|

|

|

|

|||||

|

|

AngloGold Ashanti PLC AU shares have gained 26% since it reported its second-quarter 2025 results on Aug. 1. AU reported year-over-year improvement in both its top and bottom lines. While revenues beat the Zacks Consensus Estimate, earnings fell short of expectations on higher costs.

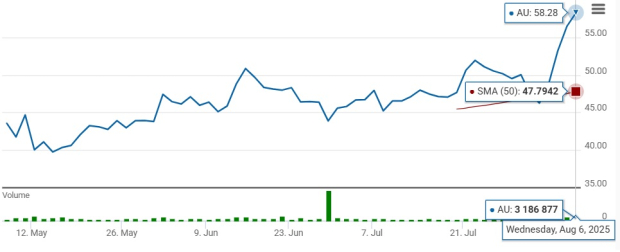

The stock broke above its 50-day simple moving average (SMA) on Aug. 1, indicating a potential short-term bullish trend.

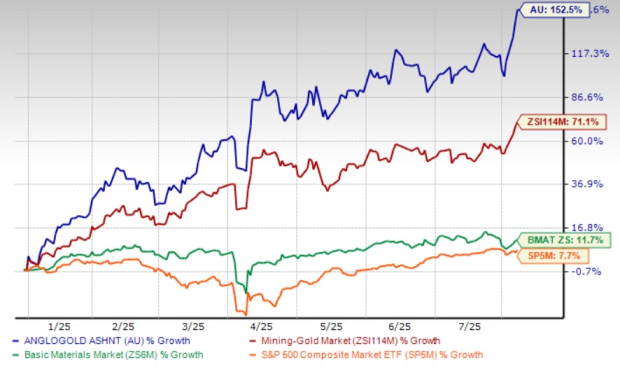

AngloGold Ashanti’s stock has skyrocketed 152.5% year to date, outperforming the Zacks Mining – Gold industry’s 71.1% growth. During this time, the Basic Materials sector has risen 11.7% and the S&P 500 has rallied 7.7%.

AngloGold Ashanti has also outpaced peers like Newmont Corporation NEM, Agnico Eagle Mines AEM and Barrick Mining Corporation B, which have advanced 82.5%, 73.2% and 46.7%, respectively, so far this year.

Is this the right time to buy AU shares to gain from the potential upside? Let us delve deeper into its second-quarter results and evaluate the stock’s fundamentals to find out.

AngloGold Ashanti reported a 21% year-over-year increase in gold production to 804,000 ounces, boosted by the recent acquisition of the Sukari mine and stronger output at Obuasi, Geita, Cerro Vanguardia, Cuiabá and Siguiri.

Gold revenues were up 78% to $2.4 billion and earnings per share increased 108% to $1.25 due to higher sales volumes and prices.

However, these gains were partially offset by higher total operating costs, including increased royalty expenses and costs associated with the initial inclusion of Sukari, elevated costs related to legacy TSFs and higher costs relating to mining contractor rate adjustments.

Total cash costs per ounce for the group were up 8% to $1,226. All-in-sustaining costs (AISC) per ounce increased 7% to $1,666.

For managed operations, total cash costs rose 6% year over year to $1,241 per ounce while AISC rose 4% to $1,694 per ounce.

These increases were driven primarily by a 28% increase in sustaining capital expenditure, inflationary cost pressures of approximately 5% and a $60 per ounce average increase in the overall royalty charge linked to the higher gold price. These factors were partly offset by higher gold sales volumes.

The company generated $535 million in free cash flow in the second quarter, a 149% year-over-year increase. It has managed to lower its adjusted net debt by 92% year over year to $92 million at the second-quarter end. The adjusted net debt to adjusted EBITDA ratio improved to 0.02X in the second quarter from 0.62X in the year-ago quarter. AngloGold Ashanti ended the quarter with $3.4 billion in liquidity, including cash and cash equivalents of $2 billion.

Gold production for 2025 is projected at 2.9-3.225 million ounces. This suggests year-over-year growth of 9-21%. For 2026, the company expects similar output levels to those in 2025.

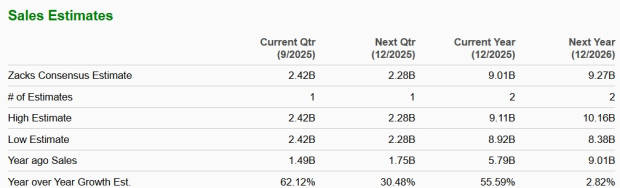

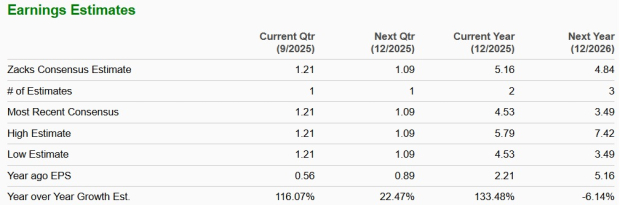

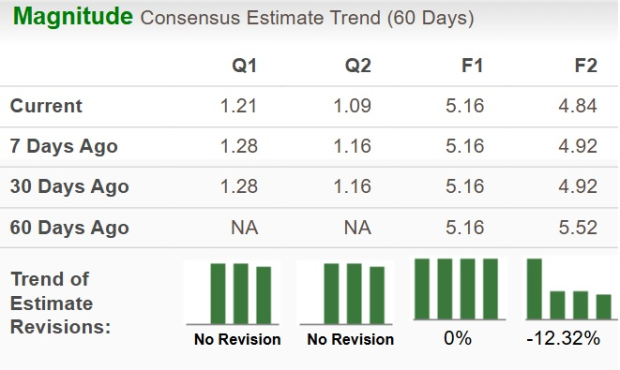

The Zacks Consensus Estimate for AngloGold Ashanti’s 2025 sales is $9.01 billion, indicating 55.6% year-over-year growth. The consensus mark for the year’s earnings is $5.16 per share, indicating a year-over-year upsurge of 133.5%. The Zacks Consensus Estimate for 2026 sales implies 2.8% year-over-year growth. The same for earnings indicates a decline of 6%.

EPS estimates for 2025 have remained unchanged over the past 60 days, while the estimates for 2026 have moved down over the past 60 days.

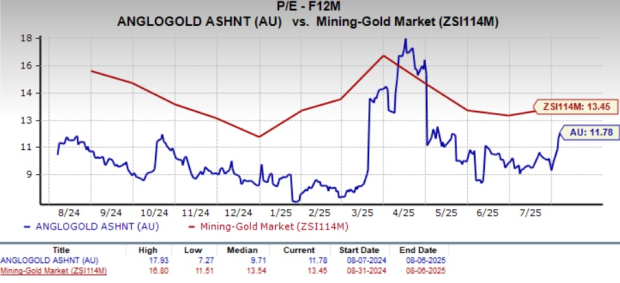

AU is currently trading at a forward 12-month earnings multiple of 11.78X, a discount to the industry average of 13.45X.

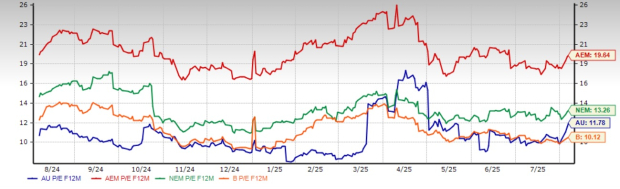

Meanwhile, Agnico Eagle and Newmont are trading higher at 19.64X and 13.26X, respectively. Barrick Mining is a cheaper option, trading at 10.12X.

The average price target on AU suggests a 15.49% downside from its last closing price of $58.28. The highest target of $63 implies growth of 8%.

AU declared an interim dividend of 80 cents per share for the second quarter, which includes the minimum quarterly dividend of 12.5 cents and its decision to pay half of its free cash flow in the first half of 2025.

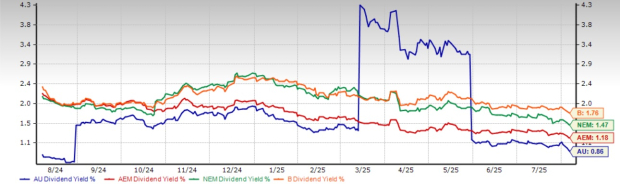

AngloGold Ashanti has a current dividend yield of 0.86, lower than the industry’s 1.22. In comparison, Agnico Eagle Mines, Newmont and Barrick Mining offer higher dividend yield of 1.18%, 1.47% and 1.76%, respectively.

AngloGold Ashanti is executing a clear strategy of organic and inorganic growth. The acquisition of Egyptian gold producer Centamin in November 2024 added the large-scale, long-life, world-class Tier 1 asset, Sukari, to its portfolio. It has the potential to produce 500,000 ounces annually.

Obuasi remains a significant pillar of its long-term strategy, which is expected to deliver 400,000 ounces of annual production at competitive costs by 2028. At Siguiri, efforts are underway to improve mining volumes through ongoing improvements to fleet availability and utilization, and to introduce gravity recovery in the processing plant to further improve metallurgical recovery.

AngloGold Ashanti is intensifying its efforts to streamline operations and sharpen its focus on core assets, particularly in the United States. AU recently inked a deal to sell its interest in the Mineração Serra Grande mine in Brazil — one of its higher-cost assets. This follows the sale of its interests in two gold projects in Côte d’Ivoire. The company recently divested its stake in Canada’s G2 Goldfields. AU’s joint venture (announced in May 2023) with Gold Fields to combine their Tarkwa and Iduapriem gold mines had been on hold as they had not obtained the requisite approvals from the Ghana government. So, divesting the stake is a wise move.

AngloGold Ashanti’s proposed acquisition of Augusta Gold will strengthen its position in the most significant emerging Beatty district.

AngloGold Ashanti has delivered strong year-to-date stock performance and reported improved second-quarter results, supported by higher gold prices and increased sales volumes. However, rising costs remain a key concern. Earnings missed expectations, and critical operating metrics such as AISC and cash costs per ounce continued to rise.

Looking ahead, the 2026 outlook is less encouraging. The company expects production to remain flat. Analysts are anticipating a decline in earnings and estimates have been trending lower recently. Additionally, the stock’s average price target suggests a double-digit decline from current levels. AU’s dividend yield also trails behind the industry and major peers.

Given these factors, it may be wise for investors to avoid the stock for now. AngloGold Ashanti currently holds a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

AEM +5.36% B NEM

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite