|

|

|

|

|||||

|

|

GE Vernova Inc. (GEV) recently announced a plan to invest $41 million to expand generator capacity at its Schenectady, NY, facility, in a bid to meet rising global energy demand. The investment will enhance the company’s gas power capacity through expanding the assembly and testing of the H65 and H84 generators, which pair with its most efficient HA gas turbines.

This expansion comes as part of the company’s larger plan of investing $9 billion through 2028, with GEV having announced $720 million in investments at its U.S. manufacturing facilities so far this year.

This strategic expansion solidifies GE Vernova's pivotal role in the global energy transition, making it an increasingly attractive investment for those seeking a resilient and forward-looking energy stock.

However, before making an investment, it would be prudent to delve deep into the company’s recent performance at the bourses, future growth prospects as well as risks (if any) to investing in the same. This way, one can make an informed decision.

Shares of GE Vernova have surged an impressive 33.1% in the past three months, outperforming the Zacks Alternative-Energy industry’s growth of 13.7% and the broader Zacks Oils-Energy sector’s rise of 5.5%. It has also outpaced the S&P 500’s growth of 10.9% over the same period.

A similar stellar performance has been delivered by other industry players, such as Bloom Energy (BE) and Talen Energy Corp. (TLN), whose shares have surged 136.7% and 56.4%, respectively, in the past three months.

GE Vernova's advanced technologies support industries across the board in the global shift to sustainable energy, reducing emissions. Its expanding clean energy and low-carbon footprint initiatives, as mentioned below, are boosting investor confidence, which must have resulted in its significant three-month share price growth.

Impressively, in July 2025, GEV received an order to supply 29 LM2500XPRESS units to Crusoe AI data centers. In the same month, GE Vernova announced second-quarter 2025 results, which highlighted a 4% increase in orders, 11% growth in revenues and a more than $5 billion rise in backlog.

The company also announced its decision to acquire France's AI-specialist, Alteia, to integrate its AI-powered visual intelligence platform into utility operations. GEV also received a contract to build a critical substation in Germany. Further, its nuclear energy unit and Fortum entered into an early works agreement to enhance the potential deployment of the BWRX-300 small modular reactor (SMR) in Finland and Sweden.

In June, the company announced plans to invest $50 million to establish a cutting-edge Canadian BWRX-300 Engineering and Service Centre in the Durham region near the Ontario Power Generation Darlington New Nuclear Project site. In the same month, GE Vernova received a contract to upgrade three GT26 gas turbines at Uniper’s Grain power plant, starting 2026. Earlier in May, GEV secured an order for five 7H-Class gas turbines from Saudi Arabia.

The International Energy Agency (“IEA”) projects wind to become the second largest source of global renewable electricity generation, surpassing hydropower, by 2030-end, with onshore wind capacity additions expected to almost double and continue dominating wind capacity growth. This should bode well for GE Vernova’s wind business, supported by consistent investments and a 57,000-unit turbine fleet.

Moreover, investments into the grid, the backbone of the electric power system, is projected to double through 2030 and overtake worldwide renewable power investment, according to the IEA. This should also benefit GE Vernova over the long run, with more than 95% of power transmission utilities in the world equipped with components from its Electrification segment.

In line with this, the Zacks Consensus Estimate for GEV’s long-term (three-to-five years) earnings growth rate is pegged at a solid 18%.

In fact, the growing investment in renewable-sourced electricity worldwide has also been bolstering the long-term growth prospects of other clean energy stocks, such as TLN and BE. Notably, the long-term earnings growth rate for TLN is 15.5%, while that for BE is 28%.

Now, let’s take a quick look at GEV’s near-term estimates to see if that also depicts the same growth story.

The Zacks Consensus Estimate for GEV’s 2025 and 2026 sales implies an improvement of 6.7% and 11.4%, respectively, year over year. A similar improvement can be witnessed in the company’s 2025 and 2026 earnings estimates.

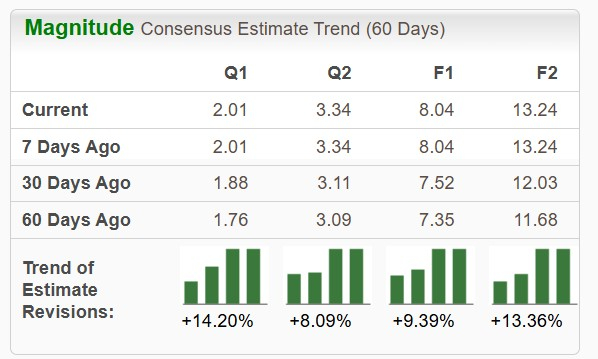

Moreover, GEV’s near-term earnings estimate has moved north over the past 60 days. The upward revision in earnings estimates indicates analysts’ increasing confidence in the stock’s earnings-generating capabilities.

Despite boasting solid growth opportunities, GE Vernova does face a few challenges and a prudent investor should be aware of those. Notably, the global supply-chain crisis has been a common challenge affecting manufacturers across industries in recent times, with GE Vernova being no exception.

The company relies on complex global supply networks for components used in its gas turbines, wind turbines and grid infrastructure. Specifically, it purchases approximately $20 billion in materials and components sourced from over 100 countries. Therefore, disruptions in the availability of raw materials, such as steel and rare earth elements, along with logistical delays, have affected and may adversely impact GE Vernova’s production timelines and hike its input costs, thereby hurting its bottom line.

Moreover, the installation and maintenance of offshore wind turbines can be particularly affected by weather-related scheduling delays due to their complex infrastructure, higher wind speeds and the challenges of accessing offshore sites. Realizing the challenging market environment of the offshore wind industry, GE Vernova has halted its engagement in new offshore wind turbine orders since last year. So, offshore wind remains a challenging business for the company.

In terms of valuation, GEV’s forward 12-month price-to-earnings (P/E) is 53.16X, a premium to its peer group’s average of 15.99X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to its peers.

Its industry peers are also trading at a premium to the peer group average. While TLN is trading at a forward 12-month earnings of 24.35X, BE is trading at 68.38X.

To conclude, investors interested in GE Vernova may wait for a better entry point, considering its premium valuation and challenges in the offshore wind business.

However, those who already own this Zacks Rank #3 (Hold) stock may continue to retain it, given its robust price performance, consistent order wins in key clean energy segments, and solid earnings growth potential supported by optimistic sales estimates.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite