|

|

|

|

|||||

|

|

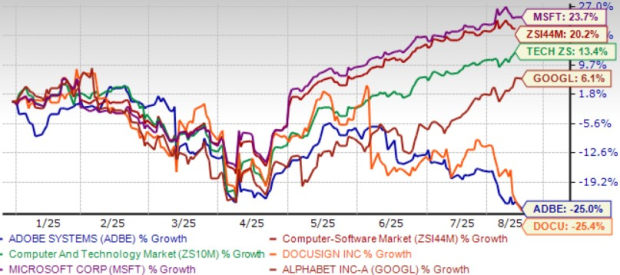

Adobe ADBE shares have declined 9% in the past month. ADBE shares have plunged 25% year to date (YTD), underperforming the Zacks Computer and Technology sector’s return of 13.5% and the Zacks Computer – Software industry’s appreciation of 20.3%.

The drop in Adobe’s share price reflects modest revenue growth prospects in the near term, as the company continues to face stiff competition in the AI and Generative AI (GenAI) space from the likes of Microsoft MSFT-backed OpenAI, as well as a lack of monetization of its AI solutions. The challenging macroeconomic environment has been a headwind for Adobe’s prospects. These factors have negatively impacted Remaining Performance Obligations (RPO), which increased 11% on a constant currency basis while current RPO grew 10% in the second quarter of fiscal 2025.

Adobe’s AI business is minuscule compared with the likes of Microsoft and Alphabet GOOGL. Microsoft’s Intelligent Cloud revenues are benefiting from growth in Azure AI services and a rise in the AI Copilot business. Alphabet’s focus on leveraging AI to drive growth is a key catalyst. AI is infused heavily across its offerings, including Search and Google Cloud. Adobe is also facing stiff competition from DocuSign DOCU in the document services & e-signature domain.

Adobe has underperformed Microsoft and Alphabet YTD, but outperformed DocuSign. While shares of Microsoft and Alphabet have returned 23.7% and 6.1%, respectively, DocuSign has declined 25.4%.

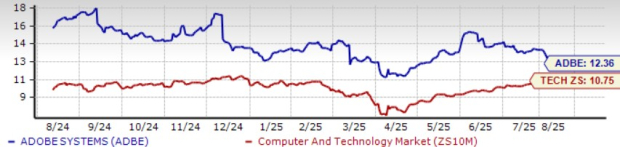

Adobe shares are overvalued, as suggested by a Value Score of D.

In terms of Price/Book, Adobe is trading at 12.36X higher than the broader sector’s 10.75X.

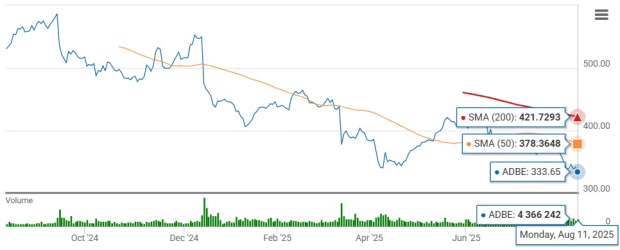

Adobe shares are now trading below the 50-day and 200-day moving averages, indicating a bearish trend.

Adobe’s second-quarter fiscal 2025 results indicate that the company is catching up through the expansion of its AI portfolio with GenStudio and Firefly Services. Adobe’s AI book of business from AI-first products, including Acrobat AI assistant, Firefly App and Services and GenStudio for Performance Marketing, is tracking ahead of the $250 million ending Annual Recurring Revenue (ARR) target by the end of fiscal 2025.

Adobe’s tools, like Acrobat AI Assistant and Adobe Express, are attracting business professionals and creators. Acrobat AI Assistant uses conversational interfaces to make it easier for users to read digital documents and gain insights within a short timeframe. Adobe Express is using AI to enable consumers to quickly design and publish content through conversational AI in an easy-to-use, all-in-one application. Adobe is integrating these solutions to facilitate a smoother creation-to-consumption process across mobile apps, web browsers and desktop offerings.

Adobe’s strategy of offering an AI-powered, comprehensive creative platform that extends from idea generation through creation to mass production and delivery is addressing the needs of Creative and Marketing Professionals. Firefly is enhancing the capabilities of Creative Cloud desktop applications. The Firefly App is attracting users for AI-powered content ideation, creation and production, and its support for third-party models, including from Alphabet division Google’s Imagen and Veo, Microsoft-backed OpenAI’s image generation and Black Forest Labs’ Flux, is a key catalyst. Adobe Firefly App availability on mobile is expected to further boost its popularity.

Adobe is leveraging Adobe Experience Platform (AEP) and native applications to deliver unified and personalized customer experiences. The launch of the AEP AI assistant enables teams across the business to interact with data smoothly and efficiently. The innovative solution helps customers leverage their first-party customer data and deliver more relevant, high-impact advertising experiences driven by direct customer relationships.

Adobe now expects fiscal 2025 revenues between $23.5 billion and $23.6 billion ($21.51 billion in fiscal 2024), up from the previous guidance range of $23.3-$23.55 billion. Fiscal 2025 non-GAAP earnings are now expected between $20.50 per share and $20.70 per share ($18.42 per share in fiscal 2024), higher than the previous guidance of $20.20-$20.50 per share.

For fiscal 2025, Digital Media Annual Recurring Revenue is still expected to grow 11% year over year. Digital Media segment revenues are expected to be between $17.45 billion and $17.50 billion. Digital Experience segment revenues are expected between $5.8 billion and $5.9 billion, while Digital Experience subscription segment revenues are expected between $5.375 billion and $5.425 billion.

For fiscal 2025, the Zacks Consensus Estimate for earnings is pegged at $20.63 per share, unchanged over the past 30 days. The figure indicates 12% growth over fiscal 2024.

The Zacks Consensus Estimate for third-quarter fiscal 2025 earnings is pegged at $5.17 per share, unchanged over the past 30 days, suggesting 11.2% growth from the year-ago quarter.

Adobe Inc. price-consensus-chart | Adobe Inc. Quote

Adobe’s focus on improving monetization of its AI tools is a positive for investors despite stretched valuation, macroeconomic challenges, and stiff competition. ADBE currently has a Zacks Rank #2 (Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 min | |

| 49 min | |

| 1 hour | |

| 1 hour | |

| 1 hour |

SoftBank-Backed Wayve Raises $1.2 Billion From Microsoft, Nvidia, Automakers

MSFT

The Wall Street Journal

|

| 2 hours | |

| 2 hours | |

| 4 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

GOOGL

The Wall Street Journal

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite