|

|

|

|

|||||

|

|

Ferrari N.V. RACE has been firing on all cylinders, with second-quarter 2025 results underscoring why the prancing horse continues to outpace the broader auto sector. The luxury automaker’s revenues surged 12% year over year to €1.66 billion, powered by not just higher deliveries but also strong pricing discipline. Its ability to raise prices without denting demand is a luxury few automakers — including giants like General Motors GM and Ford F — can claim. With the order book already filled well into 2026, Ferrari’s growth story has unusual visibility in a volatile industry.

What makes this even more compelling is the mix shift toward hybrids and high-margin special series cars. In Q2, hybrids represented 58% of shipments, sharply up from 43% a year earlier, aligning the company with tightening global emission rules while protecting profitability. The oversubscribed nature of its special series lineup further bolsters margins. These trends, combined with Ferrari’s deliberate scarcity model, make its financial engine hum at a pace few rivals can match — a sharp contrast to the volume-driven struggles facing GM and Ford.

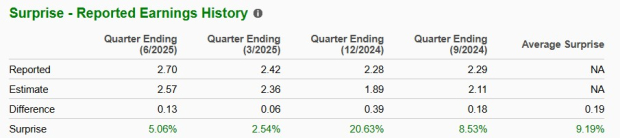

Investors are also paying attention to Ferrari’s consistent earnings beat. Over the past four quarters, it has topped consensus estimates every time, delivering an average surprise of 9.2%.

In its latest report, EPS came in at $2.70, ahead of the $2.57 consensus. Forward estimates are moving higher, with 2025 EPS forecasts jumping from $9.60 to $10.41 in just 60 days. The same upward momentum is seen for 2026, with projections climbing from $10.81 to $11.74.

Let’s take this performance lap by lap.

Ferrari’s ability to combine volume growth with price increases is the cornerstone of its financial performance. Unlike GM and Ford, which are contending with softer sales projections for 2025 and beyond, Ferrari is proving that exclusivity and brand loyalty are defensive assets. In 2024, around 81% of new cars were sold to existing customers, with nearly half owning multiple Ferraris. This loyalty allows management to adjust pricing without sacrificing demand.

The company’s hybrid penetration, apart from being part of regulatory compliance, is also a profitability driver. Hybrids command premium pricing and fit seamlessly into Ferrari’s brand narrative of performance meets innovation. The blend of hybrid and special series offerings is lifting EBITDA margins, which hit an impressive 38.3% in Q2 — one of the highest in the luxury automotive sector. Ferrari’s free cash flow of €220 million in the quarter, coupled with net industrial cash of €1.3 billion, ensures that it can keep investing in new models while rewarding shareholders.

Ferrari’s personalization program remains a high-margin growth lever, accounting for roughly 20% of total revenues. Customers routinely spend 20-25% above the base car price for bespoke features, from unique paint schemes to “One-Off” builds. This not only boosts average revenue per unit but also strengthens brand stickiness. Management expects personalization to remain a key driver through 2026, supporting EBITDA margins. GM and Ford have customization options, but the scale and profitability of Ferrari’s program are in a different league.

The company’s deliberate low-volume production strategy — under 15,000 units annually — keeps exclusivity intact and pricing power high. The two-year order backlog gives Ferrari revenue certainty, which is rare in the auto industry, insulating it from cyclical swings. Geographic allocation of production ensures scarcity across regions, preventing oversupply and discounting. This discipline supports industry-leading margins.

Ferrari’s brand is more than just its cars. Around 12% of quarterly revenues — or roughly €200 million — now comes from brand-related activities such as licensing, sponsorships, merchandise, museums, and theme parks — a notable increase from some 10% a year ago. This diversification gives Ferrari another competitive edge over peers like GM and Ford, whose brand monetization is far less developed.

At a forward P/E above 40X, Ferrari’s valuation is undeniably steep compared to mainstream automakers. But investors are willing to pay a premium for predictable earnings growth, superior margins, and unmatched brand equity.

With the stock up 5% so far this year, outperforming a nearly 9% drop in the broader auto sector, Ferrari is proving that it can command a luxury multiple. As EPS grows, that multiple could compress naturally, creating compounding potential without a valuation reset.

Ferrari’s second-quarter performance highlights why the stock continues to earn a premium valuation. Strong revenue growth, consistent earnings beats, rising analyst estimates, and a backlog stretching into 2026 paint a picture of rare visibility and resilience. The hybrid shift, high-margin personalization, and diversified brand revenues add structural support to margins, while the scarcity model sustains pricing power.

The Zacks Rank #2 (Buy) reflects this combination of positive earnings momentum and upward revisions. While the valuation demands continued flawless execution, Ferrari’s track record suggests it can deliver. For investors seeking a high-growth, high-margin name with an enduring competitive moat, RACE remains investment-worthy.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite