

|

|

McKesson Corporation MCK reported first-quarter fiscal 2026 adjusted earnings per share (EPS) of $8.26, which beat the Zacks Consensus Estimate of $8.23 by 0.4%. The bottom line improved 4.8% on a year-over-year basis. The EPS growth was driven by strong operational growth across the business, partially offset by a higher tax rate. The company also recorded a pre-tax gain of $110 million in the first quarter of fiscal 2025, which was absent this year.

GAAP EPS was $6.25, down 10.7% from the year-ago quarter’s level due to a pre-tax increase to the provision for bad debts of $189 million within the U.S. Pharmaceutical segment related to the Rite Aid bankruptcy.

Revenues of $97.83 billion beat the Zacks Consensus Estimate by 1.8%. The top line surged 23.4% year over year, primarily driven by increased prescription volumes from retail national account customers and growth in the distribution of oncology and specialty products, including contributions from acquisitions.

Higher contributions from the Prescription Technology Solutions and Medical-Surgical Solutions segments also aided the top line. International markets recorded improving sales.

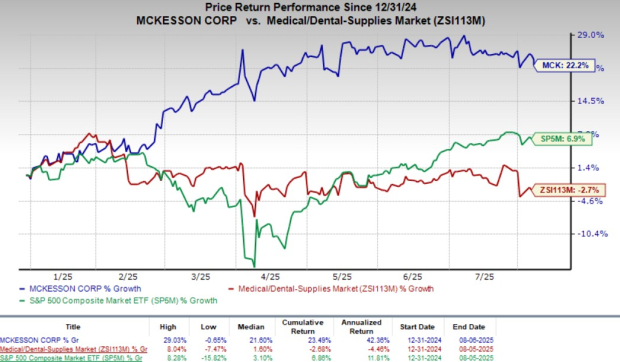

Shares of MCK were down 1.5% during after-hours trading on Aug. 6. The company’s shares have gained 22.2% year to date against the industry’s 2.7% decline. The S&P 500 Index has increased 6.9% in the same time frame.

Revenues from the U.S. Pharmaceutical segment totaled $89.95 billion, up 25% year over year. Per management, the upside was primarily driven by increased prescription volumes, including higher volumes from retail national account customers and specialty products, and growth in the oncology platform. Additional contributions from acquisitions also aided segmental sales.

The U.S. Pharmaceutical and Specialty Solutions segment reported an adjusted operating profit of $950 million, up 17% from the prior-year quarter’s level. This was due to growth in the distribution of specialty products to providers and health systems, as well as higher volumes from retail national account customers.

Revenues from the International segment amounted to $3.74 billion, up 1% year over year. This growth was led by higher pharmaceutical distribution volumes in the Canadian business, partially offset by the divestiture of the Canada-based Rexall and Well.ca retail businesses.

Adjusted operating profit at the segment totaled $99 million, down 3% from the year-ago reported figure.

Revenues from the Medical-Surgical Solutions segment totaled $2.7 billion, up 2% year over year. Sales were driven by higher volumes of specialty pharmaceuticals.

The Medical-Surgical segment reported an adjusted operating profit of $244 million, up 22% year over year. This was driven by operational efficiencies from the cost optimization initiatives.

Along with the earnings release, McKesson announced its plan to separate the Medical-Surgical Solutions segment into an independent company. This will enhance the strategic opportunity and operational focus of the new company and the remaining businesses of McKesson.

Revenues from the Prescription Technology Solutions segment totaled $1.43 billion, up 16% year over year. This uptick was due to growth in the technology services business and higher contributions from the third-party logistics businesses.

The segment reported an adjusted operating profit of $269 million, up 21% year over year, driven by growth in affordability and access solutions.

Adjusted gross profit in the reported quarter was $3.26 billion, up 6.7% on a year-over-year basis. The figure represented 3.3% of net revenues, down nearly 60 basis points (bps) year over year.

The company reported an adjusted operating income of $1.56 billion, up 16.6% from the year-ago quarter’s figure, primarily due to lower selling, general & administrative expenses. Operating margin was 1.6%, contracting 10 bps year over year.

Cash and cash equivalents totaled $2.42 billion compared with $5.69 billion during the fourth quarter of fiscal 2025.

Cumulative net cash used in operating activities amounted to $918 million compared with $1.38 billion in the year-earlier period.

McKesson Corporation price-consensus-eps-surprise-chart | McKesson Corporation Quote

McKesson raised its EPS guidance to $37.10-$37.90 from $36.90-$37.70 for fiscal 2026. The company did not provide a total and segmental sales outlook amid its potential spin-off of the surgical business. It cannot reasonably forecast LIFO inventory-related adjustments, certain litigation loss and gain contingencies, restructuring, impairment and related charges, and other adjustments.

McKesson exited the first quarter of fiscal 2026 on a strong note, with earnings and revenues beating estimates, driven by continued execution across its oncology, biopharma services and core pharmaceutical distribution businesses. Two strategic acquisitions — PRISM Vision in ophthalmology and Core Ventures via Florida Cancer Specialists — expand MCK’s multi-specialty platform and reinforce its ambitions in high-growth, high-value therapeutic areas. These deals enhance its provider network and data capabilities, supporting future value creation.

Biopharma services, particularly the Prescription Technology Solutions (RxTS) segment, continue to perform well. Growth in access and affordability solutions, especially in prior authorizations for GLP-1 medications, helped drive double-digit revenue and profit growth. With a connected network spanning 50,000 pharmacies and nearly a million providers, RxTS is well-positioned to benefit from rising demand in drug access solutions.

In distribution, specialty pharmaceutical demand and solid utilization trends remain key tailwinds. Investments in automation, including robotics and cold chain capabilities, have improved operational leverage and positioned the company to meet evolving supply-chain requirements. Meanwhile, the planned spinoff of the Medical-Surgical segment and the exit from Norway completes the company’s portfolio streamlining efforts in Europe.

These strategic and operational advancements underscore McKesson’s evolution into a diversified, tech-enabled healthcare services leader, positioning it well for sustained, profitable growth. The upcoming Investor Day in September is expected to provide further clarity on long-term capital deployment and growth priorities.

McKesson currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

Medpace Holdings, sporting a Zacks Rank #1 (Strong Buy) at present, reported second-quarter 2025 EPS of $3.10, which beat the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, which beat the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.5%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, which beat the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2 (Buy).

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite