|

|

|

|

|||||

|

|

Nvidia gives customers what they need.

IonQ could see huge gains in the future.

Quantum computing could be the next big technology for investors, if it lives up to its promise. While quantum computing companies are getting a ton of attention from investors right now, I think it will likely be 2030 before it sees widespread commercial adoption.

I think the 2030s will be a golden age of quantum computing investing. Still, many investors are looking to get in now before all of the growth is baked into the stock prices of various quantum computing competitors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Luckily, investors have a fantastic example of what to look for in a quantum computing investment by comparing it to the most successful computing company of this decade: Nvidia (NASDAQ: NVDA).

After taking a look, I think I've identified a company that could become the Nvidia of the 2030s.

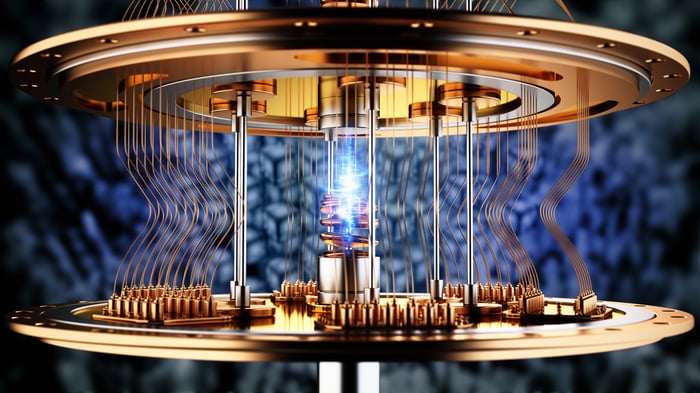

Image source: Getty Images.

First, let's look at the Nvidia traits that have made it such a dominant player in the artificial intelligence (AI) realm. The biggest factor I can see is that it's a neutral player, serving all customers. Nvidia didn't sell its graphics processing units (GPUs) to just one company, or partner to make a special GPU for another. Instead, it was focused on offering the best product possible, which other companies adopted as the standard.

If we're looking for that trait in a quantum computing company, it pretty much eliminates all of the big tech companies that are in the quantum computing arms race, as potential clients would have to stay locked into their ecosystems to gain access to their quantum computing services.

Now that we've narrowed it down to looking at the quantum computing pure plays, which of them follows Nvidia's lead the best?

Another huge factor that made Nvidia such a success story is that it offered a full solution. This ranged from leading software to connectivity equipment; having control over these ancillary products was key to Nvidia's success.

So, if you're looking for a company to fit Nvidia's mold, look for companies that have full-stack solutions. This allows quantum computing clients to purchase a full solution and deploy it rapidly without needing to buy additional equipment just to make it work.

Lastly, a company's quantum computing solution needs to scale to fit the Nvidia mold. Nvidia's GPUs can be connected to create nearly unlimited computing power.

I think IonQ (NYSE: IONQ) is setting itself up to the the Nvidia of the 2030s.

IonQ offers full-stack solutions for its clients, providing the hardware and software necessary to utilize its product. It also offers consulting and training for its products, making it a one-stop shop for any company interested in deploying quantum computing power.

It also doesn't have barriers to scaling. One of the unique characteristics of using a trapped-ion approach (versus the superconducting approach that many others use) is that the particles used for quantum computing do not require cooling to absolute zero. Instead, it can be done at room temperature. Cooling anything down to absolute zero is an expensive process and could be a huge roadblock for scaling quantum computing.

Lastly, IonQ's architecture is designed to be scalable, with IonQ projecting that it could have a 1 million-qubit device someday simply by adding more computing modules.

I think this makes IonQ one of the most likely companies to follow in Nvidia's footsteps in the 2030s, although it's impossible to tell this far out whether the industry -- and IonQ -- will flourish. Its trapped-ion approach could be a dead-end route for reasons that nobody could foresee right now. But, if it works out, the advantages it has over a superconducting approach could cause it to become the leading quantum computing technology during the 2030s.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $635,544!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,099,758!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

| 16 min | |

| 30 min | |

| 54 min | |

| 1 hour |

Stock Market Today: Dow Rises, But Tech Stocks Fall; Palantir, Tesla Extend Losses (Live Coverage)

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

NVDA

Investor's Business Daily

|

| 2 hours |

Stock Market Today: Dow, Tech Futures Slide; Nvidia Extends Losses (Live Coverage)

NVDA

Investor's Business Daily

|

| 2 hours |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

NVDA

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite