|

|

|

|

|||||

|

|

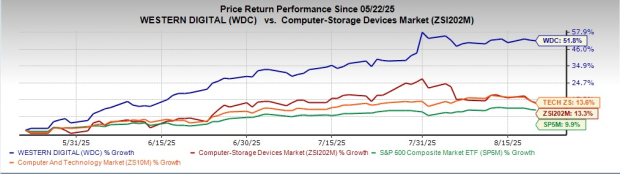

Western Digital Corporation’s (WDC) shares have gained 51.8% in the past three months, outperforming the Zacks Computer-Storage Devices industry’s rise of 13.3%. The stock has also outpaced the Zacks Computer & Technology sector and the S&P 500’s growth of 13.6% and 9.9%, respectively. This surge is powered primarily by robust cloud demand and AI-driven storage needs.

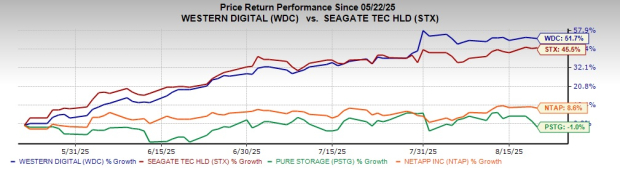

The company has outperformed its competitors in the storage space, like Seagate Technology Holdings plc (STX), Pure Storage (PSTG) and NetApp, Inc. (NTAP). PSTG has declined 1%, while STX and NTAP have gained 45.5% and 8.6% during the same time frame.

SAP has a 52-week high of $313.28. Following a strong rally, investors may wonder if SAP still holds meaningful upside or if expectations have outpaced fundamentals. Let’s break down the pros and cons to assess the road ahead.

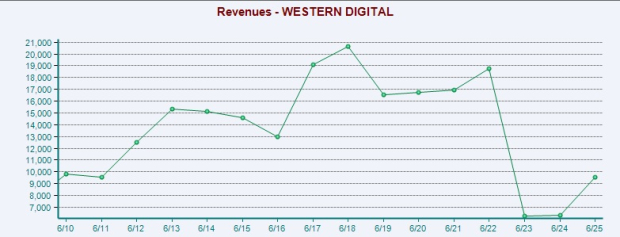

Western Digital develops, manufactures and sells HDDs, including external, client and data center drives. Following its 2025 spinoff of the Flash/SSD business into SanDisk, WDC is now a pure-play HDD company. This move has improved its margins, cash flow and overall financial strength. Improving nearline demand, higher AI-driven storage adoption and an uptick in HDD ASP play out as the company’s key catalysts.

HDDs remain the most cost-effective and reliable option for large-scale storage, with Western Digital playing a key role in the global data storage market. In the last reported quarter, it shipped 190 exabytes, a 32% increase year over year, driven by strong demand for nearline drives and rapid adoption of its 26TB CMR and 32TB UltraSMR products, with shipments doubling to 1.7 million units, marking one of its fastest ramp-ups. Its ePMR and UltraSMR technologies provide reliability, scalability and low Total cost of ownership (TCO), while next-generation HAMR drives, now in early hyperscale testing, are on track for qualification in 2027. Next-generation ePMR drives are expected to qualify by early 2026, supporting a smooth transition. Management anticipates continued revenue growth and increased profitability in the next quarter due to rising demand for high-capacity drives.

As Agentic AI adoption speeds up across industries and increases demand for unstructured data storage, WDC uses this technology to enhance efficiency, accelerating and improving product development. These AI agents, designed for specific tasks—from enterprise chatbots to engineering support—are creating new use cases and generating data at an unprecedented rate. Although still early, these trends are quickly expanding worldwide. As AI fuels data growth, the need for scalable storage rises, with HDDs remaining the most cost-effective and reliable backbone of global data infrastructure.

Furthermore, the rapid growth of AI is accelerating the company’s platforms business, which delivers high-density systems that maximize drive performance and capacity. This business is gaining traction with infrastructure providers and is well-positioned to serve the increasing number of native AI companies lacking dedicated storage teams.

WDC delivered strong fiscal fourth-quarter results, with a non-GAAP gross margin of 41.3% up 610 bps year over year, exceeding guidance on higher-capacity drive sales and tight cost control. Operating expenses fell 16% to $345 million, slightly above guidance due to higher performance-based compensation, highlighting both improved efficiency and stronger-than-expected business momentum.

The company also remains committed to bolstering shareholders' value through a dividend and buyback program. With strong cash flow, a solid balance sheet and confidence in its business outlook, its board approved up to $2 billion in share buybacks and started a quarterly cash dividend. In the fiscal fourth quarter, the company repurchased about 2.8 million shares for $149 million.

However, customer concentration, leveraged balance sheet, macro fluctuations and stiff competition from other major storage players remain major concerns limiting the growth prospects of Western Digital. Seagate, a leading data storage provider competing with WDC, is driving growth through HAMR technology that increases areal density to support rising storage demands across hyperscale data centers, AI training and edge environments.

NTAP and WDC compete in the broader storage space. NetApp focuses on software-defined storage and cloud data management, while WDC emphasizes hardware with HDDs and SSDs. Pure Storage delivers all-flash solutions like FlashArray and FlashBlade for high-performance workloads, with rising data demand driving strong growth prospects for PSTG and WDC in the growing data storage market.

As of June 27, 2025, WDC had cash and cash equivalents were $2.1 billion, while long-term debt (including the current portion) was $4.7 billion, constraining growth and demanding steady cash flow to service obligations. Ongoing macroeconomic volatility, driven by tariffs and escalating trade tensions, remains a concern for management. These factors could create further demand swings, particularly in the enterprise, distribution and retail segments.

Nonetheless, Western Digital has outlined strategies to navigate macroeconomic and geopolitical challenges. In the near term, it has created cross-functional teams to minimize disruptions and ease tariff impacts on customers and operations. At the same time, management is taking a disciplined approach to evaluating long-term supply chain shifts to stay agile and resilient. Despite broader uncertainty, demand from hyperscale customers remains strong amid tight supply.

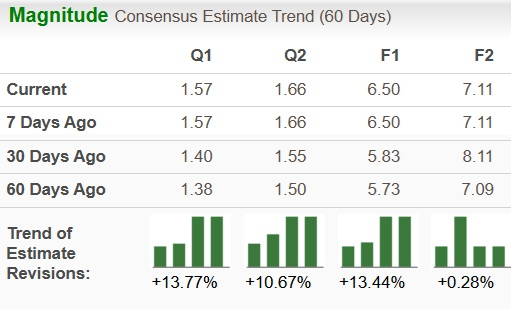

WDC’s estimates revisions are on an upward trajectory currently. The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised up 13.4% to $6.50 over the past 60 days, while the same for fiscal 2027 has gone up 0.3% to $7.11.

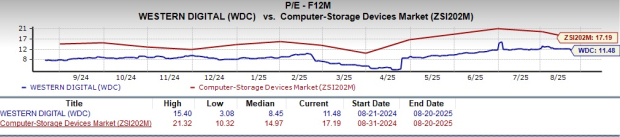

From a valuation standpoint, WDC appears to be trading relatively cheaper compared to the industry but trading above its mean. Going by the price/earnings ratio, the company shares currently trade at 11.48 forward earnings, lower than 17.19 for the industry but above the stock’s mean of 8.45.

Looking ahead, despite ongoing uncertainty around tariffs, WDC is experiencing strong product demand supported by AI-driven growth and related business tailwinds. The company continues to expand margins, generate strong free cash flow and return shareholder value. Management expects continued revenue growth and margin gains in fiscal 2026, supported by hyperscale demand, innovation and efficiency. With a rich portfolio, WDC is well-positioned to gain from emerging market dynamics. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 8 hours | |

| 8 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite