|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Shares of Bank of America BAC, one of the most interest rate-sensitive among big banks, lost 5.1% in the first quarter of 2025 amid concerns regarding the economic impact of Trump’s tariffs. In contrast, the performance of its close peers – JPMorgan JPM and Citigroup C – was better. Also, the S&P 500 Index was down 5.2% in the quarter, its worst quarterly performance since 2022.

Quarterly BAC Price Performance

Let’s try to decipher how the rest of 2025 will be for Bank of America stock.

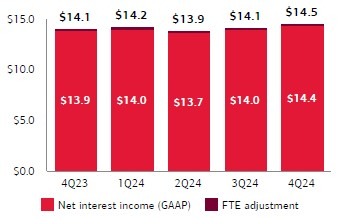

Interest Rate Cuts: When the Federal Reserve lowered the interest rates by 100 basis points last year, the company’s net interest income (NII) benefited from it. Fixed-rate asset repricing, higher loan balance and gradual decline in deposit costs drove the sequential increase in NII since the second quarter of 2024, which was partly offset by lower interest rates.

Bank of America’s Net Interest Income

The central bank is now likely to pursue a cautious approach toward interest rate cuts because of stubborn inflation, which is expected to get further aggravated due to the imposition of tariffs. Economists and policymakers generally view tariffs as a factor that could drive up prices for U.S. businesses and consumers, at least in the short term, while potentially slowing economic growth over time.

Bank of America is seeing an upside in NII in 2025, driven by decent loan demand, higher-for-longer interest rates, robust deposit balance and solid economic growth. The company expects a sequential rise in NII for all the quarters this year, with growth likely to accelerate in the second half of the year and the fourth-quarter number likely to touch the $15.5-$15.7 billion level.

Branch Expansion & Digital Initiatives: Bank of America’s aggressive branch expansion across the United States as part of a broader strategy to solidify customer relationships and tap into new markets will drive NII growth over time. The company announced plans to open more than 165 new financial centers by 2026-end. This new wave of expansion follows the branch network growth plans announced by Bank of America in June 2023. The plan focused on entering nine new markets, including Omaha, Boise and Milwaukee.

The bank's strategic investment in new financial centers and push into new markets reflects a broader industry shift toward optimizing branch networks to deepen customer relationships and tap into new business opportunities. In this competitive environment, the ability to blend digital convenience with in-person expertise is expected to give Bank of America long-term leverage in the evolving banking landscape.

Last year, digital interactions by BAC clients increased 12% year over year and reached a record 26 billion interactions “through a combination of digital logins and proactive alerts.” The company plans to continue strengthening its technology initiatives and spend heavily on these. These efforts help it attract and retain customers and boost cross-selling opportunities.

Fortress Balance Sheet & Solid Liquidity: Bank of America’s liquidity profile remains solid. As of Dec. 31, 2024, average global liquidity sources were $953 billion. Also, the company’s investment-grade long-term credit ratings of A1, A- and AA- from Moody’s, S&P Global Ratings and Fitch Ratings, respectively, and a stable outlook allow easy access to the debt market.

BAC continues to reward shareholders handsomely. After it cleared the 2024 stress test, the company increased its quarterly dividend by 8% to 26 cents per share. In the last five years, it hiked dividends four times, with an annualized growth rate of 8.72%. Currently, the company's payout ratio is 32% of earnings.

In July 2024, the company authorized a $25 billion stock repurchase program, effective Aug. 1. As of Dec. 31, 2024, almost $18.9 billion worth of buyback authorization remained available.

Subdued Investment Banking (IB) Business: As global deal-making came to a grinding halt at the beginning of 2022, it weighed substantially on Bank of America’s IB business. Though the company’s total IB fees plunged 45.7% in 2022 and 2.4% in 2023, the trend reversed in 2024. Thus, the company’s IB fees soared 31.4% year over year.

However, the anticipated resurgence in mergers and acquisitions (M&As) following President Donald Trump’s re-election and expectations of favorable regulatory changes have not yet materialized. Deal-making activities have paused as ambiguity over the tariff and ensuing trade war has resulted in extreme market volatility and economic uncertainty. Amid such a backdrop, companies are rethinking their M&A plans despite stabilizing rates and having significant investible capital. Hence, in the near term, this will significantly hurt the IB businesses of Bank of America, JPM and C, which generate billions in revenues from M&A advisory fees.

Nonetheless, as the operating backdrop gradually turns favorable for deal-making activities, global M&As are expected to witness a solid rise. Eventually, Bank of America will report growth in IB fees, driven by a healthy IB pipeline and an active M&A market.

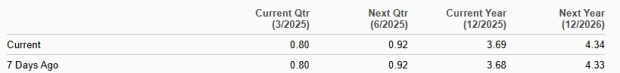

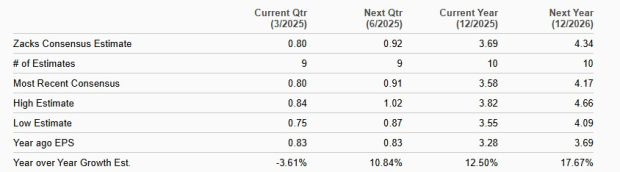

Over the past week, the Zacks Consensus Estimate for earnings for 2025 and 2026 moved marginally upward to $3.69 and $4.34, respectively.

BAC Estimate Revision Trend

These upward adjustments reflect a positive sentiment among analysts and suggest encouraging prospects.

Bank of America Earnings Estimates

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Because of weakness in its share price, Bank of America stock is currently trading at a 12-month trailing price-to-tangible book (P/TB) of 1.61X, which is below the industry’s 2.66X. This shows the stock is inexpensive.

Price-to-Tangible Book Ratio (TTM)

BAC stock is inexpensive compared with JPM, which has a P/TB of 2.68X. On the other hand, it is trading at a premium C’s P/TB of 0.82X.

Bank of America's global presence, diversified revenue streams, ongoing branch openings and relatively high rates for long and technological innovations aimed at attracting and retaining customers provide a strong foundation for organic growth. Further, bullish analyst sentiments and attractive valuation make the stock a compelling option for investors.

However, BAC faces near-term challenges, such as increased regulatory capital requirements under the Basel III framework and macroeconomic uncertainty because of the imposition of tariffs and its impact on the interest rate cuts. Also, weak IB business performance is a near-term concern. So, investors must wait for clarity on macroeconomic issues before buying the stock.

Those who already own Bank of America stock can hold onto it for solid long-term gains. Currently, Bank of America has a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite