|

|

|

|

|||||

|

|

Intel Corporation INTC has laid out bold strategies for its turnaround as it faces stiff competition from the likes of NVIDIA Corporation NVDA and Advanced Micro Devices, Inc. AMD in the artificial intelligence (AI) data center market. Amid these developments, President Donald Trump’s inconsistent stance on Intel CEO has drawn investors’ interest toward the semiconductor giant. Is it time for investors to adopt a bullish outlook on Intel stock? Let’s see –

Last month, Cadence Design Systems, Inc. CDNS acknowledged committing a crime by unlawfully exporting semiconductor design tools to a manufacturer in China that has connections to the Chinese military. Cadence agreed to pay $140 million for violating U.S. export controls. On Aug. 8, Republican Senator Tom Cotton noted that when these transfers took place, Intel’s current CEO, Lip-Bu Tan, was leading Cadence.

Trump learned of Cotton’s letter shortly afterward and urged Tan to step down immediately. However, on Aug. 7, Tan responded to Cotton’s letter, calling it misinformation, and reaffirmed his commitment to U.S. security interests. He met with Trump at the White House, where he verified that Intel's investments are in harmony with the President's expressed goals.

In reaction, Trump commended Tan's achievements, referring to his success and ascent as an “amazing story.” Trump also endorsed Tan’s leadership role at Intel. This is positive news for Intel investors. If Tan had to resign, it could have caused further turmoil at Intel during a critical period. Let’s not forget, Tan is a well-known venture capitalist, respected for his expertise in the semiconductor industry.

Intel’s business has been struggling for quite some time. Despite Tan’s initial initiatives to restore stability at Intel, the company reported total revenues of $12.9 billion for the second quarter, almost flat with the year-ago levels.

Its revenues from subsidiaries such as Altera and Mobileye may have increased, but its product revenues fell 1% to $11.8 billion in the second quarter. Revenues from the foundry business rose. However, the segment reported an operating loss of $3.2 billion in the second quarter. It’s worse than the $2.8 billion loss that the segment posted a year ago.

Intel’s gross margin remained under pressure as it reported $4.5 billion in capital expenditure (capex) to scale its foundry business. It ended the quarter with $50.7 billion in debt. On the other hand, cash and short-term investments accounted for only $21.2 billion.

However, under Tan’s strong leadership, Intel is exploring strategies to cut costs and enhance profit margins. Tan is optimizing the management team and reducing the workforce to lower operating expenses. Additionally, Tan is scaling back capital expenditures, having already canceled fabrication facilities in Germany and Poland, and plans to slow down the construction of a new plant in Ohio.

Intel is planning to provide a full-stack AI solution, including graphics processing units (GPUs) and central processing units (CPUs). Intel is embracing its new 18A process at its manufacturing facilities, which will serve a minimum of three generations of its clients. Additionally, the company is securing a major customer for its 14A node.

While all these ambitious initiatives may not lead to a quick turnaround for Intel, as shown by the latest quarterly results, they will eventually have a positive effect on the company’s business. In time, the semiconductor giant has the potential to regain its former glory.

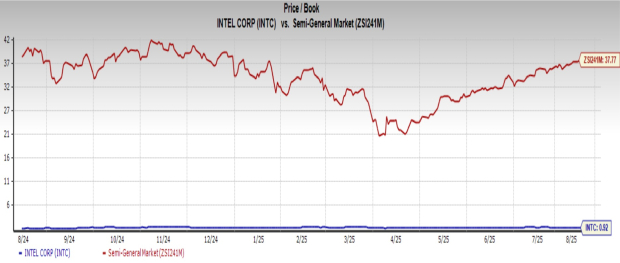

Trump’s support for Tan and his efforts to improve operations, provide a competitive AI platform, and divest assets should motivate stakeholders to remain invested in Intel stock. Furthermore, Intel’s price-to-book (P/B) ratio is slightly above 0.9, indicating that the stock has a limited risk of decline and potential for gains in the future.

Image Source: Zacks Investment Research

However, new investors should remain passive and watch for meaningful progress. This is because it’s too early to predict the potential success of Tan’s initiatives, and Intel’s financials merely show improvement. For now, Intel has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 22 min | |

| 37 min | |

| 40 min | |

| 58 min | |

| 58 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours |

Nvidia Earnings, Inflation Data, State of the Union Address: What to Watch This Week

NVDA

The Wall Street Journal

|

| 4 hours | |

| 6 hours | |

| 6 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite