|

|

|

|

|||||

|

|

Investors responded with optimism following CVS Health’s CVS second-quarter 2025 earnings release last week, buoyed by better-than-expected earnings and revenue growth, improved segment performance and an upward revision to full-year guidance, reflecting operational momentum in its Health Care Benefits and Pharmacy & Consumer Wellness segments. This, coupled with a strong year-to-date cash flow of $6.5 billion, confirms that CVS is on track with its long-term strategy, even amid industry-wide healthcare challenges.

Following its earnings release on July 31, shares of CVS have gained 2.3%, outperforming the industry, sector and benchmark’s performances.

CVS Health’s strong second-quarter 2025 performance was backed by growth across all three operating segments, Health Care Benefits, Health Services and Pharmacy & Consumer Wellness, each contributing to the company’s total revenues of $98.9 billion, an 8.4% increase year over year.

The Health Care Benefits segment stood out as a key driver, with revenues rising 11.6% and adjusted operating income surging 39.4%. This was driven by disciplined medical cost management, including lower-than-expected medical cost trends in Medicare Advantage and improved operating execution at Aetna. CVS leadership highlighted improvements in risk adjustment, utilization and Star ratings performance as important contributors to the segment’s margin expansion.

The Pharmacy & Consumer Wellness segment also played a critical role in the quarter’s results. Segment revenues grew 12.5% year over year, supported by a favorable pharmacy drug mix and increased prescription and front store volume. The segment also saw a 7.6% increase in adjusted operating income, despite ongoing pharmacy reimbursement pressure. Prescription activity was robust, with a 4.2% increase in prescriptions filled on a 30-day equivalent basis. CVS management continues to emphasize the role of this segment in supporting both retail and broader healthcare delivery, including the rollout of its CostVantage reimbursement model aimed at improving pricing transparency and sustainability.

In the Health Services segment, revenues increased 10.2% year over year, fueled by pharmacy drug mix and brand inflation, partially offset by continued pharmacy client price improvements. Despite the top-line expansion, adjusted operating income declined 17.8% due to lower pricing with pharmacy clients and a higher medical benefit ratio in the healthcare delivery business. Pharmacy claims processed remained relatively flat.

Despite CVS Health’s enterprise-wide strengths, the Health Services segment, specifically the Oak Street Health value-based care business, is underperforming. Elevated medical benefit ratios at Oak Street continued to weigh on operating income, contributing to a $200 million downward revision in full-year Health Services guidance. While patient growth was robust, it did not translate into profitability. The higher-than-expected medical costs suggest operational inefficiencies or challenges in managing the care of a growing patient base in a value-based model.

Further, CVS’ Group Medicare Advantage business continues to struggle with high medical costs. A $470 million premium deficiency reserve was recorded in the second quarter and because contracts are multiyear, fixing margins will take time. This creates ongoing pressure despite strength in other parts of the business.

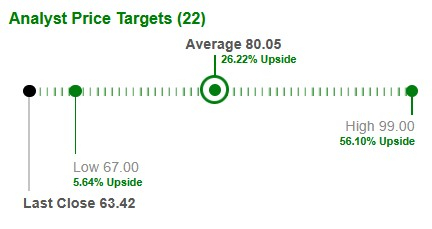

Based on short-term price targets offered by 22 analysts, CVS Health is currently trading more than 26% below its average Zacks price target.

In terms of valuation, CVS Health’s forward 12-month price-to-earnings (P/E) is 9.44X, a discount to the S&P 500’s 22.39X.

The stock is also trading at a discount to the company’s competitor, UnitedHealth’s UNH average of 12.89X. However, it is trading at a premium to another of its competitors, Herbalife’s HLF 4.31X.

CVS stock’s premium over HLF may be justified by its scale, efficiency and strategic focus on digital health, AI and value-based care. Meanwhile, its discount to the S&P 500 offers an attractive entry point for long-term investors seeking stable, growth-oriented healthcare exposure.

CVS Health: A Buy Now

Despite near-term headwinds in Health Services, CVS Health’s Q2 results highlight strong strategic momentum. Growth across all segments, disciplined cost management and rising prescription volumes justify its raised earnings guidance. With traction in its CostVantage model and a forward P/E well below the S&P 500, this Zacks Rank #2 (Buy) stock presents a solid opportunity for long-term investors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 9 hours | |

| 10 hours | |

| 13 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite